-

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

Consumer Financial Protection Bureau Directors Kathy Kraninger is under pressure to ask a federal judge to lift a stay that has kept the agency's short-term-lending rule from going into effect.

September 3 -

The debate over the CFPB's plan to revamp its payday lending regulation should focus on the benefits for borrowers.

August 30

-

House Financial Services Committee Chairwoman Maxine Waters and over a hundred other lawmakers want the agency to go forward with a mandatory underwriting requirement for payday loans.

August 23 -

Four advocacy groups questioned why the consumer bureau did not ask a judge to lift a stay of the rule's payment provisions.

August 12 -

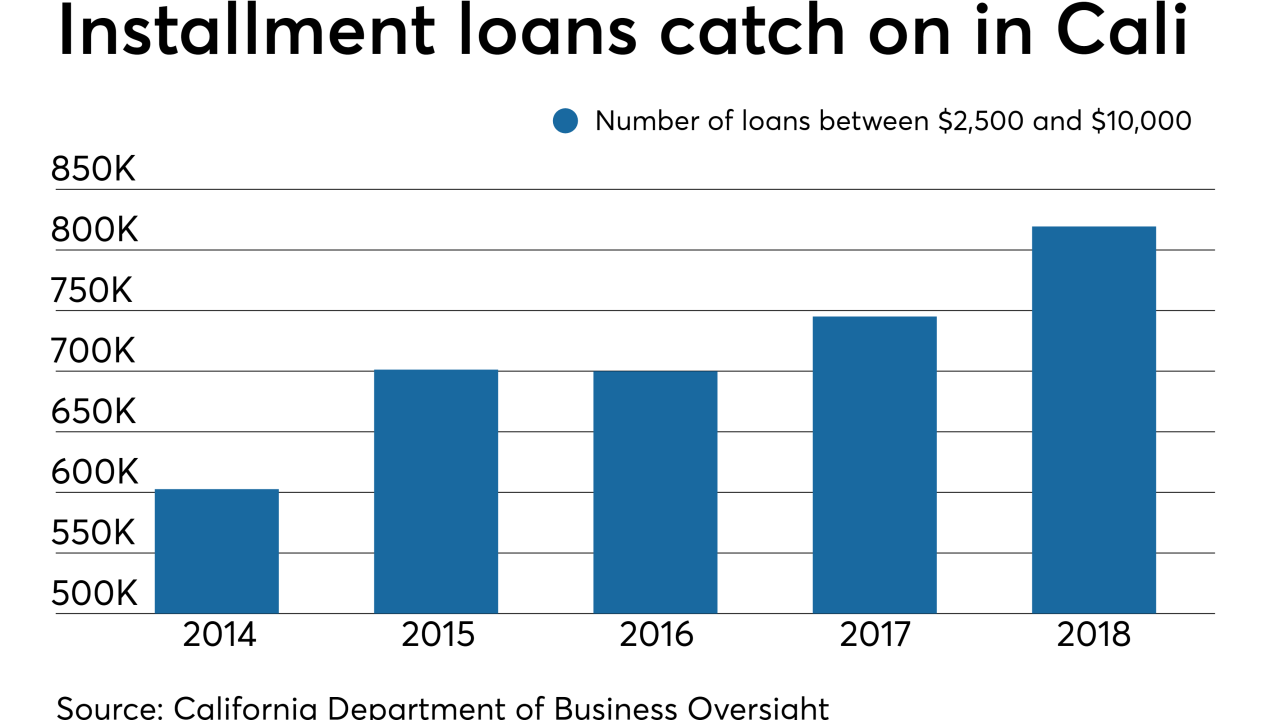

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

In a registration statement filed with the SEC, the company revealed new details about its financial performance and its growth plans.

July 18 -

The legislation, which passed a key test in the state Senate on Wednesday, is the product of a compromise between consumer advocates and some lenders.

June 27 -

Companies that offer early access to earned wages want a regulatory framework for their fast-growing industry. But the bill under consideration in Sacramento is exposing big divisions in the sector.

June 24 -

Despite renewed calls from Democrats looking to USPS to offer banking services, policymakers should instead consider reforms that would permit private-sector firms like Walmart and Amazon to offer a wider array of financial products.

June 13