-

The Housing for the 21st Century Act includes provisions covering policy, manufactured homes and rural infrastructure introduced in a prior Senate proposal.

February 6 -

The mortgage technology unit at Intercontinental Exchange posted a profit for the third straight quarter, even as lower minimums among renewals capped growth.

February 5 -

Mortgage rates edged higher after the Fed held rates steady, with markets weighing political shifts, Treasury moves and mixed signals on where borrowing costs head next.

February 5 -

Acquiring the $5.8 billion Northfield Bancorp would give Columbia a presence in both Brooklyn and Staten Island. The deal provides a window into the impact of New York Mayor Zohran Mamdani's plan to freeze rents on the city's multifamily real estate market.

February 3 -

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

-

The Tulsa, Oklahoma-based bank expects the pace of loan growth to quicken this year, driven in part by its nine-month-old warehouse lending business.

January 27 -

Trump, during his return from Davos, signaled reluctance to allow 401(k) withdrawals for home down payments, but other tax-advantaged options remain on table.

January 23 -

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

January 23 -

Mortgage borrowers filed a third amended class action complaint against the bank over modification issues from 2010 to 2015.

January 22 -

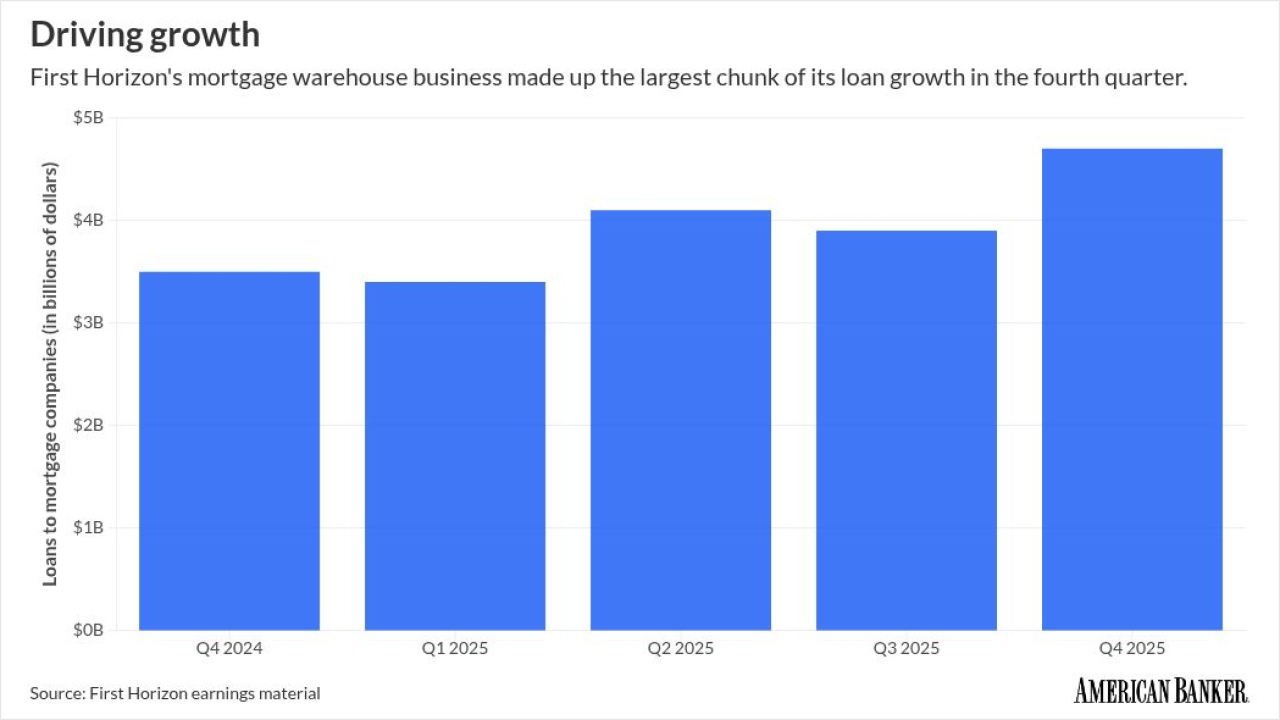

First Horizon's loans to mortgage companies in the fourth quarter rose at the fastest clip in more than two years, as the housing market showed small signs of revival.

January 15 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

First Federal Bank stretched its retail mortgage operations into Louisiana and Mississippi, following its expansion into the Midwest and Arizona in 2023.

January 5 -

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

December 31 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

The bank regulator is proposing to strengthen national preemption in the wake of conflicting decisions in related court cases.

December 24 -

-

-

New rules means sellers and servicers will need to have plans demonstrating proper oversight of their artificial intelligence and machine learning practices.

December 9 -

Bank of America was the leader in this study, with Rocket as the only nonbank mortgage lender which got a score higher than the industry average.

December 4