-

Bankers have several unanswered questions about the Paycheck Protection Program before it reopens to select lenders on Monday. Among them: When will forms be available, and which portal will the Small Business Administration use?

January 8 -

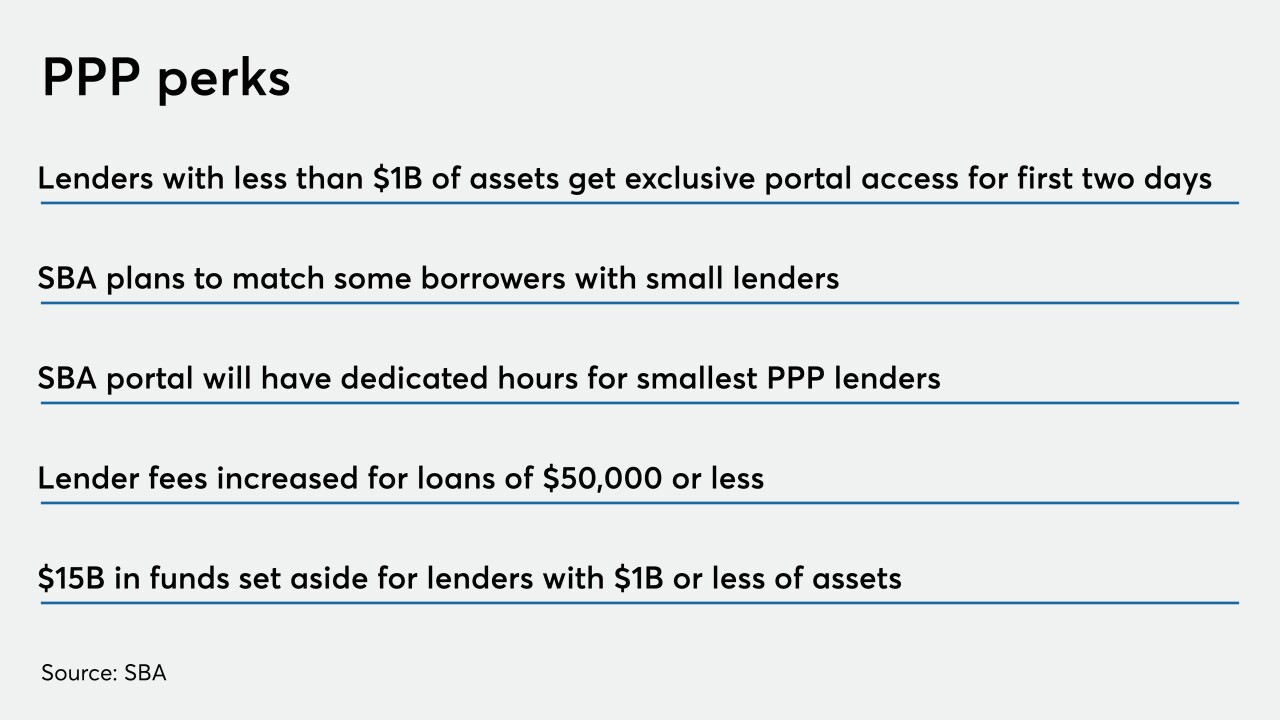

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

January 7 -

The Internal Revenue Service will allow businesses that got their Paycheck Protection Program loans forgiven to write off expenses paid for with that money, shifting policy after Congress passed new legislation last month.

January 6 -

The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

January 4 -

Triad Business Bank opened in North Carolina shortly before the launch of the Paycheck Protection Program, which brought in many clients. CEO Ramsey Hamadi, one of our community bankers to watch in 2021, will have to work hard to retain them after their loans are forgiven.

December 30 -

-

The new legislation includes a provision sparing lenders from having to pay such fees on Paycheck Protection Program loans, except in cases where they agree in advance with borrower representatives to do so.

December 29 -

Gilles Gade, one our community bankers to watch in 2021, led an effort that made Cross River Bank one of the biggest Paycheck Protection Program participants. He is ready for his team to pick up where it left off when the new stimulus package kicks in.

December 28 -

The legislation allows the Small Business Administration to waive fees and raise the guarantee for 7(a) and 504 loans, which could encourage more small businesses to apply for loans as the economy recovers.

December 22 -

The Oregon bank has launched a new division targeting businesses with up to $15 million in annual sales and tapped the banker who led its Paycheck Protection Program lending, Ashley Hayslip, to run it.

December 22