-

At first the deal seemed an unlikely marriage of two mortgage-heavy companies. But acquiring the Michigan company would help New York Community accomplish its two chief goals — reducing deposit costs and its concentration of multifamily loans — while giving it the scale to pursue more deals.

April 26 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

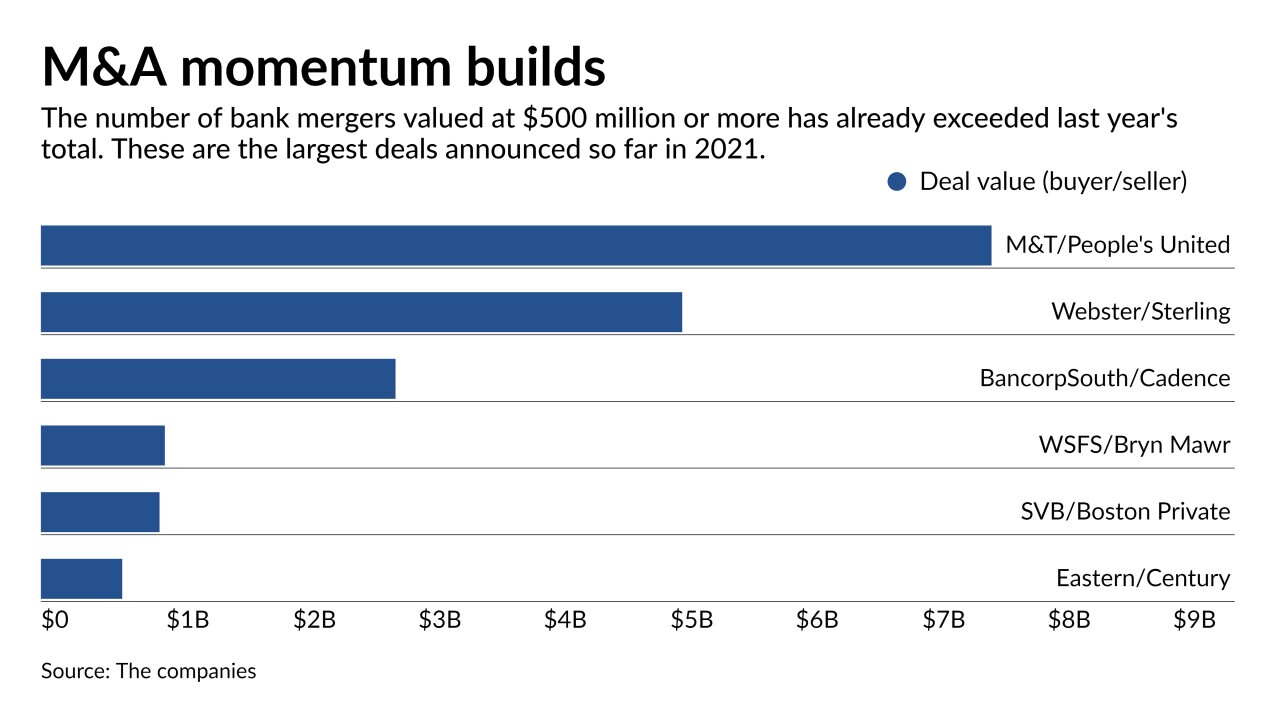

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

April 21 -

The Ohio company has opened just 32 of 120 new branches it plans in the region by 2022, but those offices are making a sizable contribution to growth.

April 20 -

The Connecticut company will have more than 200 branches and $64 billion of deposits after completing the acquisition.

April 19 -

Zions Bancorp. CEO Harris Simmons says the Secured Overnight Financing Rate is more suited for derivative traders than regional banks as a replacement for Libor. His bank this week became the largest to say it would use the alternative developed by the American Financial Exchange.

April 15 -

BancorpSouth would have $44 billion of assets after it buys Houston-based Cadence. The company will be rebranded, while the bank will retain the Cadence name.

April 12 -

Longstanding familiarity with each other and years of informal talks helped the companies negotiate their $7.6 billion merger in just two months.

April 6 -

Toronto-Dominion Bank Chief Executive Bharat Masrani said he’s still interested in a major acquisition to add to the firm’s U.S. retail operations, and that he’s unfazed by the recent valuation surge for the regional lenders that would be his most likely targets.

April 1 -

Caroline Taylor, who recently ran Small Business Administration lending at Capital One, aims to expand her team at Regions, help steer borrowers into economic recovery and reach out to women and minority small-business owners who have been underserved.

March 31