-

Lawmakers approved a measure to increase the program's funding by nearly $3 billion over four years.

March 26 -

Lawmakers should preserve the credit meant to spur economic development as part of sweeping tax reform being debated in Congress this week.

December 13 Community Development Bankers Association

Community Development Bankers Association -

The House-passed tax bill would eliminate the New Markets Tax Credit while the Senate bill would not reauthorize it when it expires in two years. Bankers and other proponents say that if it is discontinued many economic development projects in rural and low-income communities won’t be funded.

November 17 -

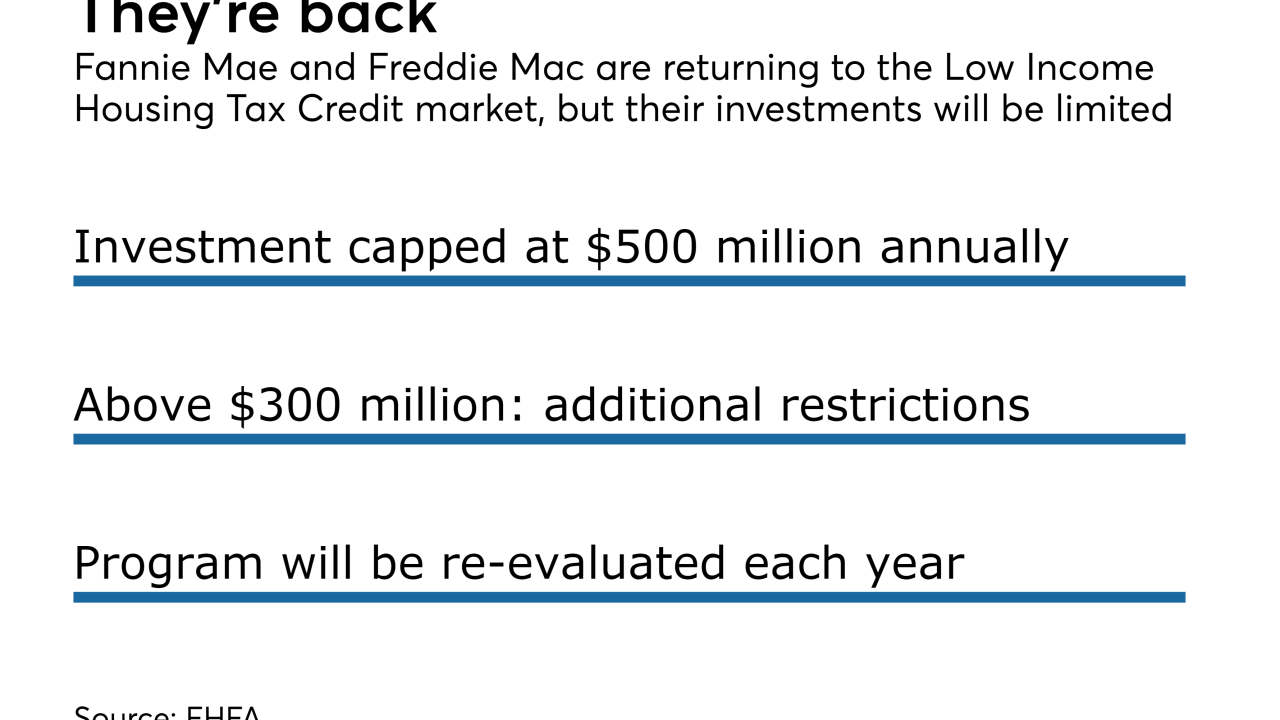

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Banks have started reconsidering how much they are willing to pay for low-income housing tax credits.

January 12