-

American Banker predicted these five bankers would make news. Several delivered, mostly with small, strategic deals and finding ways to make money in spite of challenging conditions.

December 23 -

The similarities between the mortgage crisis and subprime auto lending in 2016 are all too obvious, with constrained cash flows, defaults and investor losses all likely.

December 23 Davis & Gilbert LLP

Davis & Gilbert LLP -

With signs pointing to a possible rebound in de novo activity, the Federal Deposit Insurance Corp. released a guide to potential organizers about the application process.

December 22 -

At a time when individual accountability at corporations is mounting, here is how compliance officers can detect and prevent fraud occurrences within their own firms.

December 22 Intralinks

Intralinks -

Lenders should be braced for some potential headaches as oil-related bankruptcies are expected to continue at a steady clip in 2017 and various market and political forces could influence oil supplies and prices.

December 22 -

Flagstar Bancorp in Troy, Mich., said that the Office of the Comptroller of the Currency has terminated its 2012 consent order with its Flagstar Bank on Monday.

December 20 -

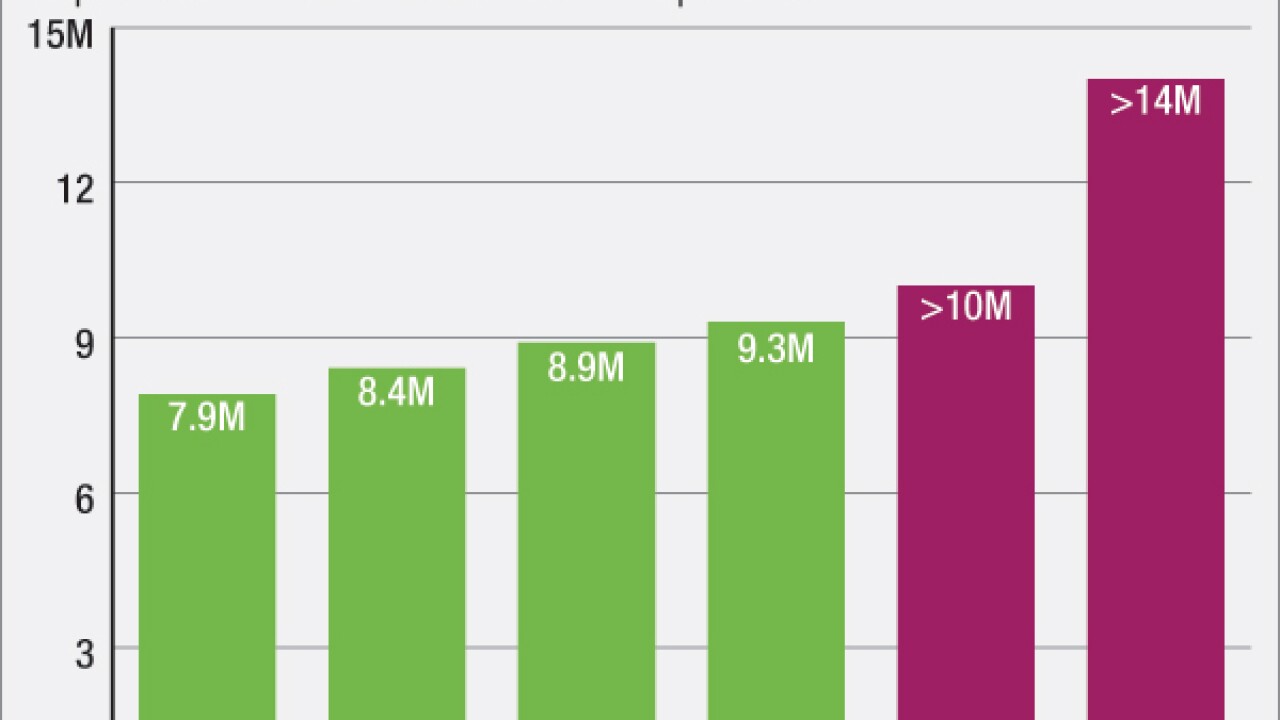

Smaller institutions have increased the size of their auto books in the last year, with the 25 most-active lenders reporting a nearly 7% increase. More borrower demand and a pullback by some bigger lenders are contributing to the rise.

December 19 -

To act like a startup as many banks say they want to do institutions must employ a nontechnical strategy: build services based on customers say they want.

December 16 Seed

Seed -

Borrowers served by the FHA program, particularly first-time buyers and minorities, have benefited from nonbanks' increase in lending. Those independent lenders should be commended for filling a gap.

December 16 Community Mortgage Lenders of America

Community Mortgage Lenders of America -

But they wont do it right away. Heres why not, and what will have to change in retail and commercial banking for deposit-funding costs to begin to rise along with increases in the federal funds rate.

December 14 -

Ralph Hamers, CEO of ING Group in Amsterdam, sat down with American Banker to talk about the company's future in the U.S., plans to grow mobile users and banks' relationship with fintech.

December 13 -

Banks aiming to market internally developed products to other banks are also taking steps to become better vendors. Leader Bank, for instance, took more than a year to get its technology and staffing up to snuff before pitching its rent-payment program.

December 12 -

The focus of banks' sales practices should be less about unit-based incentives, and more about developing a full relationship with customers and doing what's in their best interest.

December 12 Treliant LLC

Treliant LLC -

The American Bankers Association has filed a lawsuit against the National Credit Union Administration, arguing that the regulator's new field-of-membership rule go too far.

December 7 -

Citigroup in early December added its 1 millionth new customer to the Costco card portfolio it acquired earlier this year.

December 7 -

U.S. Bancorp in Minneapolis has raised its expectations for its net interest margin in the fourth quarter, citing the recent increase in benchmark rates.

December 7 -

Wells Fargo's retail bank trends in November were probably similar to those in the previous month, CEO Tim Sloan said Tuesday at an investor conference in New York.

December 6 -

JPMorgan Chase's new Sapphire Reserve credit card will reduce the banks profit by $200 million to $300 million in the fourth quarter, according to CEO Jamie Dimon.

December 6 -

Three fund managers and two advisory firms have soured on PrivateBancorp's planned sale to CIBC, raising the possibility that investors could nix the deal. What would happen next is anyone's guess.

December 5 -

Anthony Labozzetta, CEO of Sussex Bancorp in New Jersey, isn't afraid of change. His unusual approach to banking helped Sussex emerge from the financial crisis with momentum. Now he's building a branch model that could serve as a blueprint for growth-minded banks.

November 30