-

The company is once again positioning itself for growth now that it is no longer considered a systemically important financial institution.

July 25 -

Strong demand for business and multifamily loans, combined with double-digit growth in wealth management revenues, more than offset rising expenses.

July 13 -

Record loan originations and strong growth in wealth assets under management more than offset a double-digit increase in expenses at the San Francisco company.

April 13 -

Trump Bay Street, a New Jersey luxury apartment tower part-owned by Kushner Cos., received a $200 million loan from Citigroup, according to two people familiar with the deal.

March 21 -

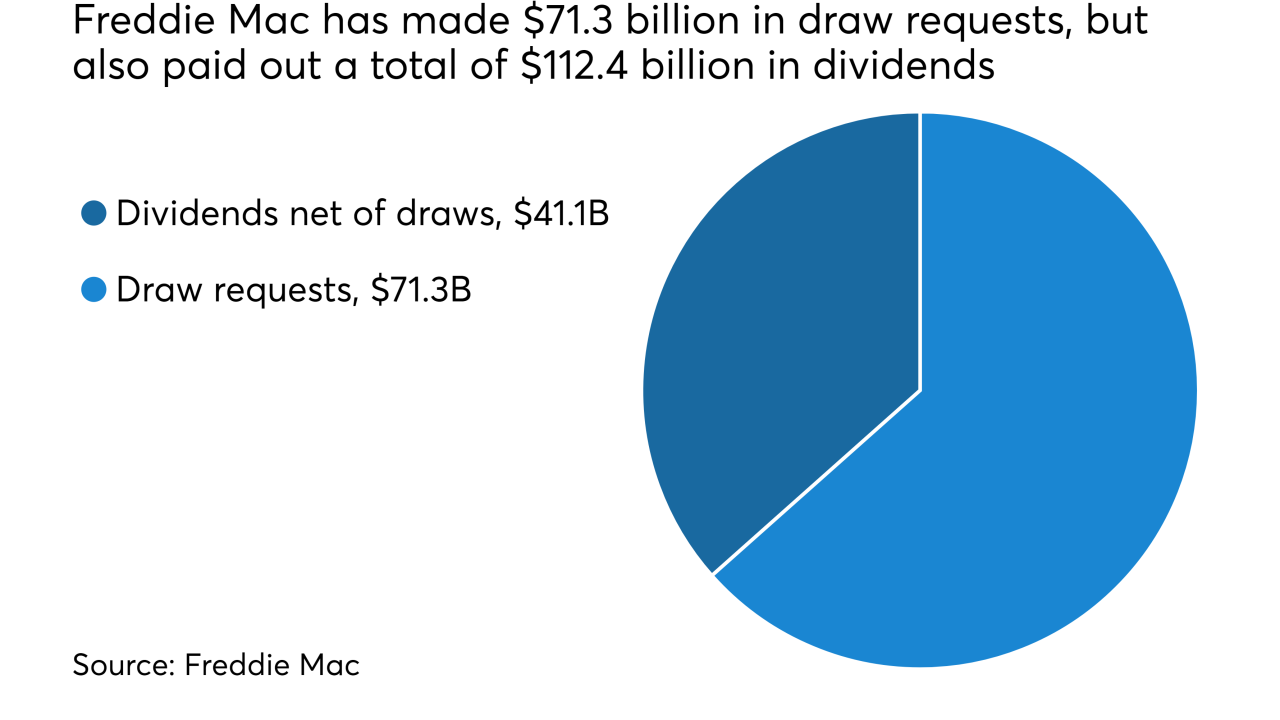

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Despite the increase in loan demand, the New Jersey company swung to a loss in the quarter as it devalued its deferred tax asset.

