-

Treasury Secretary Scott Bessent and Trump's National Economic Council director, Kevin Hassett, are set to meet Tuesday with House and Senate Republican leaders and their top tax writers to try to resolve differences over the scale of cuts and ways of paying for them.

March 24 -

The ruling further complicates an already complicated area — the law's mandate around beneficial ownership information reporting.

March 5 -

The draft legislation authored by Rep. Josh Gottheimer, D-N.J., would allow "qualified" nonbanks to issue stablecoins and create an insurance fund to offset losses.

February 2 -

The latest bipartisan plan to accelerate the economic recovery would appropriate roughly $300 billion for the Paycheck Protection Program, but the legislative package still faces long odds in the divided Congress.

December 1 -

Congress should pass legislation that would allow Home Loan banks to backstop deposits by local governments at commercial banks and lower the cost of bond financing, two mayors argue.

September 16 City of Miami

City of Miami -

A pioneer in the commercial mortgage-backed securities market argues the HOPE Act would bail out savvy investors who don't deserve it. Barclays predicts that kind of attitude will make passage difficult.

August 14 -

The legislation proposed by Rep. Nydia M. Velázquez, D-N.Y., goes further than recent state efforts to require better disclosures for high-cost lenders, but it would face an uphill battle in the GOP-controlled Senate.

July 31 -

Backers say a bill to limit asset growth instead of restricting brokered funds addresses concerns about expanding balance sheets at troubled banks. But skeptics worry it would open the door to greater risk.

July 8 -

Rancor between Democrats and Republicans has made it hard to enact subsequent bills. But the 2018 reg relief package and more recent legislation offer hope for efforts to reach across the aisle.

July 6 -

One criticism of the CARES Act is that it provides relief only to borrowers with government-backed loans. Bills in New York and California would cover the remaining 30% of homeowners.

June 5 -

One criticism of the CARES Act is that it provides relief only to borrowers with government-backed loans. Bills in New York and California would cover the remaining 30% of homeowners.

June 4 -

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

May 28 -

In some cases, financial institutions are required by court order to divert funds to private creditors. But the industry has added its voice to a consensus for a legislative update to ensure Americans receive their full amount.

April 16 -

The third credit union-related bill introduced this week would cut credit unions’ annual required board meetings to just six times per year.

February 26 -

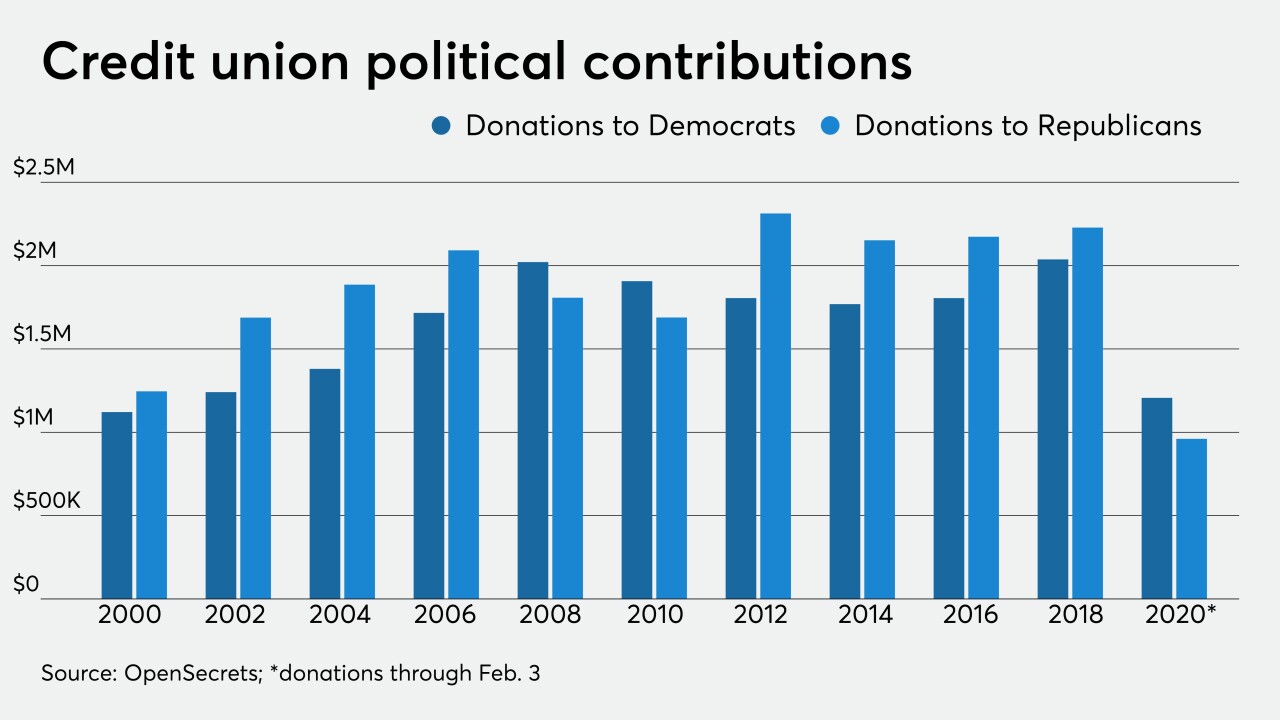

The industry loves to tout its bipartisanship, but it has very publicly embraced the Trump administration at times.

February 24 -

Lawmakers advanced legislation that would require financial regulators to give annual testimony to lawmakers and would mandate regular reports on cybersecurity efforts.

January 14 -

Lawmakers advanced legislation that would require banking regulators to give annual testimony to lawmakers and would mandate regular reports on cybersecurity efforts.

January 14 -

The Department of Business Oversight said TitleMax charged consumers fees to push loan amounts above the threshold at which the state's rate cap applies.

December 16 -

Chairman Jelena McWilliams previewed a proposal to update the agency’s definition of brokered funds, but also suggested steps lawmakers could take to improve the rule’s underlying statute.

December 11 -

With 2019 winding to a close, regulators and members of Congress are working to wrap up key items for credit unions before the end of the year.

December 9