-

The banking sector has stabilized significantly since the spring of 2023, but elevated interest rates have created lingering issues on bank balance sheets.

March 4 -

Industry Bancshares has been bogged down for years with unrealized losses. The Federal Reserve issued a cease-and-desist order against the firm, following similar actions by other agencies.

November 19 -

The top risk executives at U.S. banks are still weighing the fallout from the failures earlier this year and are considering ways they can better handle risks tied to their treasury and asset-liability management.

December 19 -

Banking crises always recur. But time and again, bankers have been shown to operate on the assumption that good times are permanent.

September 1 K.H. Thomas Associates

K.H. Thomas Associates -

Regulators had their priorities backward when it came to overseeing SVB and allowed an obvious danger to go unmitigated.

April 14 K.H. Thomas Associates

K.H. Thomas Associates -

Klarna Bank, which advertises itself as a way to spread the cost of the latest brands and smartphones, is shelling out loans for milk and gas with cash-strapped customers looking for ways to cover basic necessities.

July 11 -

In its semiannual risk report, the Office of the Comptroller of the Currency said it was working to provide clarity on the legality and soundness related to digital assets.

June 23 -

Under a proposed rule change, credit unions would no longer need to seek pre-approval from the regulator before entering into interest rate swaps, speeding up transactions for some of the industry’s biggest institutions that already hold over 80% of total assets.

January 25 -

The credit union regulator has held back in allowing the use of derivatives but has released a proposal that would remove red tape for some larger institutions.

October 15 -

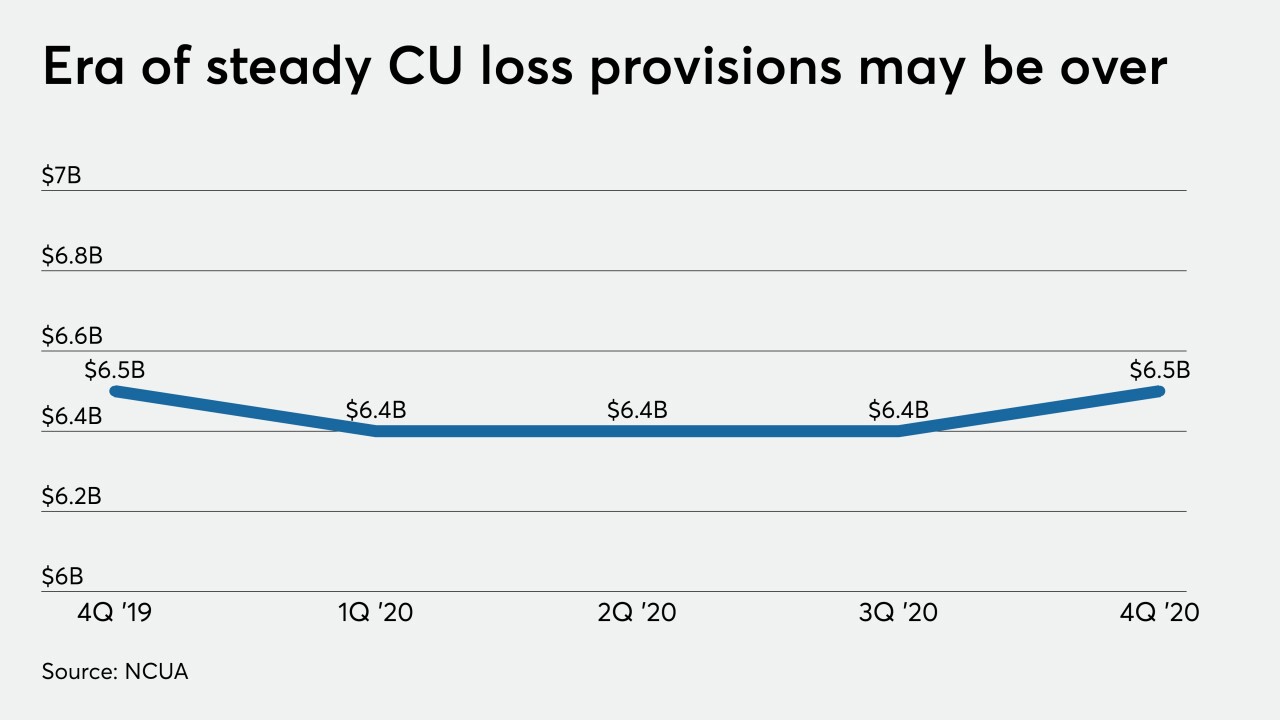

The industry will have to grapple with pressure on net interest margins, interchange income and credit quality, said CUNA Mutual's Steve Rick during a virtual conference.

August 13 -

With multiple business sectors reeling from the pandemic, banks are facing tighter net interest margins, provisioning more for losses and seeing their balance sheets expand, the agency said in a report.

June 29 -

Consumers are parking their funds at financial institutions as lending slows and interest rates remain near zero, making it difficult for credit unions to deploy these deposits.

June 22 -

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.

May 18 -

The group that worked with the Fed to devise an alternative rate to Libor rejects criticism that the index favors megabanks.

May 11 Alternative Reference Rates Committee

Alternative Reference Rates Committee -

Some megabanks are pushing New York lawmakers to add a legal safe harbor if lenders use the new Secured Overnight Financing Rate. Smaller banks would have little choice but to take that option.

May 4 Signature Bank of New York

Signature Bank of New York -

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 7 Nations Lending Corp.

Nations Lending Corp. -

While his focus is on organic growth in Texas and California, Curt Farmer says he would consider a deal in those states if the right one comes along.

January 2 -

Negative benchmark interest rates are becoming commonplace in Europe and Japan. Here’s what US credit unions need to know in case that happens here.

December 3 Bonneville Power Administration

Bonneville Power Administration