-

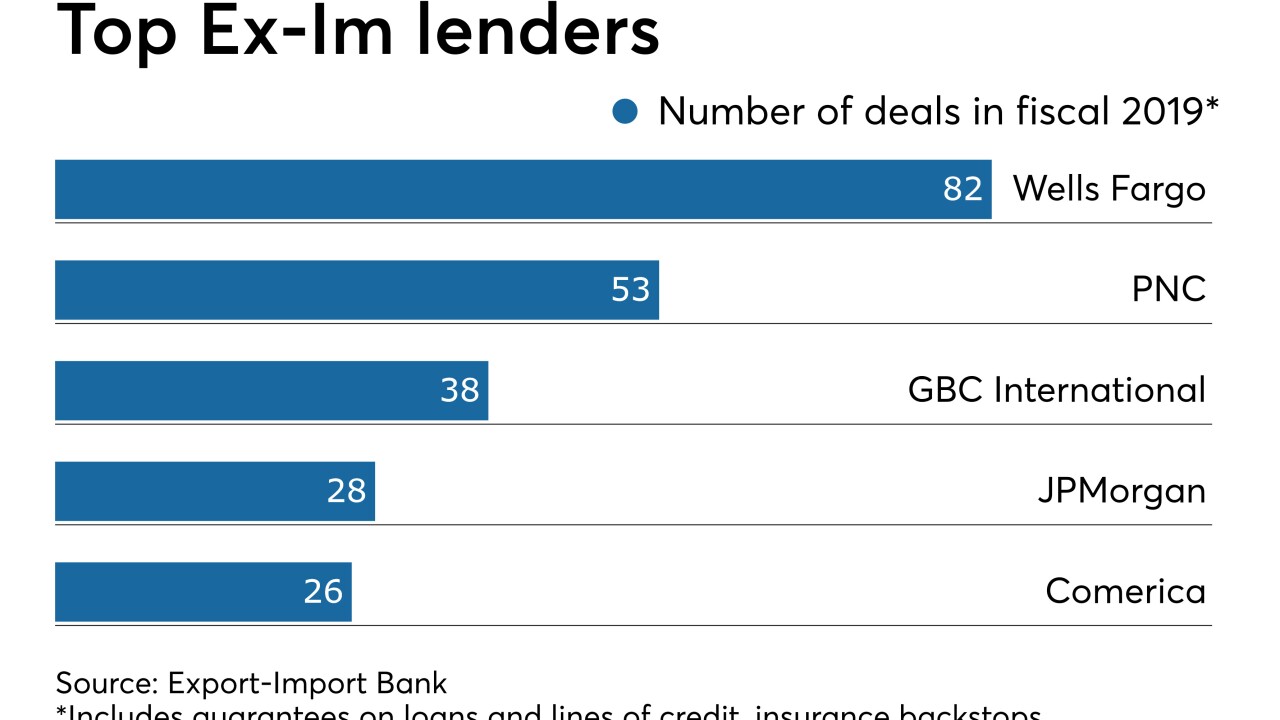

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

The head of the small-bank trade group called for hearings to discuss tougher limits on credit union acquisitions of banks.

January 30 -

To guard against headwinds in the agricultural sector, the Federal Deposit Insurance Corp. recommended that institutions consider the “overall financial status” of farm loan borrowers.

January 28 -

The body will include the Bank of England, Bank of Canada, the Bank of Japan and the European Central Bank, but not the Federal Reserve or the People's Bank of China.

January 21 -

Federal legislation introduced this week by Rep. Gregory Meeks, D-N.Y., would ensure that taxi drivers don't get taxed on medallion debt that gets forgiven. The bill dovetails with a debt forgiveness plan under development in New York, where hundreds of drivers have filed for bankruptcy.

January 17 -

Federal legislation introduced this week by Rep. Gregory Meeks, D-N.Y., would ensure that taxi drivers don't get taxed on medallion debt that gets forgiven. The bill dovetails with a debt forgiveness plan under development in New York, where hundreds of drivers have filed for bankruptcy.

January 17 -

The president tapped the pair in July for the two remaining vacancies, but the formal announcement of his intention to nominate them didn’t come until this week.

January 17 -

Alan Kline, a 22-year veteran of American Banker, has previously served as editor-in-chief of US Banker.

January 16 -

The proposal announced Tuesday is aimed at attracting younger voters.

January 14 - LIBOR

Regulators' oversight of the industry's switch to a new interest rate benchmark is expected to intensify as a key deadline approaches.

December 29 -

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

December 27

-

The agency’s semiannual report warned institutions to be mindful of operational risks from the innovation in core banking systems, and detailed supervisory steps to monitor the adoption of a new reference rate.

December 9 -

Federal Reserve officials said they contained fallout from the rate spike in the repurchase agreement market, but the episode poses longer-term repercussions for liquidity rules, the transition to a new interest rate benchmark and other issues.

December 3 -

One-time expenses at a handful of large banks marred an otherwise solid quarter, while higher charge-offs point to possible credit-quality concerns.

November 26 -

More than half of U.S. counties lost access to bank branches between 2012 and 2017, with rural counties that have less educated and minority residents especially hurt, the central bank said.

November 25 -

A recent bill would require financial institutions to provide data on suspicious firearms transactions as part of anti-money laundering efforts.

November 22 -

A recent bill would require banks to provide data on suspicious firearms transactions as part of anti-money-laundering efforts.

November 21 -

The central bank originally predicted FedNow's launch within five years, but the Fed chairman told House lawmakers that he expects it will happen sooner.

November 14 -

Unlike previous central bank chiefs, Powell’s chances of being renominated by either the current president or many of the Democratic contenders are slim.

November 10 -

If elected president, Sen. Elizabeth Warren would charge large banks a fee to help pay for her Medicare-for-all plan.

November 4 American Banker

American Banker