-

Past is not prologue, and a successful strategy for becoming a top-performing bank in 2020 is very different from what it might have been just six months ago.

June 5

-

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

June 4 FS Vector

FS Vector -

Representatives of lenders as well as businesses that received pandemic bailout money told an oversight board Wednesday that delayed and confusing instructions from the government hampered the effectiveness of the main rescue program for smaller companies.

June 4 -

The bank’s Asia-Pacific chief backs law giving greater mainland control over the territory; the Center for Responsible Lending said big banks took in almost $12 billion in overdraft fees last year, with the bulk of it paid by lower-income customers.

June 4 -

The bill, which passed the House last week on a 471-1 vote, now heads to President Trump’s desk for his signature.

June 3 -

John Dugan says a successful effort by banks to alleviate the economic damage of the pandemic could boost the industry's reputation.

June 3 -

Automation and technology allow lenders to handle an evolving situation that changes by the day: adjustments are easily made to terms, timing and required data for loan forgiveness, says PayNet’s William Phelan.

June 3 PayNet, an Equifax company

PayNet, an Equifax company -

The program is intended to aid businesses hit hard by pandemic-induced lockdowns, but lenders are lobbying to have the rules relaxed to help owners of stores and offices damaged by recent riots and looting.

June 2 -

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

June 2 -

The Georgia company said the agency is looking at its policies for paying, or withholding, Paycheck Protection Program fees to borrowers' agents.

June 2 -

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

June 1 -

The agency is trying to get small lenders to help underserved businesses get the loans; although the British government is guaranteeing small-business loans, banks are required to collect on delinquents.

June 1 -

The SBA issues guidance on Paycheck Protection Program loan forgiveness; after staffing up for PPP, Bank of America may need to delay investments to meet cost targets; American Express has leaned hard on cloud tech to help employees work at home during the pandemic.

May 29 -

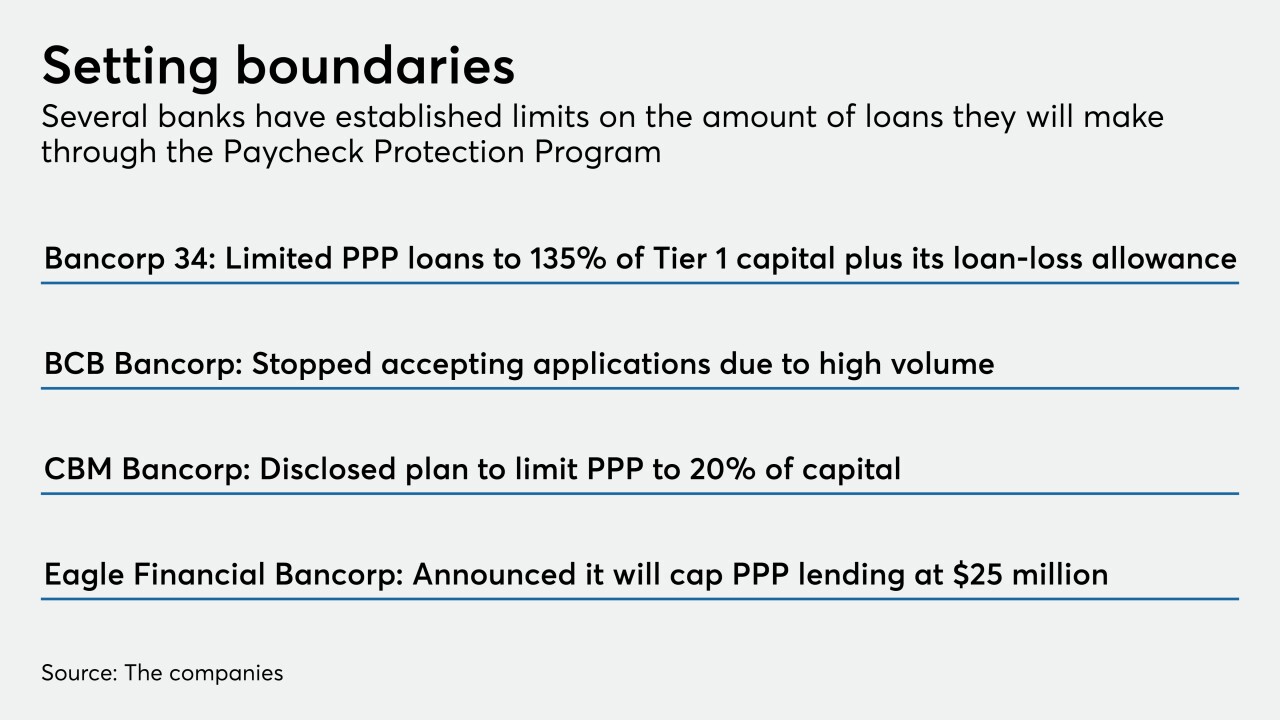

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

The bill, which now goes to the Senate, would give small businesses greater flexibility in how they use the funds; not everyone's on board with Otting's signature achievement.

May 29 -

The website, ppp.bank, will help borrowers in the Paycheck Protection Program apply for loan forgiveness.

May 28 -

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

May 28 -

The funds include $3.2 billion in loans that community development financial institutions had already approved during the PPP's second phase.

May 28 -

The funds include $3.2 billion in loans that community development financial institutions had already approved during the PPP's second phase.

May 28 -

Expenses soared in the rush to deploy emergency loans to small businesses, and now Bank of America may need to delay some investments if it hopes to meet cost targets, CEO Brian Moynihan said.

May 27