-

CEO Greg Carmichael said Wednesday that online-only banks "aren't relationship-based" and that Fifth Third would stick to its plan of attracting new depositors by selectively expanding into new markets.

June 12 -

Lenders are turning to the Farm Service Agency to backstop more loans as their Midwestern customers are beset by flooding in addition to the U.S. trade war with China and volatile crop prices. Can the FSA meet the increased demand?

June 10 -

Despite tension between the U.S. and trading partners, bank are doing booming business in financing cross-border commerce; some Republican lawmakers are getting antsy at the pace of rollbacks for bank regulations, and are pushing regulators for a sense of urgency.

June 10 -

As credit unions buy up community banks, policymakers should take another look at ending the industry’s tax exemption and regulatory breaks.

June 7

-

The merging banks, whose new headquarters would be Charlotte, N.C., will each double their charitable giving over the next three years in Atlanta and Winston-Salem, N.C.

June 5 - cuj bulletin lead

The Federal Communications Commission is expected to consider changes that would allow consumers to block calls from numbers not on their contacts list while the House should vote to extend the National Flood Insurance Program.

June 3 -

A former employee from a New York credit union pleaded guilty to theft and tax evasion while another was accused of falsifying records.

May 31 -

One credit union economist says tit-for-tat on tariffs could slow economic growth but will not result in an economic downturn.

May 24 -

Banks would be better able to comply with anti-money-laundering laws if all 50 states collected information on the owners of new corporations and published it in a national database, Comptroller Joseph Otting said Monday.

May 20 -

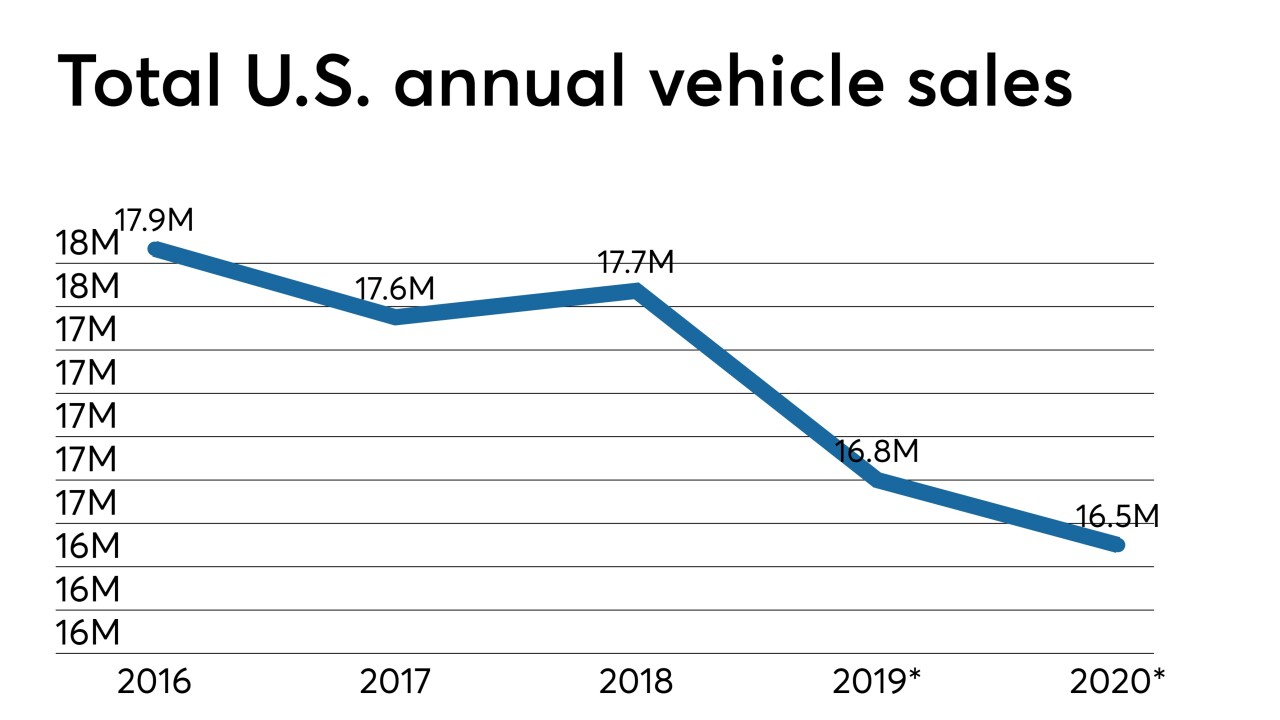

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20 -

A federal court this week will hear arguments in NCUA's appeal of a a judge's split decision on its 2016 field of membership rule while the new NCUA board meets later in the week.

