-

States have the option of adopting the oversight framework issued by the Conference of State Bank Supervisors, which resembles capital and liquidity plan proposed by the Federal Housing Finance Agency.

July 27 -

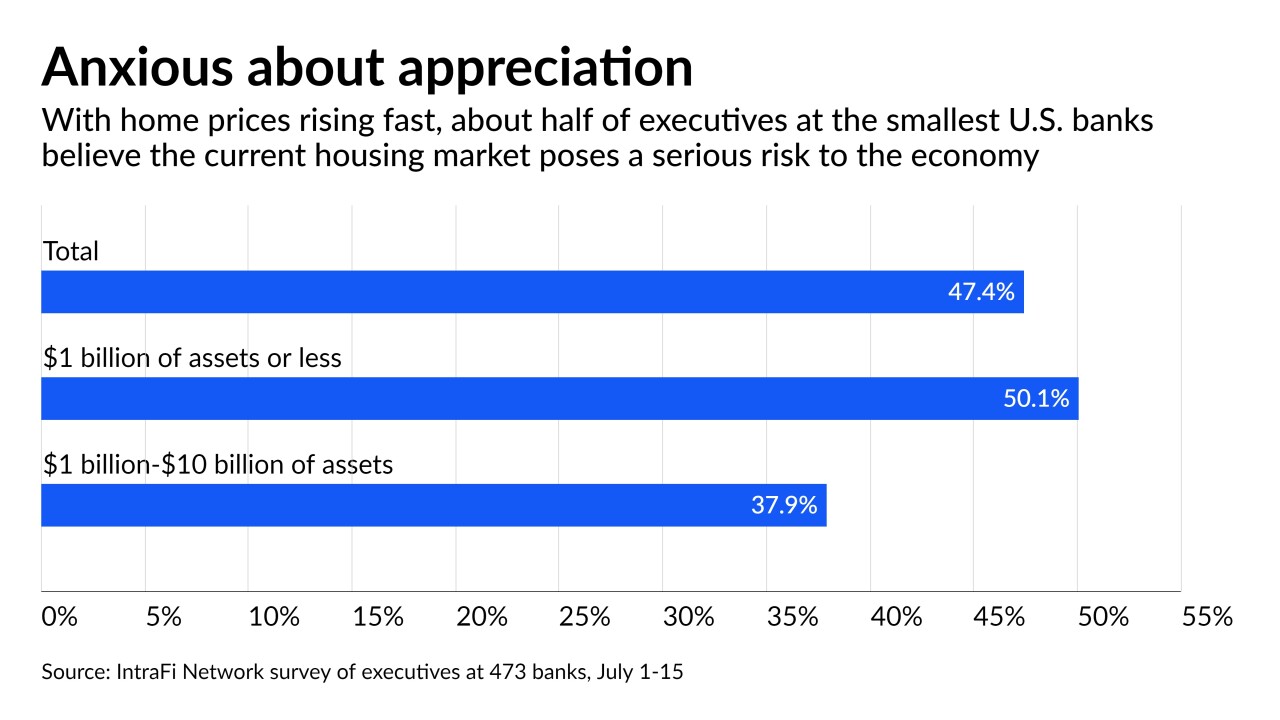

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

While federal regulators attempt to overhaul the Community Reinvestment Act for banks, Congress has shown little interest in applying it to other lenders. But recent moves in Illinois and New York have given some stakeholders hope that state lawmakers will pick up the slack.

July 26 -

The guarantor has for the first time proposed a risk-based capital requirement for companies not subject to other federal regulation. The industry says the plan, which would impose a heavy charge for servicing portfolios, could drive lenders away from government-backed programs.

July 26 -

The plan aims to cut monthly payments by roughly 25% for homeowners in government-backed mortgages who are negatively impacted by the pandemic.

July 23 -

The best performers in our annual ranking of banks with $10 billion to $50 billion of assets benefited from a big lending push. But like their peers, the top 10 as a group saw their profitability slip last year compared with 2019.

July 23 -

The Rhode Island bank endured a sharp decline in fee income from home loans, which had spiked earlier in the pandemic. But CEO Bruce Van Saun says the company is well positioned as the refinancing boom fades and the home purchase market becomes more important.

July 20 -

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

July 16 -

Prosecutors have rested their case against onetime bank CEO Stephen Calk, who allegedly approved millions of dollars in loans in exchange for a potential job in the Trump administration. Federal Savings Bank employees have testified against Calk, whose lawyers have sought to shift blame to underlings

July 8 -

The White House's firing of Federal Housing Finance Agency Director Mark Calabria sparked immediate speculation about who will run the agency and help chart the future of the two mortgage giants. Potential nominees include ex-Obama administration officials, congressional staffers and members of the Biden transition team.

July 8