-

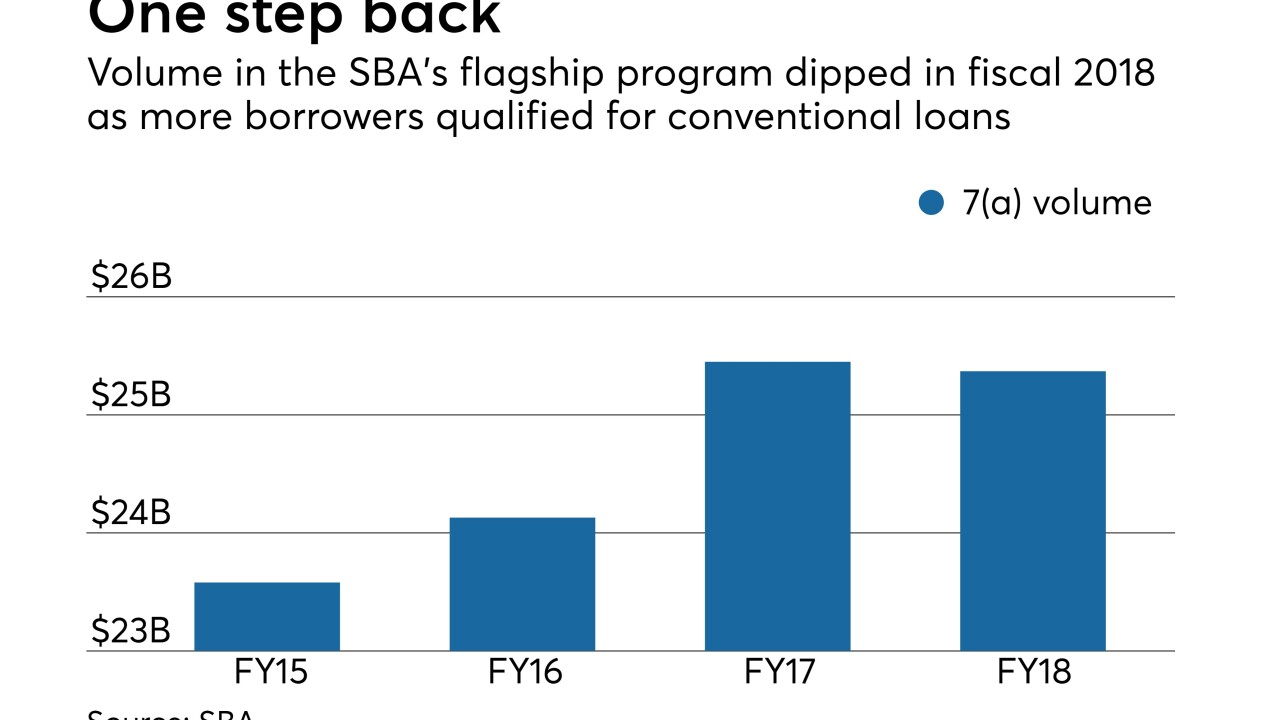

The agency's 7(a) program had a small year-over-year decline, with bankers pointing to lender discipline and more borrowers qualifying for conventional loans.

October 9 -

The economy could “positively slow down in mid-2019” and consumer debt levels are a huge concern, but technology and lessons learned from the crisis could still create opportunity for small banks, says Beneficial’s Gerry Cuddy ahead of a big speech on current conditions.

October 2 -

The agency found that banks with less than $10 billion in assets were more prone than larger lenders to go beyond using standard criteria in evaluating borrowers.

October 1 -

Among the three measures is a requirement for boards of publicly traded firms to include more women.

October 1 -

Readers parse JPMorgan Chase CEO Jamie Dimon's latest public comments, debate a California small-business lending bill, weigh the impact of open banking and more.

September 27 -

Few small businesses in Puerto Rico applied for credit to finance recovery from hurricane damage. The reasons are instructive for financial institutions’ response to disaster recovery, the New York Fed says.

September 27 -

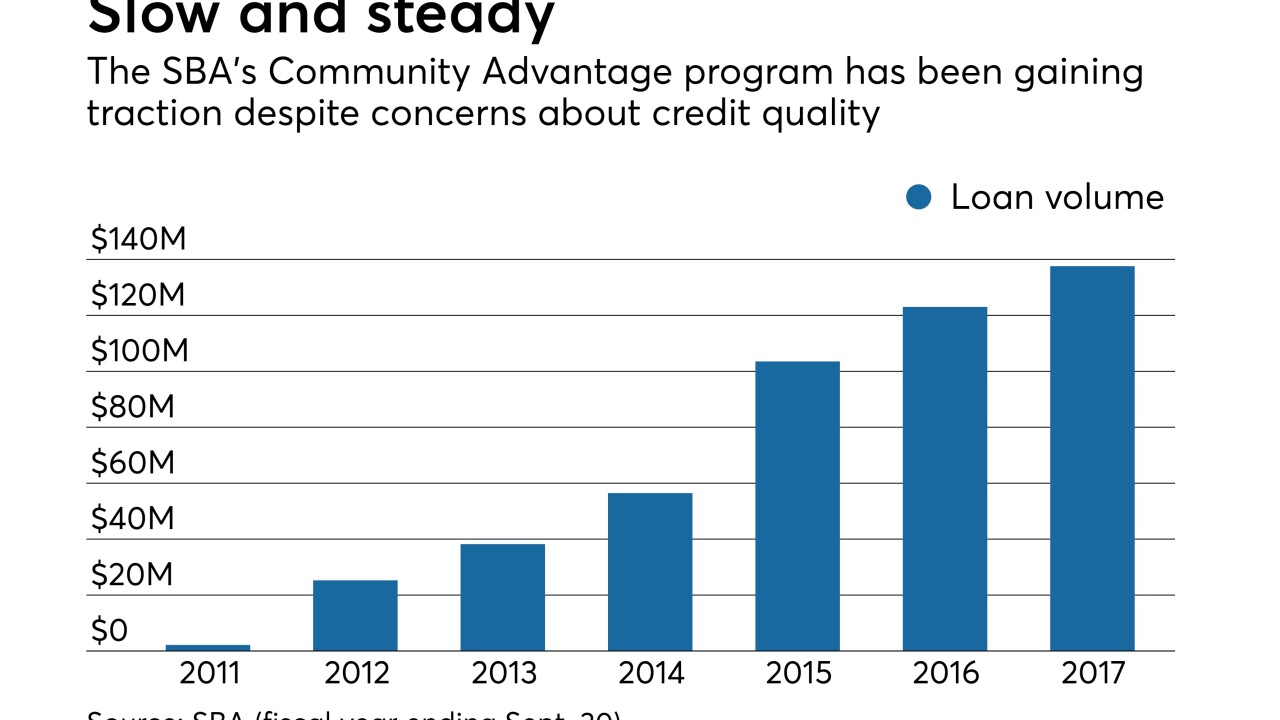

Some lenders fear a moratorium on new participants, and other restraints, could be the beginning of the end for the agency's Community Advantage program.

September 26 -

The bank seeks to answer the threat posed by disruptors with quick online loans and a card that rewards small businesses for more kinds of spending.

September 25 -

The legislation would help small-business owners better evaluate financing options by requiring updated disclosures.

September 25 Lending Club

Lending Club -

JPMorgan's chief cautioned against expanded regulation for big companies, arguing that businesses contribute to the economy.

September 24