-

Banks would be better able to comply with anti-money-laundering laws if all 50 states collected information on the owners of new corporations and published it in a national database, Comptroller Joseph Otting said Monday.

May 20 -

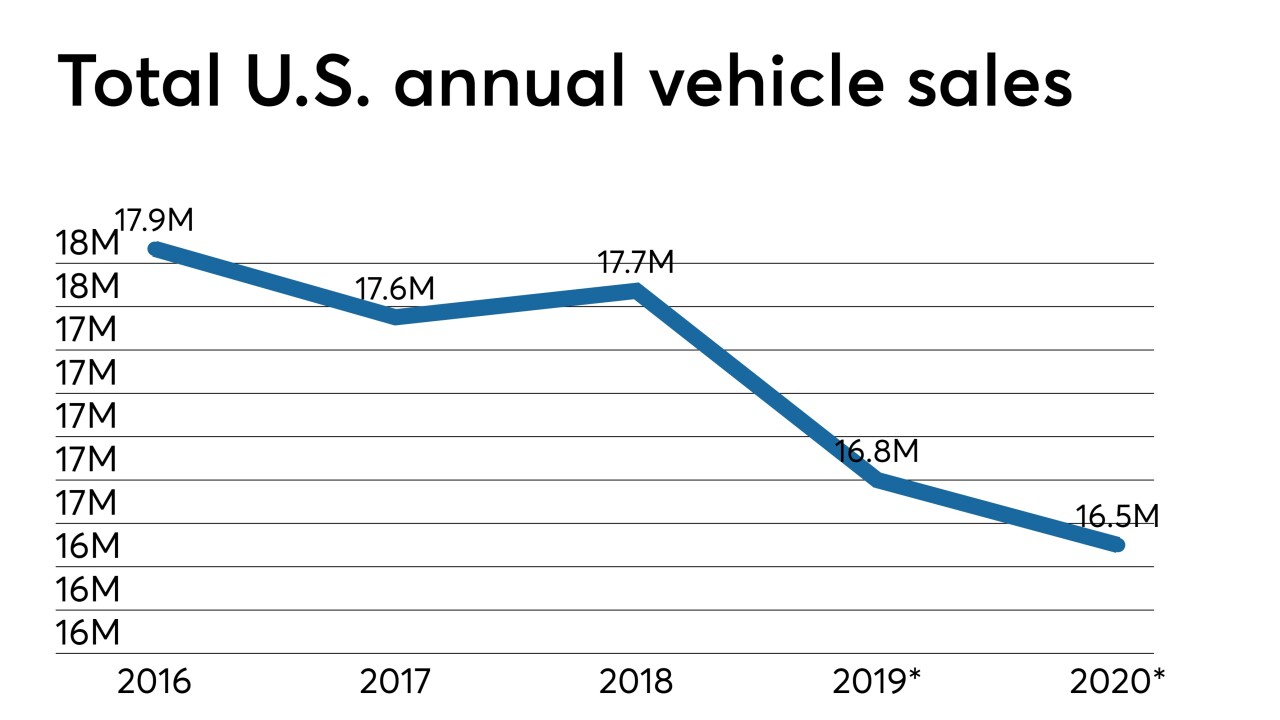

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20 -

A federal court this week will hear arguments in NCUA's appeal of a a judge's split decision on its 2016 field of membership rule while the new NCUA board meets later in the week.

April 15 -

The fight over the credit union industry's tax-exempt status has moved from the federal to state level. It will take the entire movement working together to combat these challenges.

April 15

-

Tax-related identity theft can be especially worrisome, not only for the monetary consequences it carries, but tax documents often contain highly sensitive information, like Social Security numbers, writes Paige Schaffer, president and COO of Generali Global Assistance’s Identity and Digital Protection Services Global Unit.

April 11 Generali Global Assistance

Generali Global Assistance -

Along with amendments to the Bank Secrecy Act, the Taxpayers First Act could help credit unions maintain their tax-exempt status.

April 9 -

A banking lobbyist recently quoted in Credit Union Journal is painting an inaccurate picture of the industry and its tax exemption.

April 8 League of Southeastern Credit Unions

League of Southeastern Credit Unions -

The North Carolina company was hit with a tax penalty tied to its purchase of Chattahoochee Bank of Georgia.

April 4 -

Sens. Sherrod Brown, D-Ohio, and Ron Wyden, D-Ore., pressed Stephen Moore for details about reports that he owes more than $75,000 in taxes and failed to pay more than $300,000 in alimony and child support.

April 3 -

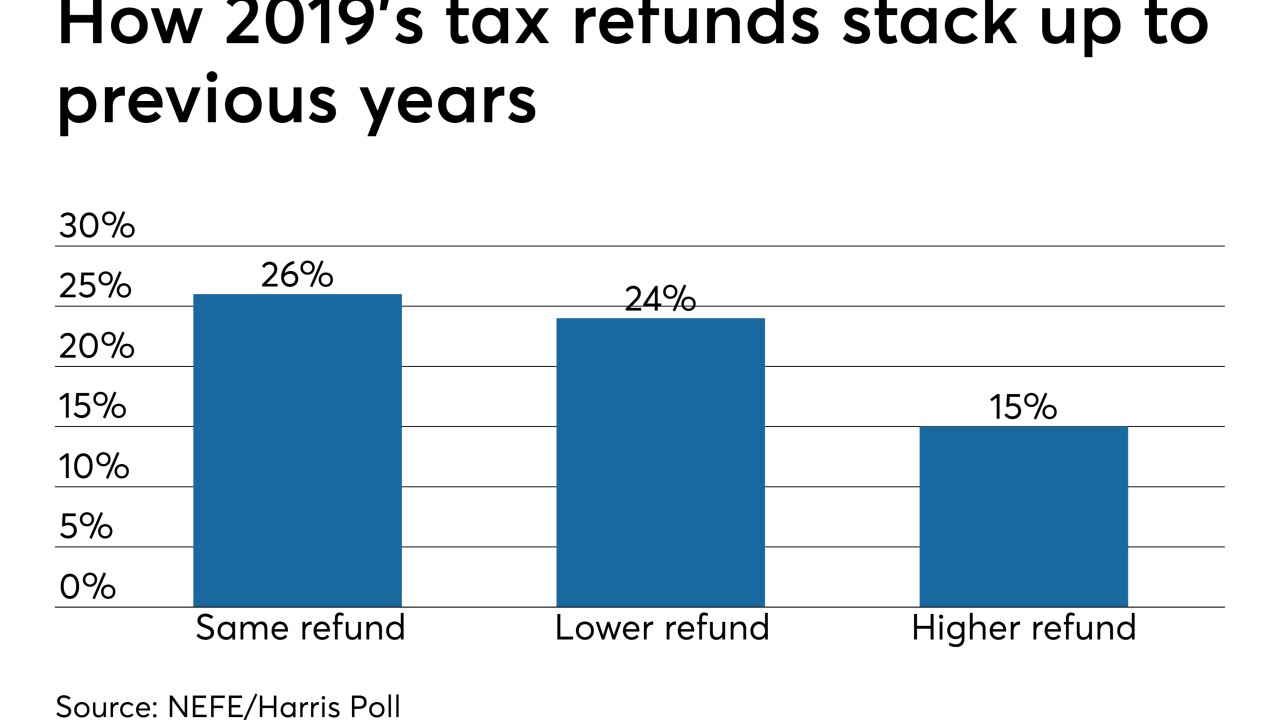

Volunteer Income Tax Assistance is reportedly bringing an influx of consumers to credit unions this tax season, but those institutions are hamstrung on the extent to which they can turn that opportunity into new business.

April 2