-

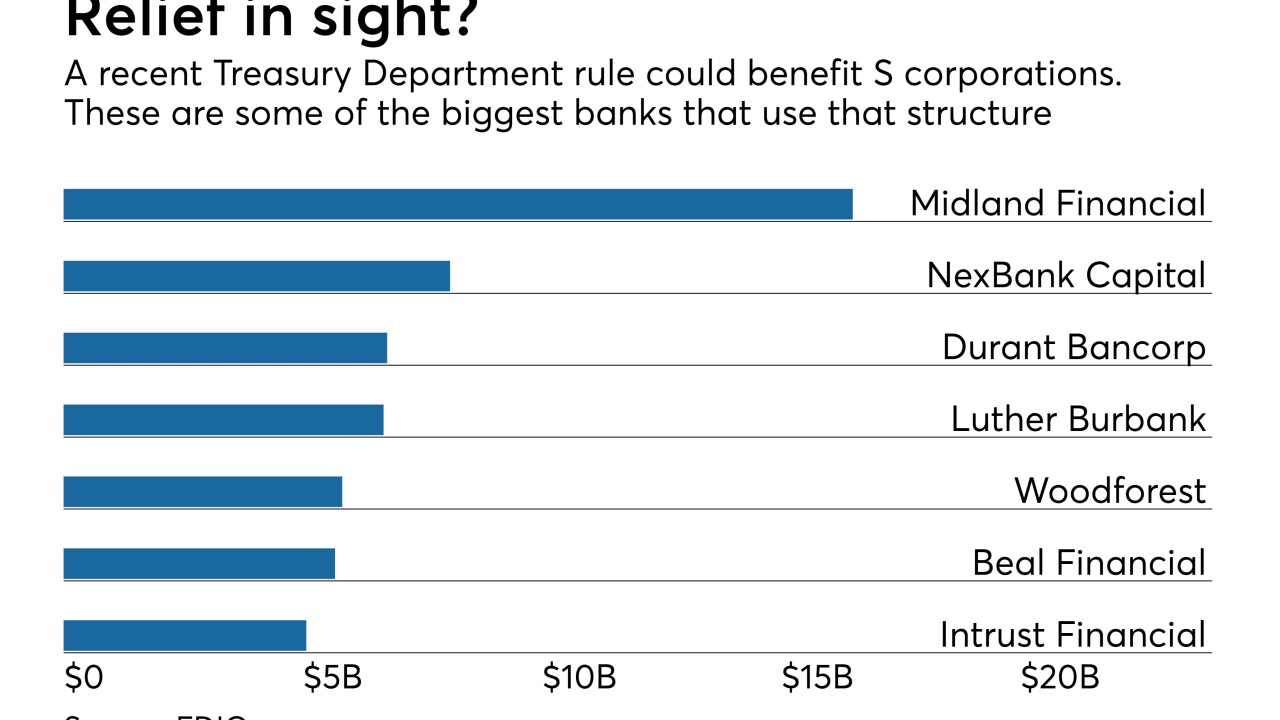

Shareholders in Subchapter S corporations will get some tax relief of their own under a new Treasury Department rule that will let them take a 20% deduction on qualified business income, which includes loan originations and sales.

February 5 -

Company’s first earnings report since the data breach also discloses lots of suits and investigations; Senate bill also calls for one-year delay in corporate tax rate cut to 20%.

November 10 -

The financial services industry has largely warmly greeted the GOP’s proposed overhaul of tax policy, yet some provisions have triggered concern and uncertainty. Here is a rundown of the key provisions and how they may impact the industry.

November 6 -

The proposed 20% corporate tax rate would benefit banks more than other industries; online lenders made nearly a third of new personal loans in the first half.

November 3 -

Banks have started reconsidering how much they are willing to pay for low-income housing tax credits.

January 12