-

As other banks de-emphasize mortgage lending, Citizens is spending half a billion dollars to buy a large originator with a big servicing portfolio.

May 31 -

The Rhode Island regional agreed to buy Franklin American Mortgage. With the acquisition it would have one of the nation's 15 largest bank-owned mortgage platforms.

May 31 -

Whether they’re thwarting cyber thieves or building out new apps, bank chiefs say hefty tech investments are now a cost of doing business — but they have to convince shareholders.

May 30 -

Despite Tuesday's blip, many banks have seen double-digit gains in the months since the Dodd-Frank reform law was unveiled. There's good reason to think the run-up will continue.

May 29 -

The London interbank offered rate will likely be replaced by a new reference rate that critics say is better suited for the derivatives market than it is for commercial lending.

May 28 -

A competitive job market and improved security protocols are pushing more banks to consider letting employees work remotely.

May 24 -

The agreement was tied to the Puerto Rico company's 2010 purchase of the failed Westernbank.

May 24 -

A recent wave of high-premium acquisitions, paired with sweeping regulatory reform, is setting the stage for more large-scale M&A.

May 23

-

Mahesh Aditya will immediately take over risk management for the U.S. subsidiary of Banco Santander, which is trying to turn the corner after several tough years on the regulatory and financial fronts.

May 22 -

A number of credit unions and banks have been accused of operating websites that violate the Americans with Disabilities Act. Here’s why trial lawyers are targeting them and are expected to sue more.

May 21 -

Several dozen banks have been accused of operating websites that violate the Americans with Disabilities Act. Here’s why trial lawyers are targeting them and are expected to sue more.

May 21 -

The nearly $5 billion deal to acquire MB Financial would provide the Cincinnati company with immediate scale in the Windy City.

May 21 -

Equity warrants. Capital calls. Off-balance-sheet accounts. SVB's unusual business model thrives on financing rainmakers and cutting-edge firms, but old-school issues like overconcentration, unpredictable fee income and stock market swings lurk in the background.

May 15 -

Lenders are taking steps to reduce exposure to fluctuations in oil prices, including getting tougher in demanding that drillers use commodity hedges.

May 14 -

A planned stock offering by the French banking giant would lower its stake in First Hawaiian to 49.9%.

May 8 -

The Japanese bank, owner of Union Bank in San Francisco, has hired RBC alum Roger Blissett to raise its profile among lawmakers, oversee compliance and build deeper relationships with regulators as its recent charter switch continues to stir controversy.

May 8 -

The Bridgeport, Conn., company said Friday that CEO Jack Barnes has relinquished the president's title and that Jeff Tengel has moved into the role.

May 4 -

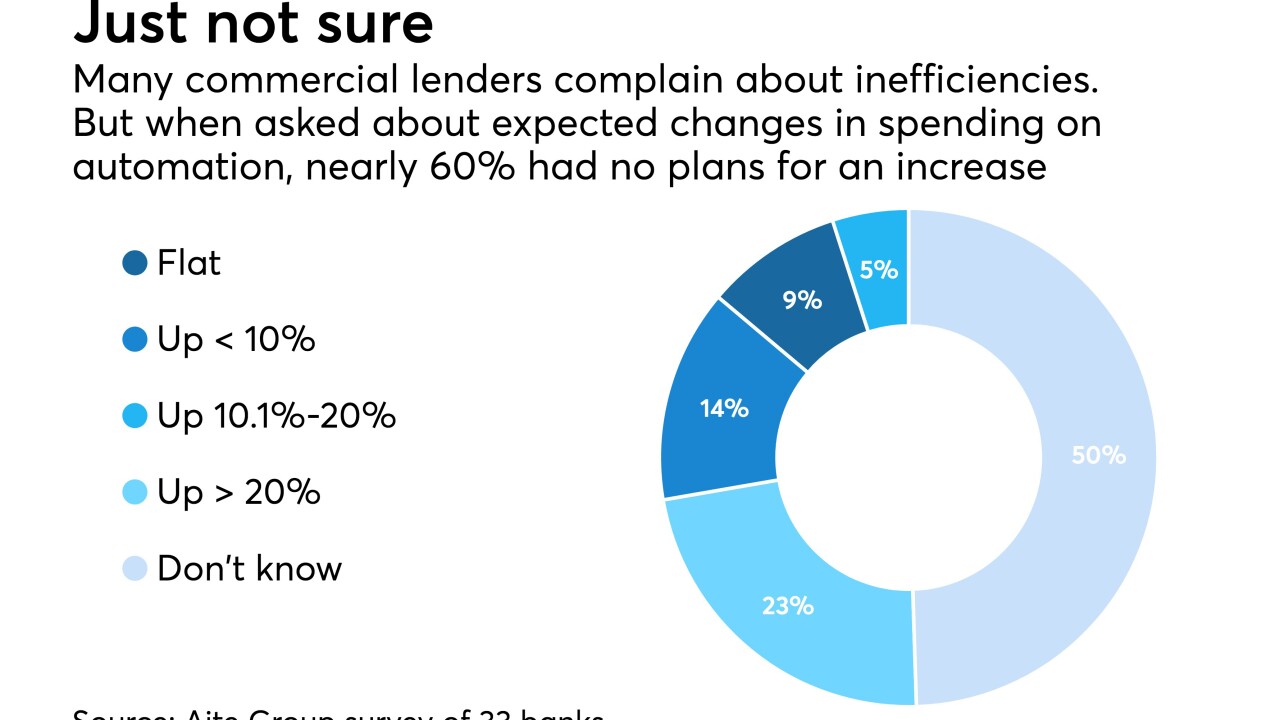

A bank that can deliver a loan decision a little faster, or ask a client to input information just once, could get a leg up on the competition. But some executives are skeptical of software sales pitches and fear overpaying.

May 3 -

Fifth Third is helping babies born in Chicago today (Get it? 5-3) save for college. It's the kind of nontraditional marketing that branding experts say more banks should experiment with.

May 3 -

Anderson Insurance & Investment Agency in Minneapolis also specializes in workers' compensation services.

May 1