-

More than 30 banks across the country, including dozens of community banks and some lenders with more than $1 billion in assets, could generate fees that surpass their 2019 net revenue before set-asides for loan losses.

July 7 -

Restaurants, medical offices and car dealerships were the top recipients of large loans; increased usage of the drive-ups is putting a strain on the low-tech lanes.

July 7 -

The Trump administration released details of almost 4.9 million loans to businesses — from sole proprietors to restaurant and hotel chains — under the federal government's largest coronavirus relief program so far, the $669 billion Paycheck Protection Program.

July 6 -

As PPP enters forgiveness phase, some banks see outsourcing as best move; after the Fed’s stress tests, Wells Fargo to cut dividend while other big banks boost capital buffer; Supreme Court strikes down CFPB leadership structure; and more from this week’s most-read stories.

July 2 -

The Senate had passed the bill Tuesday, shortly before the Small Business Administration was to stop accepting new loan applications.

July 2 -

The Main Street Lending Program is off to a slow start, while the PPP is extended five weeks to distribute the remaining $130 billion in loans; the European regulator is softening its stance to allow more deals.

July 2 -

The Paycheck Protection Program propped up many banks' balance sheets in the first half of the year, but what will drive loan demand in the second half?

July 1 -

The company seeks to help funnel more loans to minority businesses and consumers; the regulator says short-staffed banks are having trouble handling new government programs.

July 1 -

The extension to Aug. 8 was offered by Sen. Ben Cardin, a Maryland Democrat, and cleared the chamber by unanimous consent. The House has yet to take up the bill but could pass it as soon as Tuesday night.

June 30 -

Lenders are selling their Paycheck Protection Program loans or hiring outside companies to navigate the process in an effort to reduce risk and avoid overloading their employees.

June 30 -

Supreme Court says the president has the power to remove the director at will; the bank is the only one of the six largest U.S. banks to say it will cut its dividend next quarter.

June 30 -

The company said it had cut 20 positions and found a way to shed 35,000 square feet of office space by the end of 2020.

June 29 -

Wells Fargo customers targeted with phishing attacks using calendar invites; Fed freezes stock buybacks, caps dividends after stress test results; Citigroup names Titi Cole its head of global operations and fraud prevention.

June 26 -

The Loan Source, the nonbank lender buying the Paycheck Protection Program loans, has similar deals in place with other lenders.

June 26 -

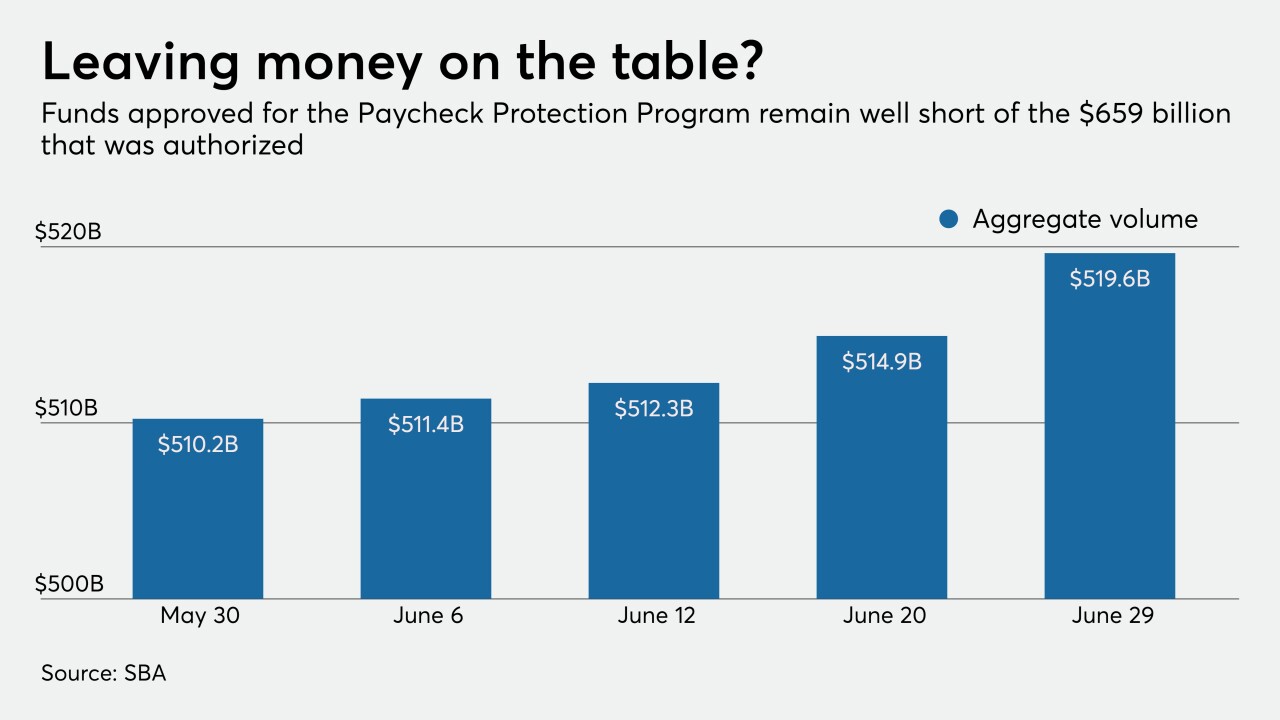

The Paycheck Protection Program had more than $100 billion in funding left as of last Saturday, with only days remaining until the Small Business Administration stops taking new applications on June 30.

June 25 -

Despite success lobbying for PPP inclusion and the elimination of Regulation D, the industry must continue to push for additional reforms.

June 25

-

The payments company is buying Finicity, which powers platforms for Rocket Mortgage and others; the small N.J.-based lender to fintechs is the fourth largest PPP provider.

June 24 -

The Paycheck Protection Program put a premium on speed in processing and funding loans.

June 23 -

Business owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

June 21 -

The agencies said late Friday that they will provide information on small businesses that received $150,000 or more from the Paycheck Protection Program.

June 19