-

The Federal Home Loan Bank of New York paid its departing director of diversity and inclusion $561,600 after an external review found "oversight issues" that led to a shake-up of the bank's human resources department; CDFI Friendly America launches an online mapping system to spotlight growth opportunities nationwide; global law firm A&O Shearman expands its U.S. debt finance team; and more in this week's banking news roundup.

August 23 -

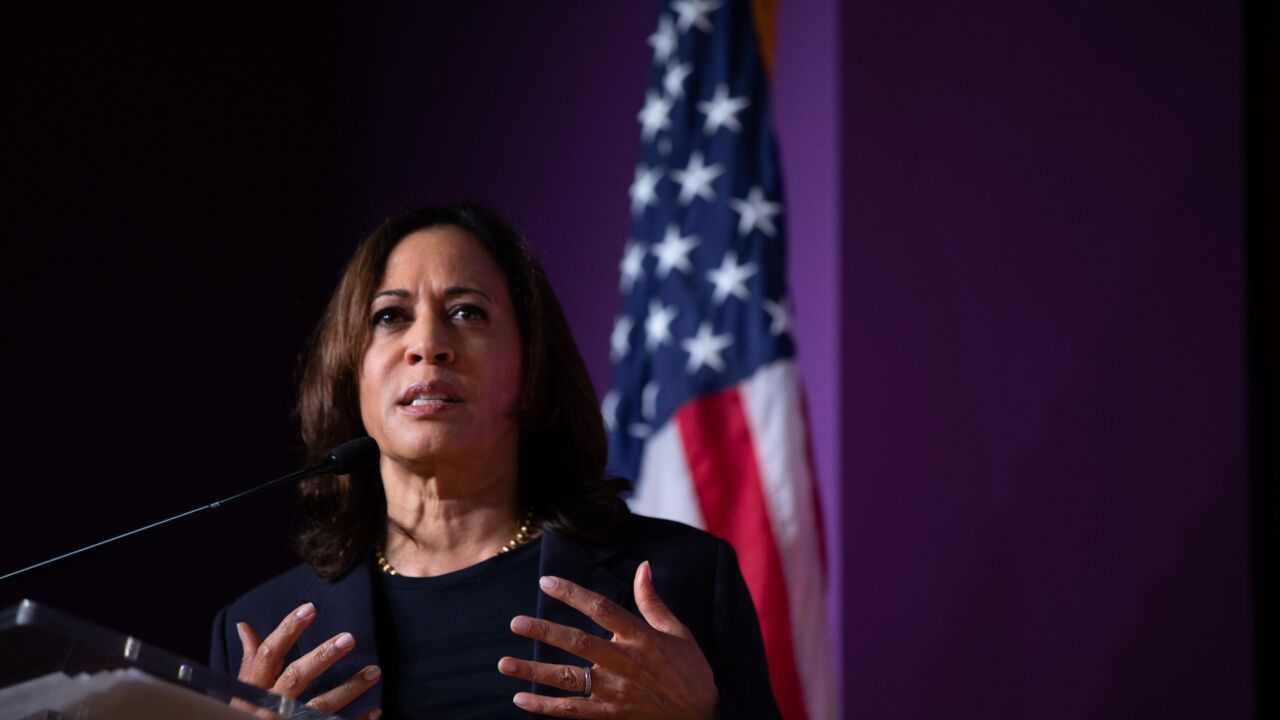

Vice President Kamala Harris' pledge to deliver 3 million homes has drawn applause from homebuilders, lenders and affordability advocates, but experts are uncertain how her administration would pull it off.

August 23 -

The Federal Home Loan banks must be looking at the shift in presidential polling with alarm. A Democratic victory would open the door to tougher regulation and potential streamlining of the 11-bank system.

August 23

-

Fay disputes claims it violated servicing laws and a previous order related to dual tracking allegations but agreed to settle without admission of wrongdoing.

August 21 -

The banking giant's sale of the non-agency, third-party portion of its commercial servicing business will boost the buyer's position in the securitized market.

August 20 -

Borrowing costs have fallen to their lowest level in more than a year as inflation metrics drop to 2021 levels, seemingly vindicating the Federal Reserve's decision to maintain their restrictive monetary policy.

August 15 -

Specialized Portfolio Servicing's sale resolves questions about it that arose when UBS bought the troubled Credit Suisse last year.

August 14 -

Thanh Roettele will help guide the Canadian bank's growth in the mortgage warehouse space in one of its latest moves aimed at the U.S. market.

August 14 - AB - Policy & Regulation

The administration will release $100 million in grant funds focused on slashing red tape at the state and local levels, and will advance other programs to increase home construction.

August 13 -

Pandemic era changes to credit reporting have dangerously distorted credit scores for mortgage borrowers. The market is in worse shape than we realize, writes a former Federal Housing Finance Agency director.

August 13

-

The 30-year fixed rate loan was down 26 basis points as investors reacted early in the week to the employment numbers, according to Freddie Mac.

August 8 -

The same creativity and flexibility that community development financial institutions bring to business lending ought to be applied to financing affordable housing.

August 7

-

-

High borrowing costs led to fewer mortgage originations in the second quarter, according to the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit released Tuesday.

August 6 -

Bond traders now see a roughly 60% chance of an emergency quarter-point cut by the Federal Reserve within one week because of the market turmoil.

August 5 -

The 30-year fixed rate mortgage was at its lowest level since early February as the benchmark 10-year Treasury dropped under 4%.

August 1 -

The lender denied its software uses artificial intelligence in fighting a 'digital redlining' case.

July 31 -

Election speculation about policy change at Fannie Mae has boosted its stock slightly this year. It's also profitable, but there's much more to consider.

July 30 -

Changes to the regulatory regime surrounding the Federal Home Loan banks should be carefully calibrated so as to do no damage to their successful support for housing and the provision of liquidity to members.

July 30

-

The San Antonio-based bank is in the midst of a yearslong expansion effort spanning Houston, Dallas and Austin — all of which are fueling loan growth.

July 25