-

In an exclusive survey of bankers nationwide, American Banker found that regulatory relief and ensuring fintech companies faced banklike rules were the two top priorities for the industry this year while taxing credit unions and restructuring the CFPB took a back seat.

January 29 -

WASHINGTON Large banks will simulate their ability to weather both deflation and a recession among the annual economic scenarios provided by the Federal Reserve Board on Thursday for the central banks 2016 stress tests.

January 28 -

Presidential candidates' arguments to stop the Federal Reserve from paying interest on banks' excess reserves betray a poor understanding of monetary policy and why the Fed began the practice. Here's why.

January 28 American Banker

American Banker -

Banks that prioritize structural changes in their compliance process will make risk frameworks more effective and sustainable over time.

January 27 McKinsey & Company

McKinsey & Company -

American International Groups announcement Tuesday that it plans to split off its mortgage insurance business takes the prospect of a broader breakup off the table in the short term, but some observers think the firm may still break itself up eventually.

January 26 -

American International Group announced $3.6 billion in new costs to fill a reserve shortfall and said it will hold an initial public offering for its mortgage insurer and sell an adviser network as Chief Executive Peter Hancock seeks to boost returns and protect his job after criticism from activist investor Carl Icahn.

January 26 -

Regulators and alarmists are targeting a key source of financing on which some of the best-known American companies rely.

January 25 Ebenconcepts

Ebenconcepts -

Progressives' push for a more drastic overhaul of the industry ignores post-crisis changes that have had an undeniably positive effect.

January 22 IBM Global Business Services

IBM Global Business Services -

International events like the Davos economic forum should remind business leaders of the importance of being stewards and of having workforce diversity.

January 19

-

An international regulatory body said this week that they are looking at setting new, enhanced leverage ratio requirements for the largest global banks, a move that echoes the higher standards in the U.S.' supplemental leverage ratio and demonstrates why going beyond international accords can influence the rest of the world.

January 14 -

Financial services issues that helped define a presidency were largely absent from Tuesday's State of the Union address, including the crucial policy items that have not yet been resolved.

January 14

-

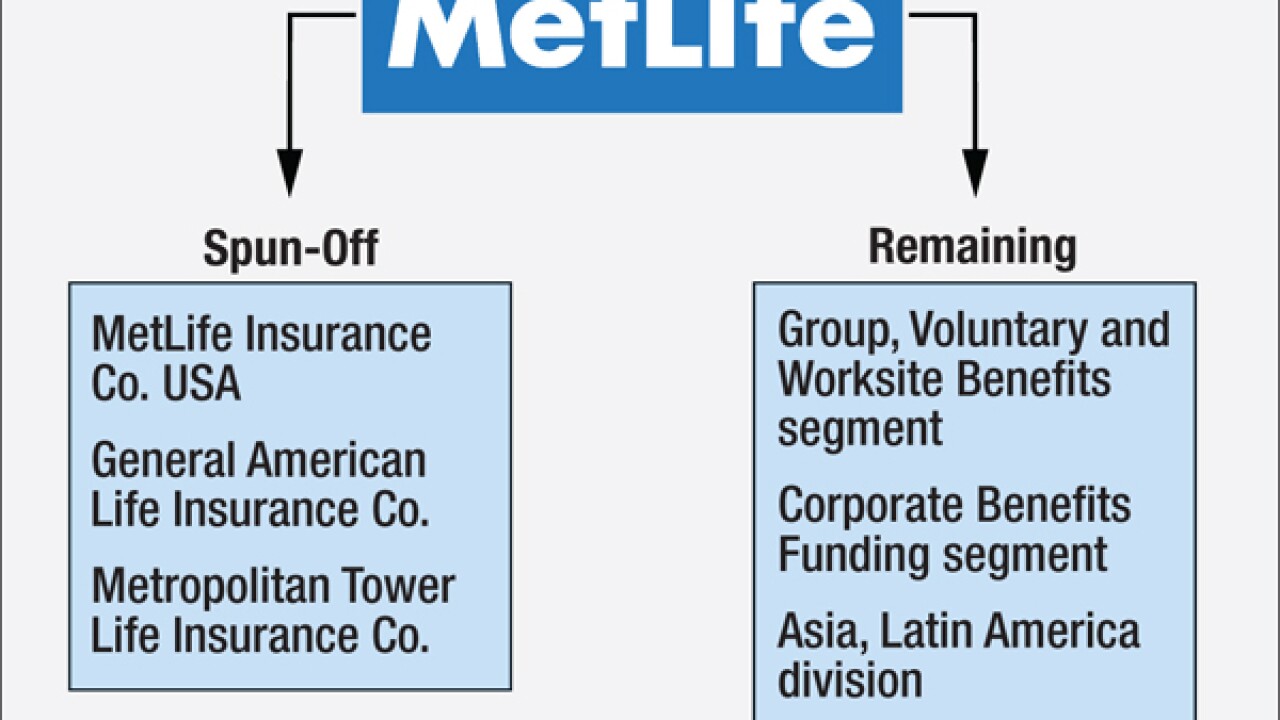

The conventional wisdom is that MetLife is breaking itself up partly as a response to its designation as a systemically important company. But there is significant evidence that's wrong here's why.

January 13 -

The insurance giant MetLife dropped a bombshell on Tuesday, saying it would separate a "substantial portion" of its U.S. retail segment, in part because of the current economic and regulatory environment.

January 12 -

MetLife plans to separate much of its U.S. retail business as Chief Executive Officer Steve Kandarian works to shrink the company to limit federal oversight.

January 12 -

Convictions of big banks have lacked any tangible consequences for perpetrators, leaving many still doubting that the government is serious about prosecuting large firms.

January 12

-

M&A momentum is building, even among larger banks that have been sidelined for years.

January 10 -

In theory, Sen. Bernie Sanders' plan to use Section 121 of the Dodd-Frank Act to break up the big banks sounds plausible. In practice, it won't ever happen. Here's why.

January 7IntraFi Network -

Sen. Richard Shelby's bill changing how regulators gauge if a bank is "systemic" would refocus post-crisis policy on institutions that pose the greatest threat.

January 7

-

After enduring a slew of post-crisis scandals, bankers are beginning to see the light on becoming stewards of their organizations.

January 6

-

In a speech in New York City, Sanders vowed to remove the ability of the Federal Reserve to pay interest to banks for their excess reserves, turn the credit rating agencies into nonprofits, allow the U.S. Postal Service to offer bank products, and cap ATM fees and interest rates for loans.

January 5