-

By enabling instant settlement for bank payments at checkout, the retailer is adding speed to an option that reduces card transaction fees. But getting consumer buy-in may be a challenge.

September 20 -

After Republican presidential nominee Donald Trump said he intends to place a temporary cap on credit card interest rates, many felt the plan would create a large constriction of credit.

September 20 -

Merchants and card networks have battled over interchange rates for years. How will the next president change the fight?

September 20 -

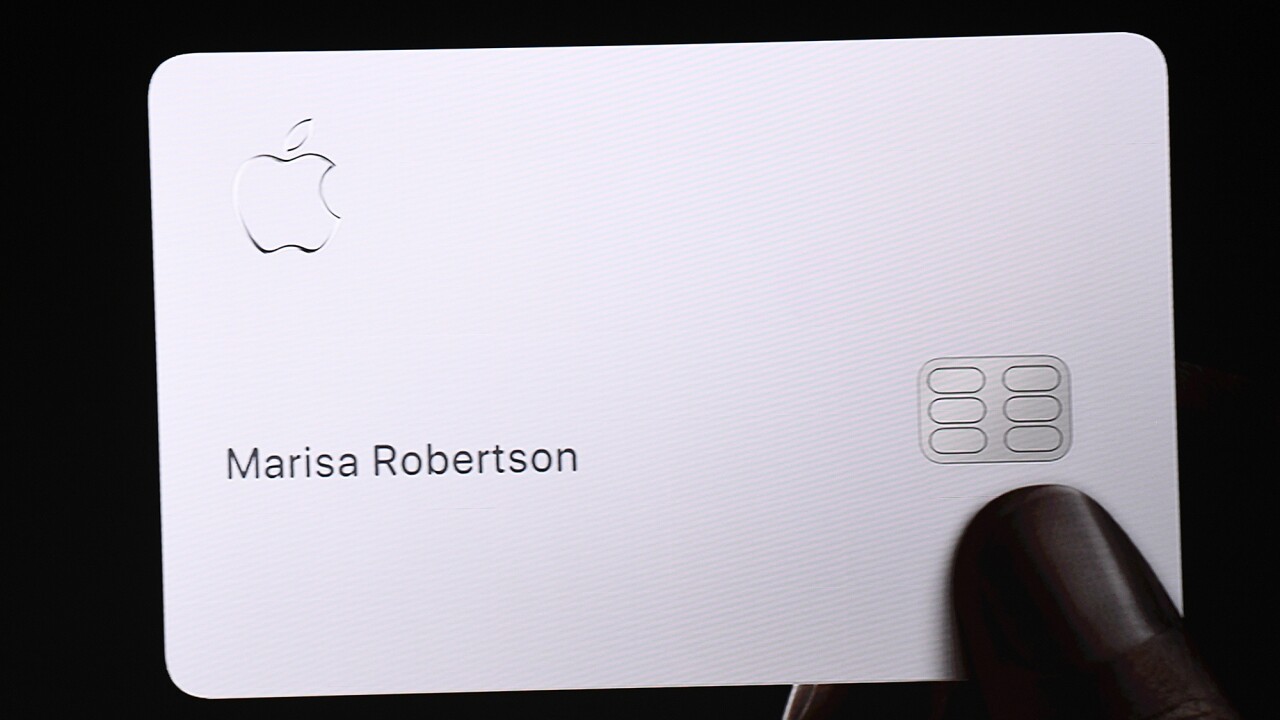

Apple's credit card business is up for grabs, presenting a chance to cross-sell financial products. But that opportunity comes at a cost.

September 19 -

Regulators in two countries are strengthening rules requiring banks and merchants to accept paper, while a majority of Canadian payments are now tap to pay.

September 18 -

The BNPL industry is growing at a fast clip. Australia-based Zip's new CEO for U.S. operations is looking to carve out a place in what is becoming a crowded industry with expanded merchant partnerships and a Pay-in-8 product.

September 18 -

As member demand for installment payments increases, resource-strapped institutions are looking for outside help. Fintechs offer the service.

September 16 -

The bank's acquisition of embedded finance firm Rize Money and collaboration with open banking firm Trustly will enable the bank to grow real-time processing, account-to-account transfers and address emerging compliance challenges.

September 13 -

As the toll of financial crime rises, the card network is attempting to boost its fraud-fighting game by buying threat intelligence firm Recorded Future.

September 12 -

The card network is building a model for account-to-account payments, which are gaining popularity, while Swedish regulators criticize Klarna's money-laundering prevention efforts. That and more in American Banker's global payments roundup.

September 11