-

After its planned sale to a larger competitor fell through, the renamed bank plans to expand into new markets, starting with St. Louis.

July 12 -

Two days after the megabank was hit with $136 million of fines, Citi executives said they aren't changing the company's full-year expense guidance. Citi has 30 days to submit a plan to regulators showing that the bank has allocated enough resources to achieve compliance in a timely and sustainable manner.

July 12 -

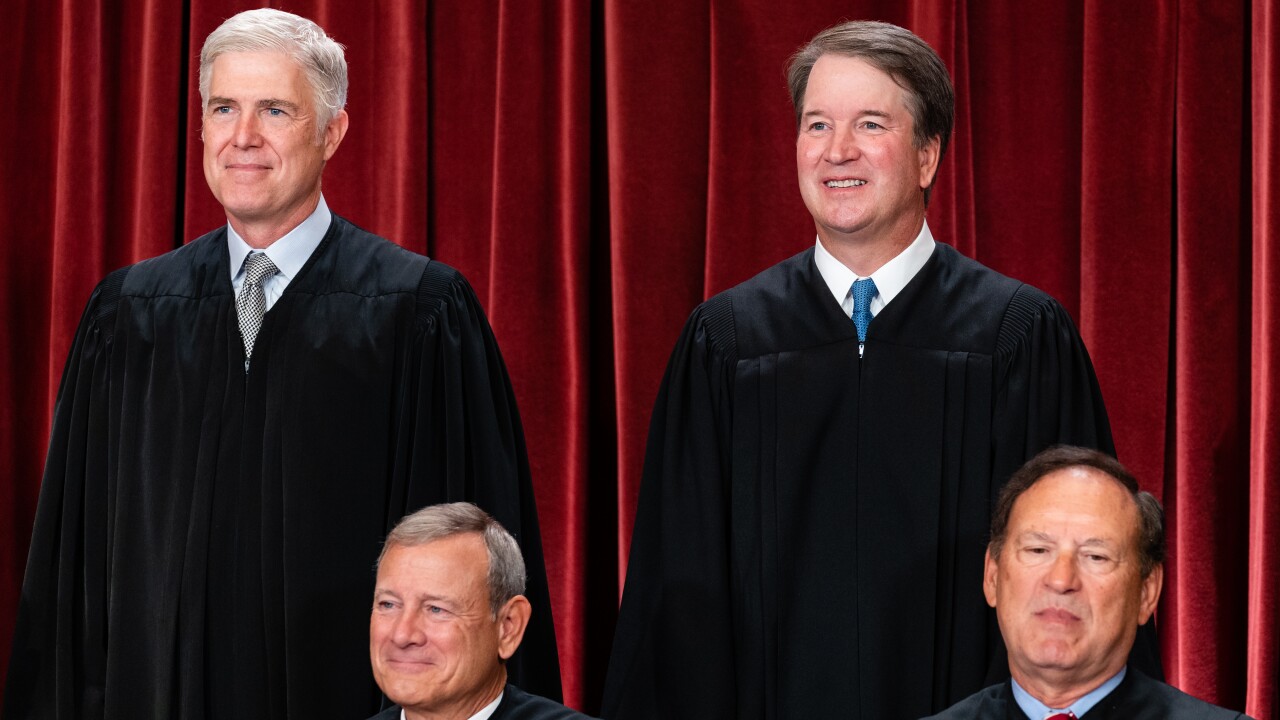

In this month's roundup of top banking news: a cease-and-desist issued by the Federal Reserve, high CFO turnover, the end of Chevron deference and more.

July 3 -

Investors are keeping a close eye on recent banking news, including Mastercard's latest plan for crypto, Comerica's proposed settlement of a class action, employment gains and skeptical shareholders.

June 25 -

The Honolulu bank is raising $165 million through depositary shares, a move that two observers said would help boost its below-average leverage ratio.

June 20 -

As high interest rates continue weighing on banks' balance sheets, some are selling branches to real estate firms and leasing them back. The strategy is helping lenders that want to restructure their underwater bond portfolios.

June 13 -

During New York Community Bancorp's annual shareholder meeting, executives reiterated their mission to restore value in the beleaguered Long Island-based company. Questions from shareholders suggested at least some discontent following a capital influx that significantly diluted their position in the company.

June 7 -

In this month's roundup of top banking news: a Supreme Court ruling on CFPB funding, TD Bank's money laundering woes, an FDIC workplace probe reveals a culture of misconduct and more.

June 3 -

The beleaguered Los Angeles-based bank reported its strongest quarterly results in more than a year, but executives at its Canadian parent company cautioned that improvements may not be linear.

May 30 -

New York Community Bancorp hasn't said who will replace Chief Operating Officer Julie Signorille-Browne, who is resigning amid a management shake-up.

May 17 -

What lies ahead for the banking industry this year? Here's what analysts and investors are tracking after the latest bank earnings reports.

May 13 -

Many banks got shares in the lucrative payments network when it went public in 2008. Some of them are now looking to sell in order to offset losses on their sales of underwater bonds.

May 9 -

OakNorth Bank in London is eager to utilize the data it's collected from providing risk management software to American banks over the past five years. Its growth plans include eventually acquiring a charter here and making commercial real estate loans.

May 7 -

The combination of two Pacific Northwest banks was supposed to create a regional powerhouse, but rising deposit costs have stung. CEO Clint Stein says he's "laser-focused" on making Columbia a top performer again.

May 3 -

The embattled Long Island bank unveiled a turnaround plan that involves selling noncore assets and diversifying its commercial loan book. But first, it will need to sort through credit-related challenges in its large commercial real estate portfolio.

May 1 -

New York Community Bancorp CEO Joseph Otting has added three former colleagues to the embattled company's leadership team. The hires come six weeks after the Long Island bank got a $1 billion capital infusion, which led to Otting's appointment as CEO.

April 16 -

The global bank is making good on its promise to trim expenses, but its ability to increase revenues at the same time remains unclear, partly because of the relatively weak performance of its wealth management business.

April 12 -

- Yahoo Finance Feed

The Tupelo, Mississippi, company announced a management simplification plan in which several executives, including the president and the chief financial officer, are gaining new responsibilities. Most of the changes took effect April 1.

April 4 -

Each spring during the rush of annual meetings, a handful of financial institutions take heat from shareholders who demand new strategies, management shakeups and, at times, even a sale of the company.

March 26