-

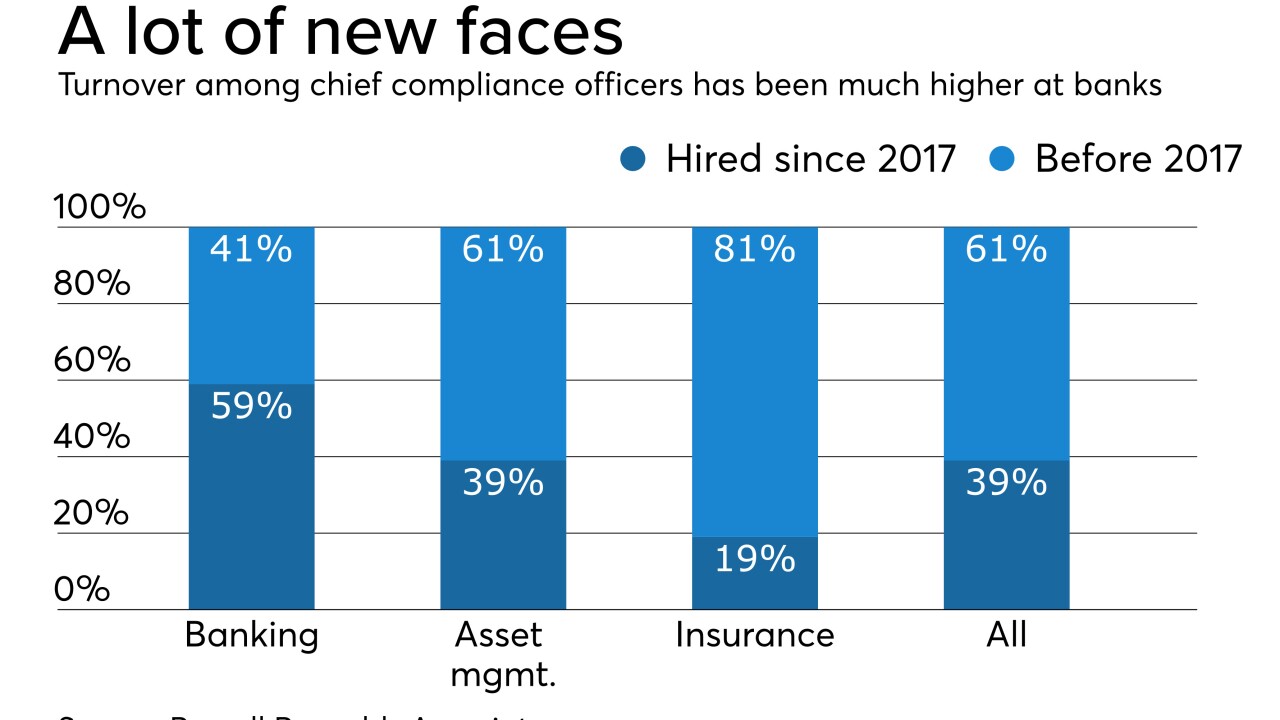

Banks had the highest turnover of chief compliance officers among the 100 largest financial services firms in the world, according to a recent study. Recruiters say that’s a function of changing job demands, high pressure and poaching by fintechs — plus old-fashioned demographics.

January 3 -

While his focus is on organic growth in Texas and California, Curt Farmer says he would consider a deal in those states if the right one comes along.

January 2 -

Political uncertainty, sector-specific concerns as well as interest rate and labor trends may continue to depress commercial and industrial lending in the coming months.

December 31 -

With adjustments to the post-crisis regulatory framework now complete, the Federal Reserve may begin the decade year with a focus on supervisory and examination processes.

December 25 -

The fresh optimism is starting to outweigh some of the worries hanging over the sector heading into the new year.

December 19 -

Fintechs want access to customers’ financial data, but banks are resisting, on security concerns; Deutsche Bank may cut bonus pool 20% after 14% drop last year.

December 16 -

In addition to overseeing the bank’s lines of business, technology and operations, Kevin Blair will now be responsible for human resources, credit administration and all customer-facing support functions.

December 13 -

Though details of a potential pact with China aren't clear, bankers are hoping it could convince leery customers to finally go through with delayed investments.

December 13 -

The average price of a previously owned car has fallen in two consecutive months, and if the trend continues, lenders could see losses mount, Richard Fairbank said this week.

December 12 -

Many business customers are putting off expansion because they can’t find enough workers to fill available jobs.

December 11 -

Brendan Coughlin will succeed Brad Conner as head of consumer banking, and Beth Johnson will be the bank's first chief experience officer.

December 10 -

BB&T and SunTrust showed that big-bank mergers are still possible, but top executives at other large regional banks say that a knee-jerk response would be a mistake.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

The sale comes just three years after the San Francisco bank bought the platform.

December 9 -

Cost cutting and systems integrations are short-term priorities, but over time CEO Kelly King and his heir apparent, Bill Rogers, will have to exploit the combined BB&T-SunTrust's revenue potential and prove the biggest post-crisis merger was a good idea.

December 9 -

BB&T has said the outage, which blocked customers' account access for hours, cost it about $20 million.

December 3 -

Once struggling to remain relevant, the Providence, R.I., bank is now an industry standout. Inside the story of its resurgence.

-

Many lenders are establishing a firm bottom on variable interest rates amid intense competition for commercial credits, rising deposit costs and the possibility that the Fed could take rates to unprecedented lows.

November 27 -

Toronto-Dominion Bank would end up with a smaller stake in a larger brokerage if Schwab and TD Ameritrade combined. But it could parlay that stake into funds for a U.S. bank acquisition.

November 21