-

The $380-billion asset company will soon join the parade of big banks and tech companies that are migrating online to meet the demands of business owners.

October 22 -

Netspend customers kept from accessing paychecks; Sen. Elizabeth Warren rebukes Comerica over fraud in benefits program; FDIC poised to revamp deposit rules (about time, say banks); and more from this week's most-read stories.

October 19 -

The program will focus on increasing lending to small and medium enterprises in Guatemala, Burkina Faso and Kenya.

October 18 -

The San Antonio bank will refer customers seeking small-business loans to StreetShares, a financial startup that is similarly focused on serving veterans of the U.S. military.

October 16 -

ODX will pursue deals with banks that want to use the New York lender’s technology to offer online small-business loans.

October 16 -

The tech giants might be moving into small-business lending, but they’re more likely to take business away from large commercial lenders, not community institutions.

October 15 NBH Bank

NBH Bank -

On Jun. 30, 2018. Dollars in thousands.

October 15 -

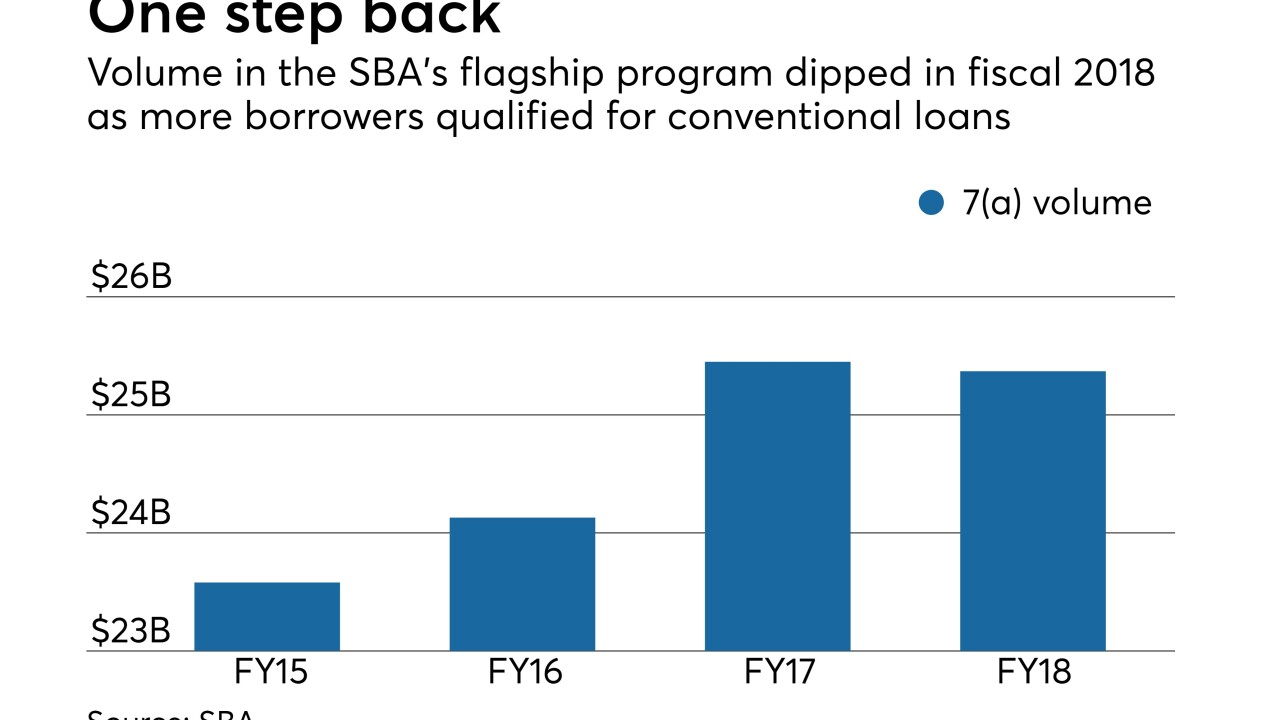

The agency's 7(a) program had a small year-over-year decline, with bankers pointing to lender discipline and more borrowers qualifying for conventional loans.

October 9 -

The economy could “positively slow down in mid-2019” and consumer debt levels are a huge concern, but technology and lessons learned from the crisis could still create opportunity for small banks, says Beneficial’s Gerry Cuddy ahead of a big speech on current conditions.

October 2 -

The agency found that banks with less than $10 billion in assets were more prone than larger lenders to go beyond using standard criteria in evaluating borrowers.

