-

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

June 1 -

The agency is trying to get small lenders to help underserved businesses get the loans; although the British government is guaranteeing small-business loans, banks are required to collect on delinquents.

June 1 -

The SBA issues guidance on Paycheck Protection Program loan forgiveness; after staffing up for PPP, Bank of America may need to delay investments to meet cost targets; American Express has leaned hard on cloud tech to help employees work at home during the pandemic.

May 29 -

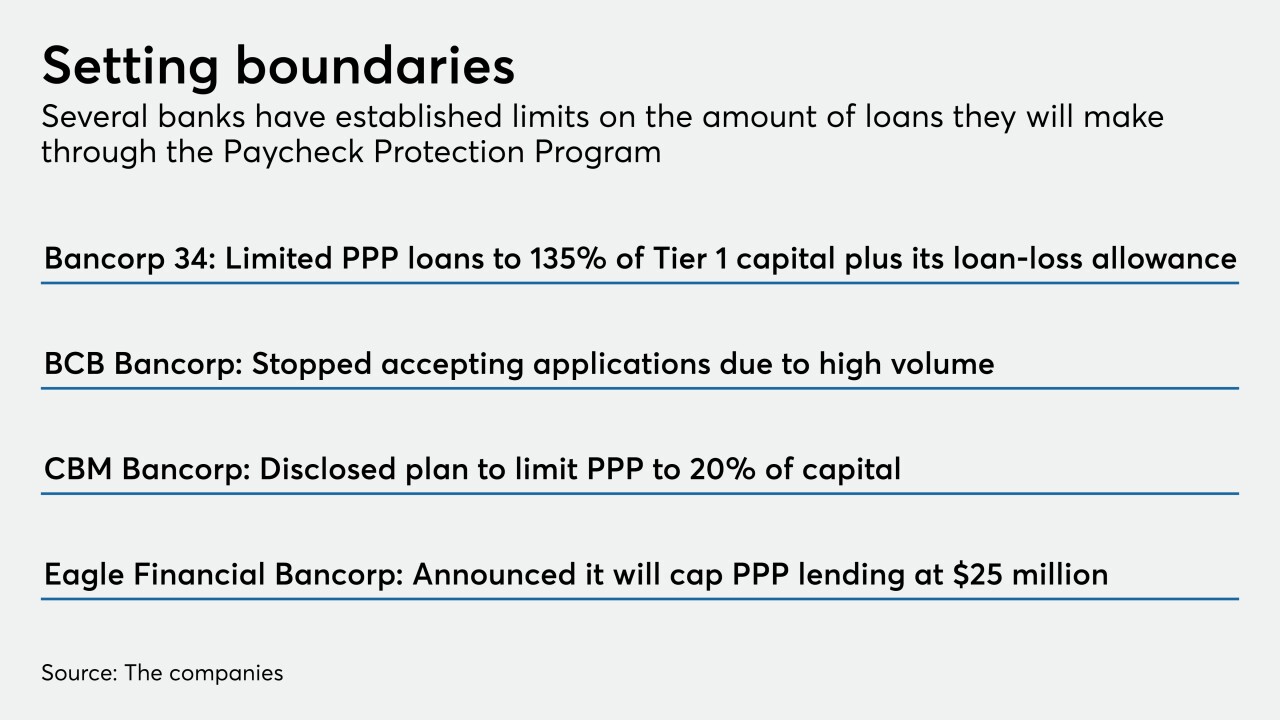

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

The bill, which now goes to the Senate, would give small businesses greater flexibility in how they use the funds; not everyone's on board with Otting's signature achievement.

May 29 -

The website, ppp.bank, will help borrowers in the Paycheck Protection Program apply for loan forgiveness.

May 28 -

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

May 28 -

The funds include $3.2 billion in loans that community development financial institutions had already approved during the PPP's second phase.

May 28 -

The funds include $3.2 billion in loans that community development financial institutions had already approved during the PPP's second phase.

May 28 -

Expenses soared in the rush to deploy emergency loans to small businesses, and now Bank of America may need to delay some investments if it hopes to meet cost targets, CEO Brian Moynihan said.

