-

The San Francisco company's quarterly earnings also reflected higher wealth management revenue.

January 15 -

The Federal Housing Administration's risk-sharing program with the Federal Financing Bank began as a temporary fix, but the agency is exploring how to make it more permanent.

November 27 -

Challenges will likely increase as interest rates rise and investors grow more concerned about a downward turn in the economic cycle.

November 16 -

Tepid loan and deposit growth has been a persistent theme in 2018, but that could soon change for community and regional banks in the New York and Washington markets.

November 14 -

Real estate and mortgage industry groups outspent proponents 3-to-1 to defeat Proposition 10, a measure to allow California municipalities to set local rent control laws.

November 7 -

Strong growth in the bank's core business of multifamily lending was offset by higher rates it paid on CDs and borrowed funds.

October 24 -

Double-digit gains in interest and noninterest income more than offset higher deposit, compensation costs.

October 12 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

As the demand for home rentals continues to rise, regulatory burdens could decrease the multifamily housing supply and drive up costs, witnesses said at a congressional hearing.

September 5 -

With values on multifamily properties soaring, some building owners are using aggressive tactics to push out existing tenants to make room for higher-earning ones. That’s raising questions about whether their lenders are abetting this behavior.

July 27 -

The company is once again positioning itself for growth now that it is no longer considered a systemically important financial institution.

July 25 -

Strong demand for business and multifamily loans, combined with double-digit growth in wealth management revenues, more than offset rising expenses.

July 13 -

Record loan originations and strong growth in wealth assets under management more than offset a double-digit increase in expenses at the San Francisco company.

April 13 -

Trump Bay Street, a New Jersey luxury apartment tower part-owned by Kushner Cos., received a $200 million loan from Citigroup, according to two people familiar with the deal.

March 21 -

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Despite the increase in loan demand, the New Jersey company swung to a loss in the quarter as it devalued its deferred tax asset.

January 25 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

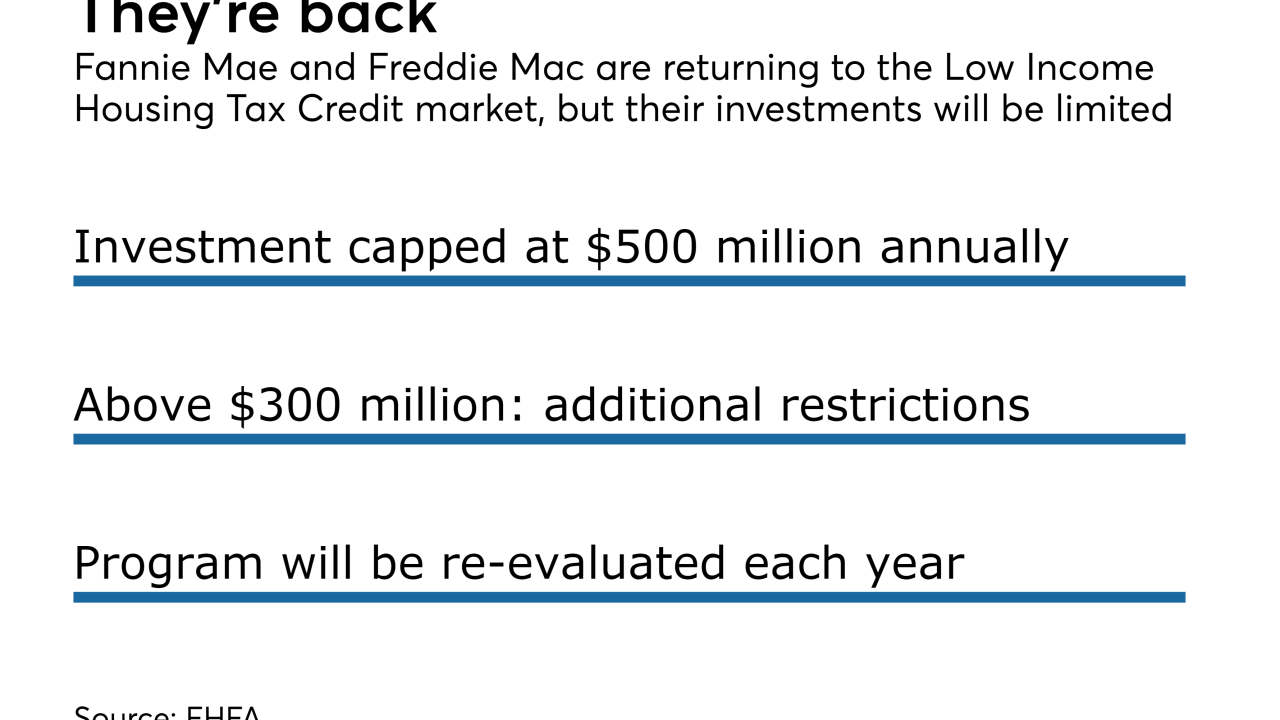

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Fee income also surged as the San Francisco bank reached the $100 billion mark in wealth management assets.

October 13 -

Putting faith in its team of experts analyzing every loan application, the Arkansas bank is shrugging off warnings of a real estate downturn.

September 28