October 1 -

Among the three measures is a requirement for boards of publicly traded firms to include more women.

October 1 -

Readers parse JPMorgan Chase CEO Jamie Dimon's latest public comments, debate a California small-business lending bill, weigh the impact of open banking and more.

September 27 -

Few small businesses in Puerto Rico applied for credit to finance recovery from hurricane damage. The reasons are instructive for financial institutions’ response to disaster recovery, the New York Fed says.

September 27 -

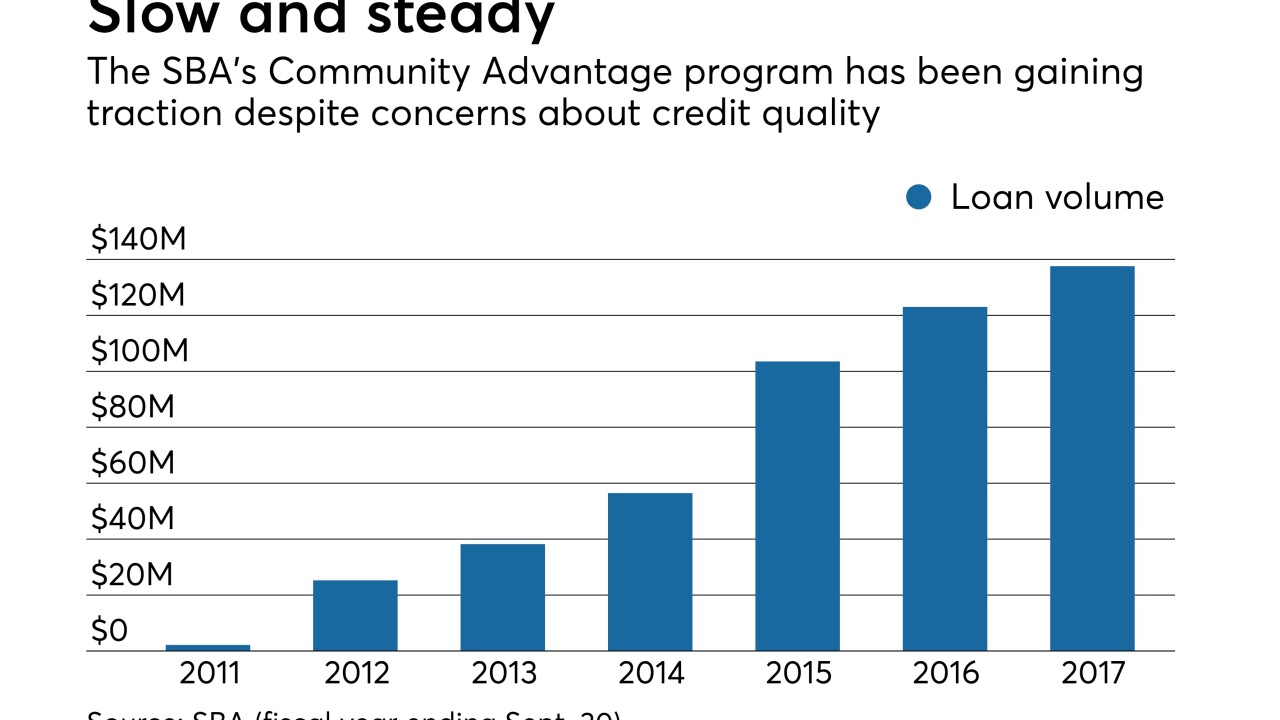

Some lenders fear a moratorium on new participants, and other restraints, could be the beginning of the end for the agency's Community Advantage program.

September 26 -

The bank seeks to answer the threat posed by disruptors with quick online loans and a card that rewards small businesses for more kinds of spending.

September 25 -

The legislation would help small-business owners better evaluate financing options by requiring updated disclosures.

September 25 Lending Club

Lending Club -

JPMorgan's chief cautioned against expanded regulation for big companies, arguing that businesses contribute to the economy.

September 24 -

BMO Harris Bank has made significant strides in recent years attracting retail and small-business customers, and now it's up to Ernie Johannson to keep the momentum going.

September 23 -

The agency wants more information as it conducts fair-lending exams, but conflicting statutes make writing a data collection rule difficult.

September 21 -

Community bankers reject the conclusions of a Government Accountability Office report that say regulatory burdens only had a “modest effect” on the declining number of banks since 2010.

September 19