-

Financial services issues that helped define a presidency were largely absent from Tuesday's State of the Union address, including the crucial policy items that have not yet been resolved.

January 14

-

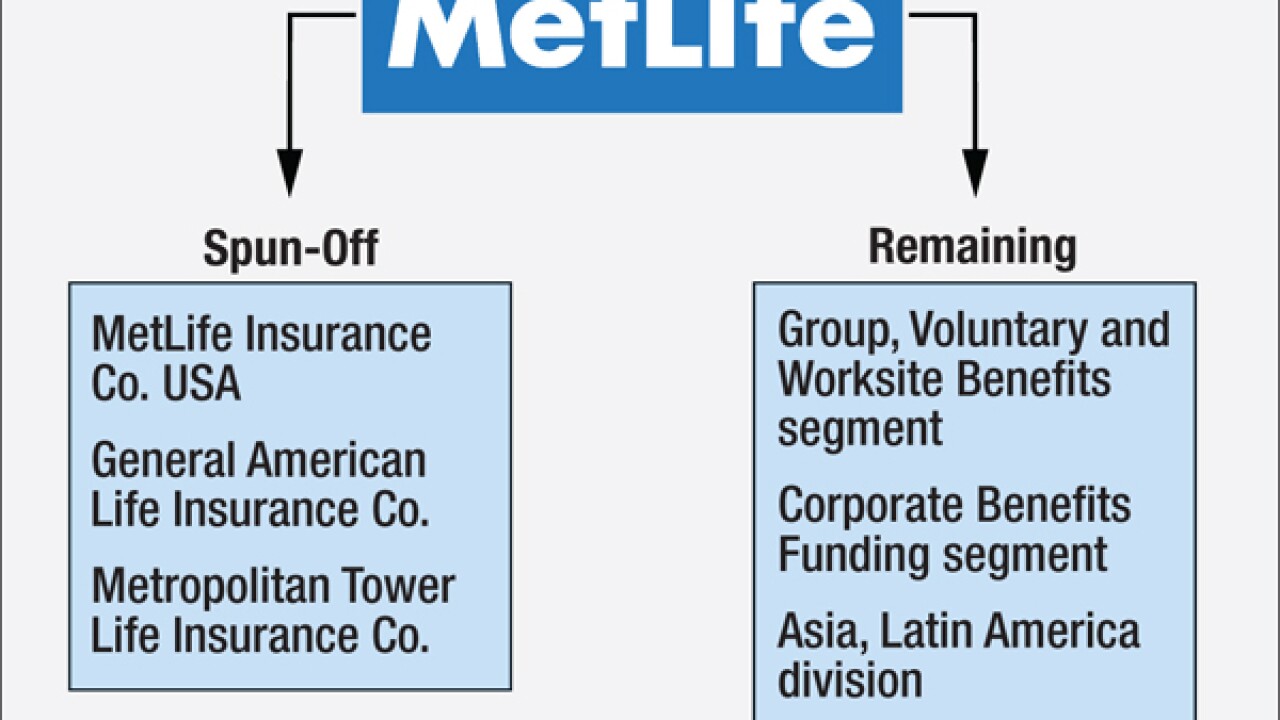

The conventional wisdom is that MetLife is breaking itself up partly as a response to its designation as a systemically important company. But there is significant evidence that's wrong here's why.

January 13 -

The insurance giant MetLife dropped a bombshell on Tuesday, saying it would separate a "substantial portion" of its U.S. retail segment, in part because of the current economic and regulatory environment.

January 12 -

MetLife plans to separate much of its U.S. retail business as Chief Executive Officer Steve Kandarian works to shrink the company to limit federal oversight.

January 12 -

Convictions of big banks have lacked any tangible consequences for perpetrators, leaving many still doubting that the government is serious about prosecuting large firms.

January 12

-

M&A momentum is building, even among larger banks that have been sidelined for years.

January 10 -

In theory, Sen. Bernie Sanders' plan to use Section 121 of the Dodd-Frank Act to break up the big banks sounds plausible. In practice, it won't ever happen. Here's why.

January 7IntraFi Network -

Sen. Richard Shelby's bill changing how regulators gauge if a bank is "systemic" would refocus post-crisis policy on institutions that pose the greatest threat.

January 7

-

After enduring a slew of post-crisis scandals, bankers are beginning to see the light on becoming stewards of their organizations.

January 6

-

In a speech in New York City, Sanders vowed to remove the ability of the Federal Reserve to pay interest to banks for their excess reserves, turn the credit rating agencies into nonprofits, allow the U.S. Postal Service to offer bank products, and cap ATM fees and interest rates for loans.

January 5 -

The Financial Stability Oversight Council will face critical tests in 2016, including a lawsuit over its designation of MetLife as a systemically important nonbank and whether it will de-designate GE as a SIFI.

January 5 -

The Dodd-Frank Act is a burden on community banks and credit unions but regulators are struggling to quantify the costs, according to a report released Wednesday by the Government Accountability Office.

December 31 -

Lawmakers are expected to debate a number of key banking provisions this year, even with the November elections on the horizon.

December 31 -

Some lost their jobs while others made major missteps or faced serious challenges to their business plans. Here are the folks who had a rough 2015 and are looking forward to better times in 2016.

December 29 -

The Federal Reserve is looking for advice and insight into how it might improve its annual stress testing regime, but banks and industry observers say the central bank is unlikely to touch the aspect of the tests that bothers them most: its secrecy.

December 28 -

With its proposal to force big banks to deliver "recovery plans," the Office of the Comptroller of the Currency is filling a gap in the current regulatory regime and making a power play at the same time.

December 23 -

Regulators' recent focus on the leverage ratio to measure capital adequacy is similar to a golfer ignoring the shape, speed and cut of a putting green.

December 23

-

Both banks and Wall Street critics support a new Fed proposal to implement a countercyclical capital buffer on megabanks, but the two sides diverge on when and how the Fed would use it.

December 22 -

A healthy bank culture can only be built from within, rather than as a compliance exercise to satisfy regulators.

December 22

-

The Federal Reserve issued a proposal Monday outlining a framework to implement a countercyclical capital buffer for the largest and most internationally active banks, a key part of Basel III that has until now lacked any details.

December 21