-

Strong net interest income and other factors made up for a drop in investment banking and other noninterest income at the Atlanta bank, which reported double-digit earnings growth.

October 19 -

Commercial and industrial lending rose 8% in the third quarter at the Cleveland bank, but other factors drove its double-digit gain in profits as overall loan growth was modest.

October 18 -

The Dallas bank has picked a bad time to shift from cost-cutting to expansion as big banks are in a commercial lending funk.

October 16 -

The largest U.S. bank's strong third quarter did not insulate its leaders from being pressed about the downside of pricey investments in technology, whether capital rules make commercial lending growth hard for big banks to achieve, and whether another economic downturn is edging closer.

October 12 -

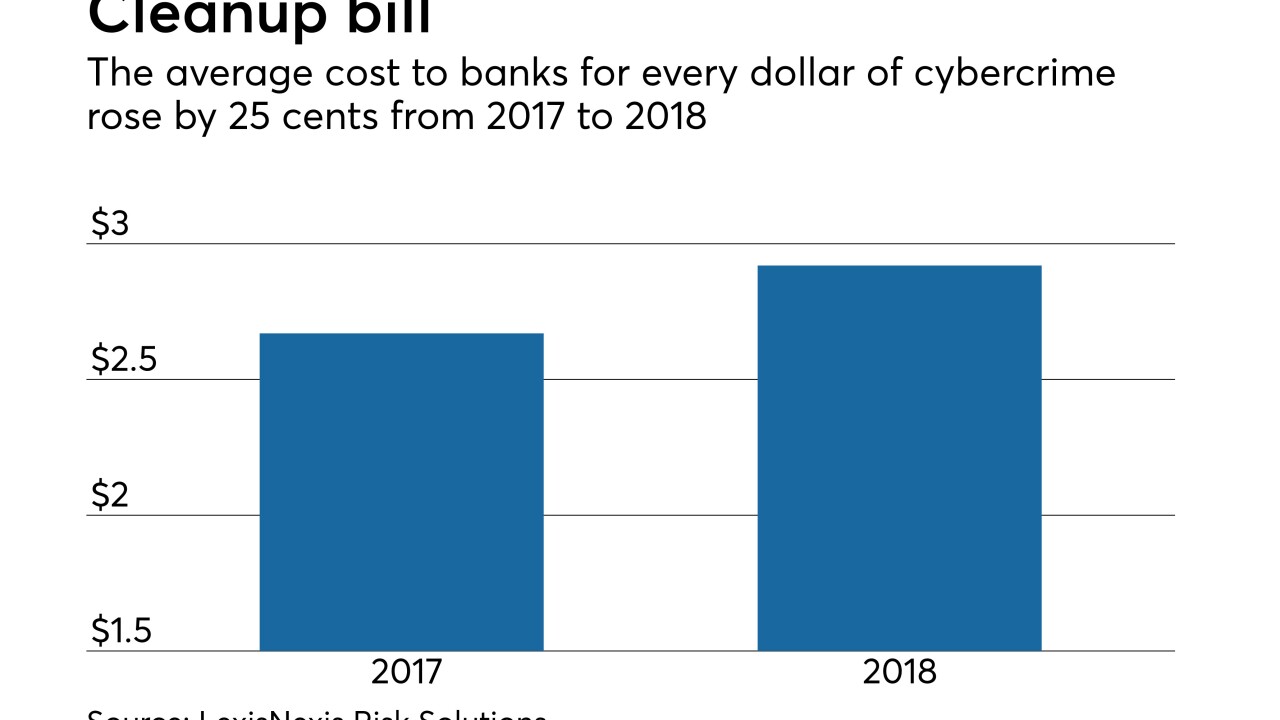

Banks’ tab to fight hackers rose 9% from last year by one measure. Investors want them to rein in tech investments, but security experts say the crooks are getting smarter and smarter.

October 2 -

Our 16th annual Most Powerful Women in Banking rankings; why Regions did away with teller jobs; small banks lagging in deposit share; and more from this week's most-read stories.

September 28 -

It will also invest in mortgage and small-business lending and in neighborhood revitalization efforts there. The moves are part of a nationwide expansion by the largest U.S. bank.

September 24 -

As Synovus Financial’s chief strategy officer, a job that includes responsibility for deciding how bank resources are allocated, Liz Wolverton often has to play the role of referee.

September 23 -

"Normal system upgrade" knocks out SunTrust's online- and mobile-banking ops; "just a matter of time" before Amazon, Google enter mortgages; Wells Fargo looking for Tim Sloan's replacement?; and more from this week's most-read stories.

September 21 -

The cuts are part of a broader effort to trim expenses by roughly $3 billion a year by 2020.

September 20