-

Banks have added so much capital in the past several years that they're better protected from declines in real estate values than they were before the financial crisis.

November 2 -

Deutsche Bank is exiting agency residential mortgage-backed securities trading as part of a larger strategic plan announced Thursday that cuts thousands of positions in numerous business lines worldwide.

October 30 -

The administration apparently intends to leave office without addressing Fannie Mae and Freddie Mac's capital bases and therefore the tight credit conditions.

October 30

-

The report from independent auditors will likely show that FHA remains below its 2% statutory minimum capital ratio, but HUD officials and outside observers still expect it to show major improvement over last year.

October 29 -

Californias Richmond Community Foundation will pursue a new social impact bond vehicle with a $3 million revenue bond private placement it hopes to close next month with the local Mechanics Bank.

October 29 -

Executives at small banks and credit unions told the Senate Banking Committee about horror stories of technical glitches, vendor delays and overworked appraisers, while expressing an interest in having more time to comply with new mortgage rules.

October 28 -

Nobody thought it would be pretty, but last quarter's results were even worse than expected, and low fee revenue is largely to blame. Trading and mortgage banking were particularly bad, and few of the big banks managed to offset the declines.

October 28 -

Sure, the U.S. government recently handed down strong new rules designed to protect consumers from unwanted robo-calls. But maybe some robo-calls aren't so bad. Like debt-collection calls in cases where the debt happens to be backed by Uncle Sam.

October 27 -

Department of Housing and Urban Development staff are working on a revision to the agency's condo rule and "we anticipate a rulemaking process," the HUD Secretary Julian Castro said this week.

October 27 -

Flagstar Bancorp in Troy, Mich., reported a third-quarter profit, as it originated more residential mortgages and recorded higher fee income.

October 27 -

Quicken Loans CEO Bill Emerson's term as chairman of the Mortgage Bankers Association underscores how the Internet-and-phone channel has grown from a quirky novelty to transformative force in the industry.

October 27 -

The financial condition of the Federal Housing Administrations mortgage insurance fund has improved significantly over the past year, Department of Housing and Urban Development Secretary Julian Castro predicted late Monday.

October 27 -

Legislation would require GAO to study the impact the FHFA membership rule would have on the FHLB System and its members.

October 23 -

Community organizations and the banking industry are advancing dueling visions for how to reach the unbanked, with community groups asking regulators to strengthen existing rules while community banks want to lighten their regulatory burden so they can extend their services.

October 23 -

Lawmakers and industry groups are urging FHA to update condo rules to provide more homeownership opportunities for first-time buyers.

October 23 -

Mortgage servicer Ocwen Financial failed four servicing tests in the second half of 2014. Joseph A. Smith Jr., the monitor of the $25 billion national mortgage settlement, said the Atlanta servicer was beginning to show progress in complying with terms of the 2012 agreement.

October 22 -

The head of the Consumer Financial Protection Bureau warned software vendors that they face new scrutiny from regulators for causing mortgage lenders to miss the TRID-compliance deadline. He was vague about how far the CFPB might go, but many in the industry are prone to fear the worst.

October 21 -

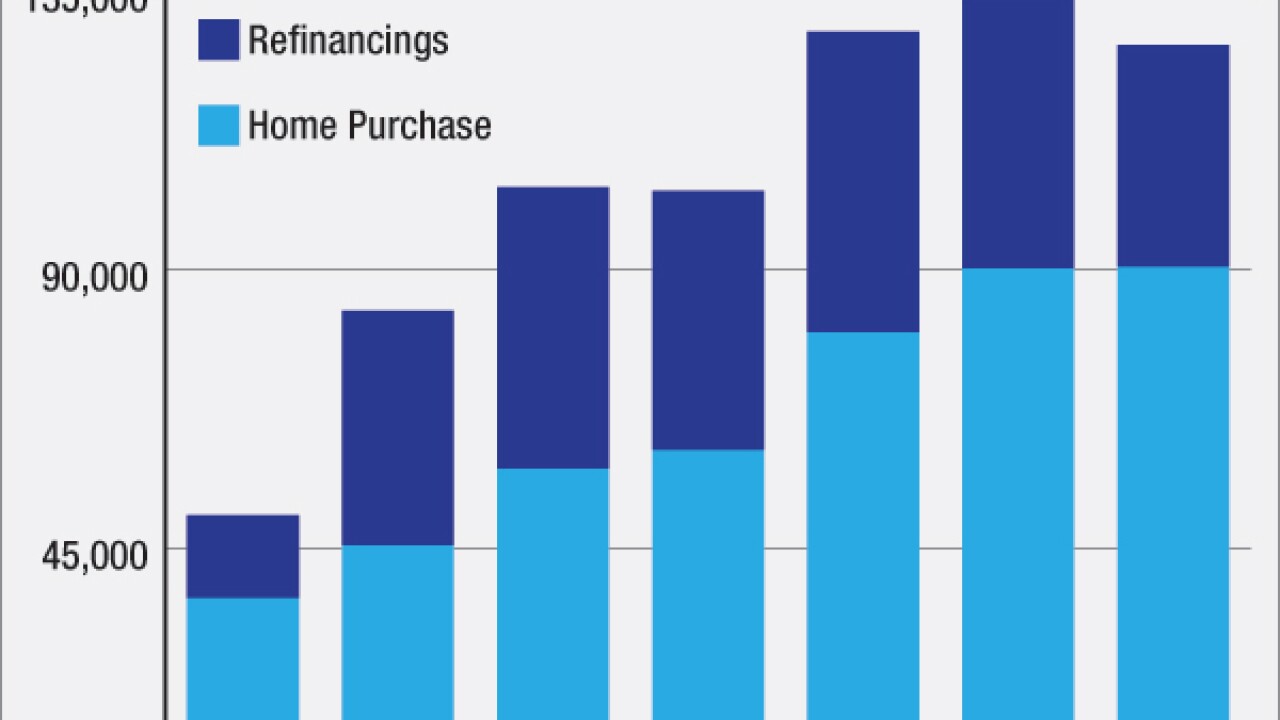

Both forecasts call for growth in home purchase volume over the next few years, but the decline in refinance originations will be so steep that overall origination volume will decrease.

October 21 -

Profits fell at New York Community Bancorp in Westbury, N.Y., as it continued to manage its balance sheet to stay below a key regulatory threshold.

October 21 -

Private mortgage insurers are seeking a larger share of the credit risk on Fannie Mae and Freddie Mac-guaranteed loans.

October 20