January 25 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

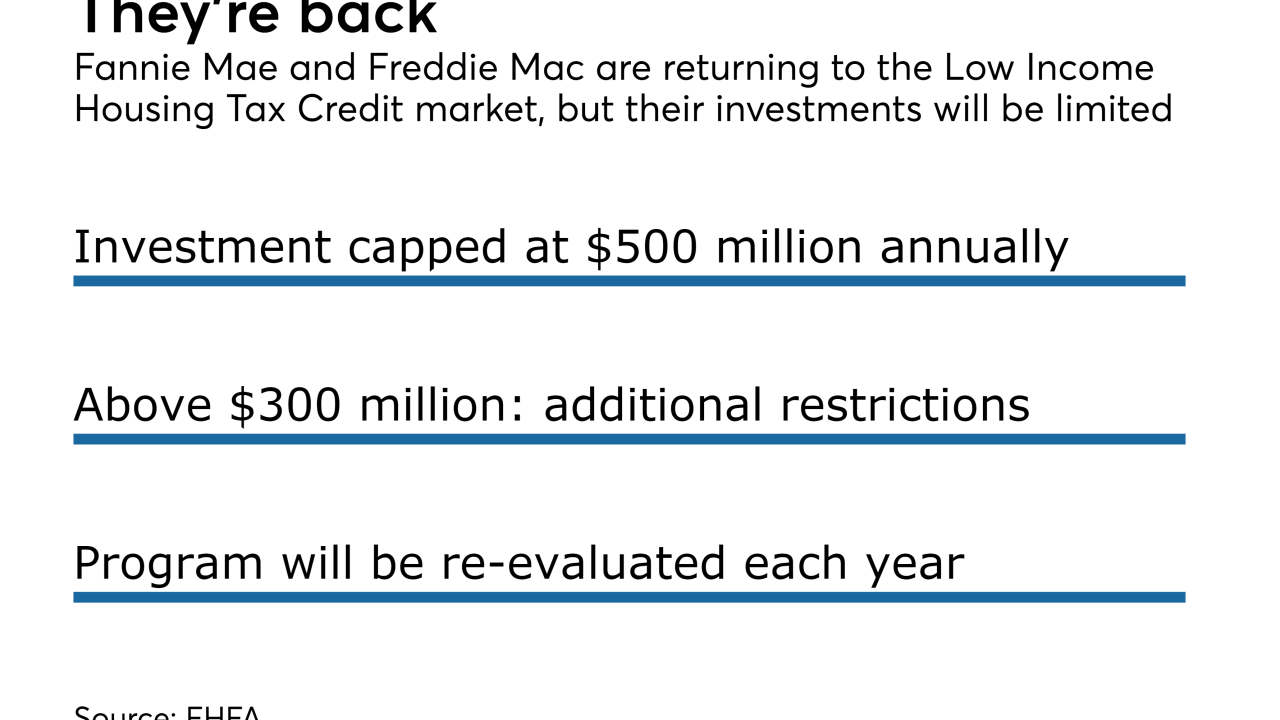

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Fee income also surged as the San Francisco bank reached the $100 billion mark in wealth management assets.

October 13 -

Putting faith in its team of experts analyzing every loan application, the Arkansas bank is shrugging off warnings of a real estate downturn.

September 28 -

Diana Reid's real estate unit accounts for roughly one-third of PNC’s annual revenue.

September 25 -

So-called transitional lending has traditionally been kept on balance sheet; but it’s become attractive to bundle the loans for transactions called (take a deep breath) commercial real estate collateralized loan obligations. Can investors stomach the features these deals sported before the crisis?

August 2 -

Insurers are seeing modest gains in market share as banks, facing increased scrutiny from regulators, lightly tap the brakes.

August 1 -

The Westbury, N.Y., company reported a 15% drop in earnings despite recording a large gain on the sale of some securities.

July 26 -

The California lender, which specializes in trade finance, reported strong growth in commercial and other lending categories last quarter, and it urged the Trump administration to seek fair trade deals with China.

July 20 -

With traditional mortgage lending opportunities becoming increasingly scarce, banks in Seattle and Portland are loading up on jumbos, diving into multifamily and reviving dormant bridge loan programs.

July 6 -

The Westbury, N.Y., company is angling for an acquisition as it approaches the $50 billion-asset mark.

April 26 -

The New York bank has rapidly expanded its commercial real estate lending over the last several years, but now it is ready to slow down a bit and add more commercial and industrial loans to the mix.

April 19 -

The Birmingham, Ala., company's profit climbed 8% as higher market interest rates and investment securities balances offset lower average loan balances.

April 18