May 27 -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

May 27 FS Vector

FS Vector -

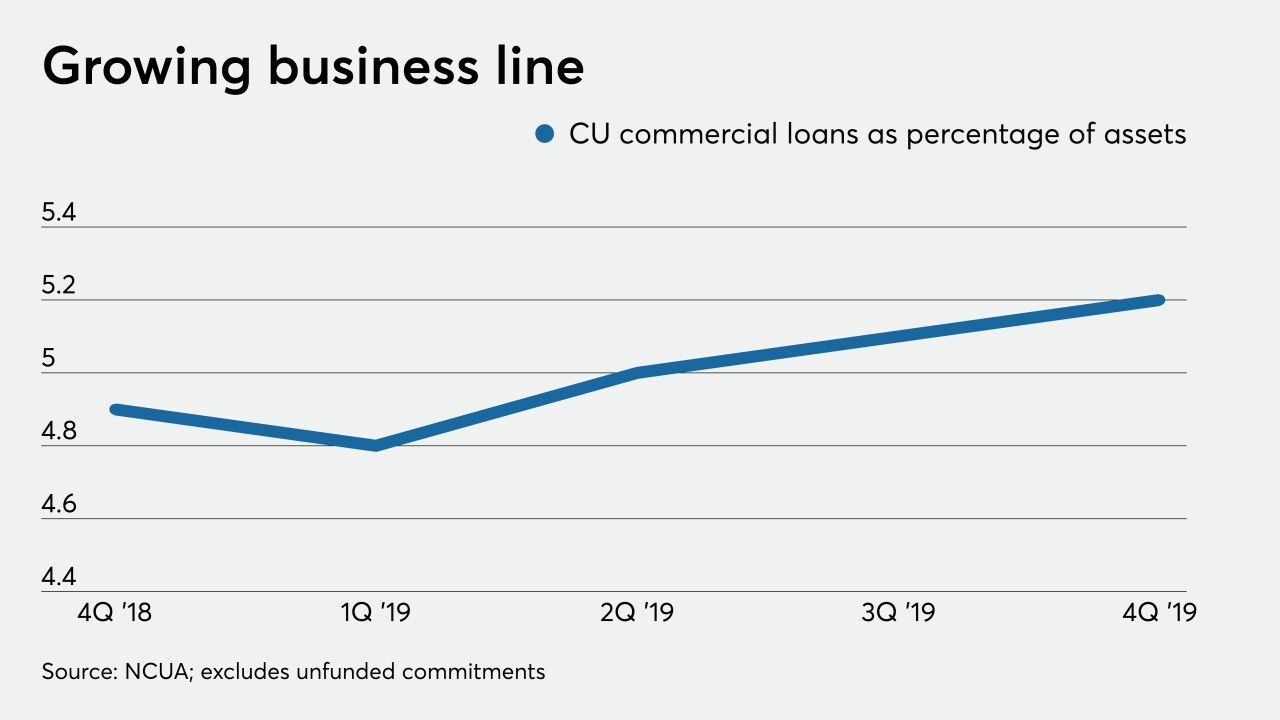

The industry is well positioned to gain market share, but institutions may not see the same levels of growth as after the last recession.

May 26 -

The new Paycheck Protection Program rules, which created a review process and timeline for paying lenders, did not extend the time borrowers have to comply or increase how much money can be spent nonpayroll expenses.

May 24 -

The SBA and Treasury Department release more guidance on PPP loan forgiveness; Santander Consumer reaches $550M settlement with state AGs; how Wells Fargo's tech chief is managing coronavirus response; and more from this week's most-read stories.

May 22 -

Companies that received funding from the Paycheck Protection Program in early April can start to submit forgiveness applications at the end of May.

May 22 -

The company, the product of a big merger shortly before the outbreak, had to build portals on the fly, help many customers shift to mobile and accomplish in days tasks that once took months, its digital chief says.

May 21 -

A Manhattan man was charged by federal prosecutors with fraudulently trying to obtain more than $20 million in government loans intended to aid small businesses affected by the coronavirus pandemic.

May 21 -

The FHFA says the two government-sponsored enterprises need at least $240 billion of capital before they can go private; Transunion says more than 3% of consumer loans it tracks are in financial hardship.

May 21 -

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

May 21 JPMorgan Chase & Co.

JPMorgan Chase & Co. -

The Small Business Administration gave lenders some direction for closing out Paycheck Protection Program loans. Bankers say it's an encouraging start, but they want more protection from liability and a concession on nonpayroll expenses.

May 20