-

A recent proposal by the Financial Stability Oversight Council to focus less on certain nonbank firms and more on risk activities would create unintended economic harm.

June 27 NYU Stern School of Business

NYU Stern School of Business -

There is bipartisan agreement in the Senate that Fannie Mae and Freddie Mac are "too big to fail," but some lawmakers are skeptical that a SIFI designation is appropriate.

June 25 -

This is the first year that only the largest and most complex banks will be included after the Federal Reserve decided to let smaller firms wait until next year to resume testing.

May 31 -

There's been chatter about whether the government-sponsored enterprises should be considered systemically important. But supporters must consider that such a designation would put the Fed in charge of their supervision, a step that would do more harm than good.

May 31 American Enterprise Institute

American Enterprise Institute -

The FHFA director’s recent comments about whether the government-sponsored enterprises should be designated as SIFIs tees up a potentially significant element of the mortgage finance debate.

May 23 American Banker

American Banker -

Draft legislation to make annual testimony mandatory for the chiefs of the largest banks was added to the agenda of a House Financial Services Committee hearing set for Thursday.

May 15 -

Over a dozen progressive lawmakers urged the central bank to reverse its course and protect bank regulations enacted after the financial crisis.

May 15 -

The Financial Stability Oversight Council is shifting away from designating specific nonbanks and moving toward identifying activities that threaten the whole system. But some say that approach just weakens the council.

May 9 -

The congressional hearing will be ripe with opportunities for lawmakers to raise flags on issues of diversity, deregulation and social policy.

April 8 -

A bipartisan group of senators is proposing legislation to require the Financial Stability Oversight Council to weigh alternatives before putting a large, complex nonbank under Federal Reserve supervision.

March 14 -

The revisions would emphasize activities-based regulation over labeling individual firms as systemically risky.

March 6 -

The central bank is limiting the use of its qualitative objection in this year’s stress tests, the agency announced Wednesday.

March 6 -

The interagency panel formed to head off approaching systemic risks must figure out its next move after having undone designations of nonbank firms.

March 5 -

Assets increased 6% in 2018 to nearly $52 billion as loan originations surged and the company redeployed $2 billion of cash into higher-yielding securities.

January 30 -

Sen. Elizabeth Warren questioned the five largest U.S. retail banks in a letter on what they are doing to reduce the impact of the government shutdown on customers.

January 16 -

A no-deal Brexit could throw the international swaps market into disarray in a way that could be difficult to predict, and could have dire consequences for U.S. banks and the world economy.

January 15 American Banker

American Banker -

The Dodd-Frank Act gave the central bank authority to set capital requirements for insurance companies that own a federally insured bank, as well as those determined to be systemically important.

January 9 -

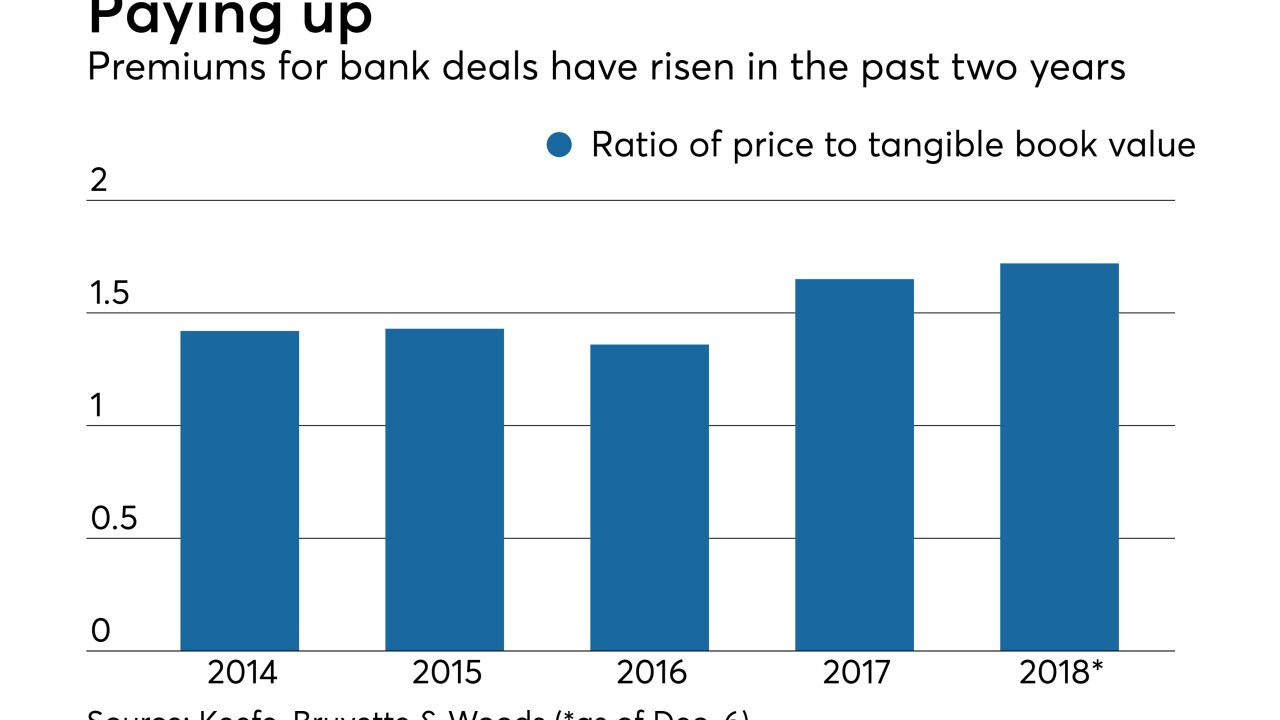

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

Sen.-elect Kyrsten Sinema, D-Ariz., and Sen. Tina Smith, D-Minn., will join the panel as their caucus loses two other committee members who suffered election defeats.

December 13 -

Just as a recent law softened Dodd-Frank resolution plan requirements, the head of the Federal Deposit Insurance Corp. announced an effort to ease such rules for depository institutions.

November 28