April 15 -

The fight over the credit union industry's tax-exempt status has moved from the federal to state level. It will take the entire movement working together to combat these challenges.

April 15

-

Tax-related identity theft can be especially worrisome, not only for the monetary consequences it carries, but tax documents often contain highly sensitive information, like Social Security numbers, writes Paige Schaffer, president and COO of Generali Global Assistance’s Identity and Digital Protection Services Global Unit.

April 11 Generali Global Assistance

Generali Global Assistance -

Along with amendments to the Bank Secrecy Act, the Taxpayers First Act could help credit unions maintain their tax-exempt status.

April 9 -

A banking lobbyist recently quoted in Credit Union Journal is painting an inaccurate picture of the industry and its tax exemption.

April 8 League of Southeastern Credit Unions

League of Southeastern Credit Unions -

The North Carolina company was hit with a tax penalty tied to its purchase of Chattahoochee Bank of Georgia.

April 4 -

Sens. Sherrod Brown, D-Ohio, and Ron Wyden, D-Ore., pressed Stephen Moore for details about reports that he owes more than $75,000 in taxes and failed to pay more than $300,000 in alimony and child support.

April 3 -

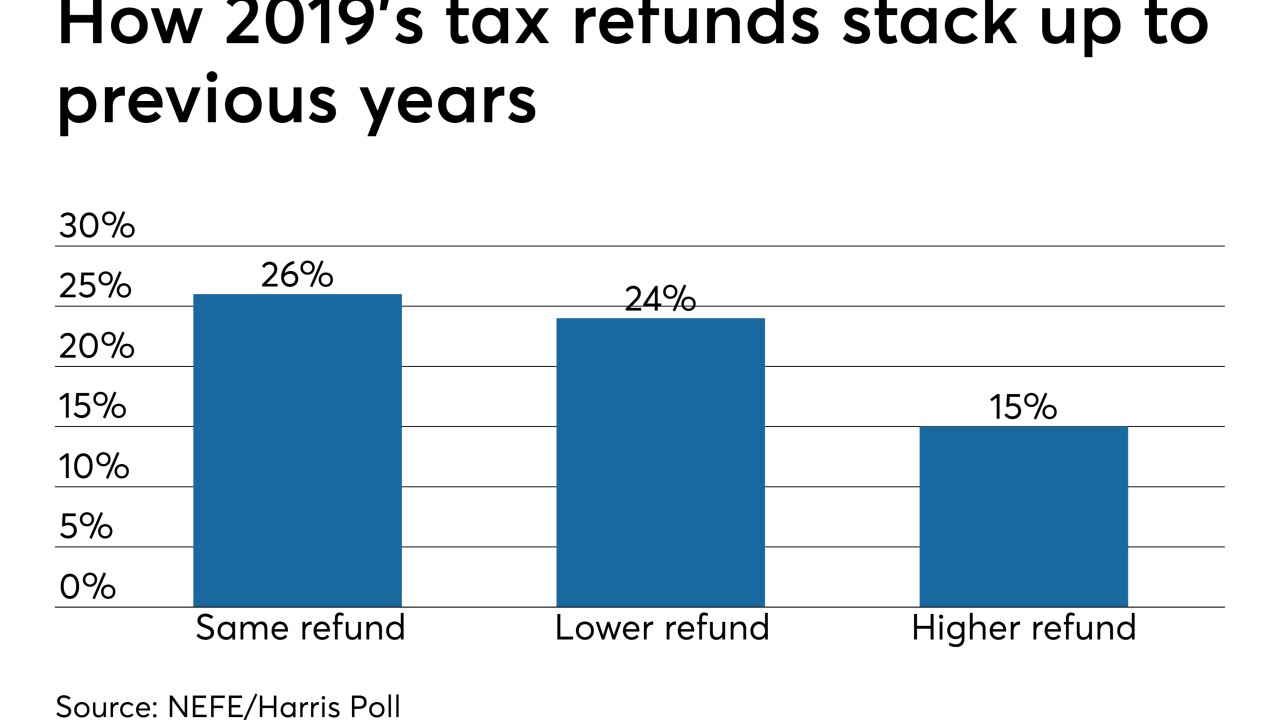

Volunteer Income Tax Assistance is reportedly bringing an influx of consumers to credit unions this tax season, but those institutions are hamstrung on the extent to which they can turn that opportunity into new business.

April 2 -

Regional and community banks are working to finance the economic development districts created by the new law. But they have lots of questions about how the program works — and thoughts on how to improve it.

March 26 -

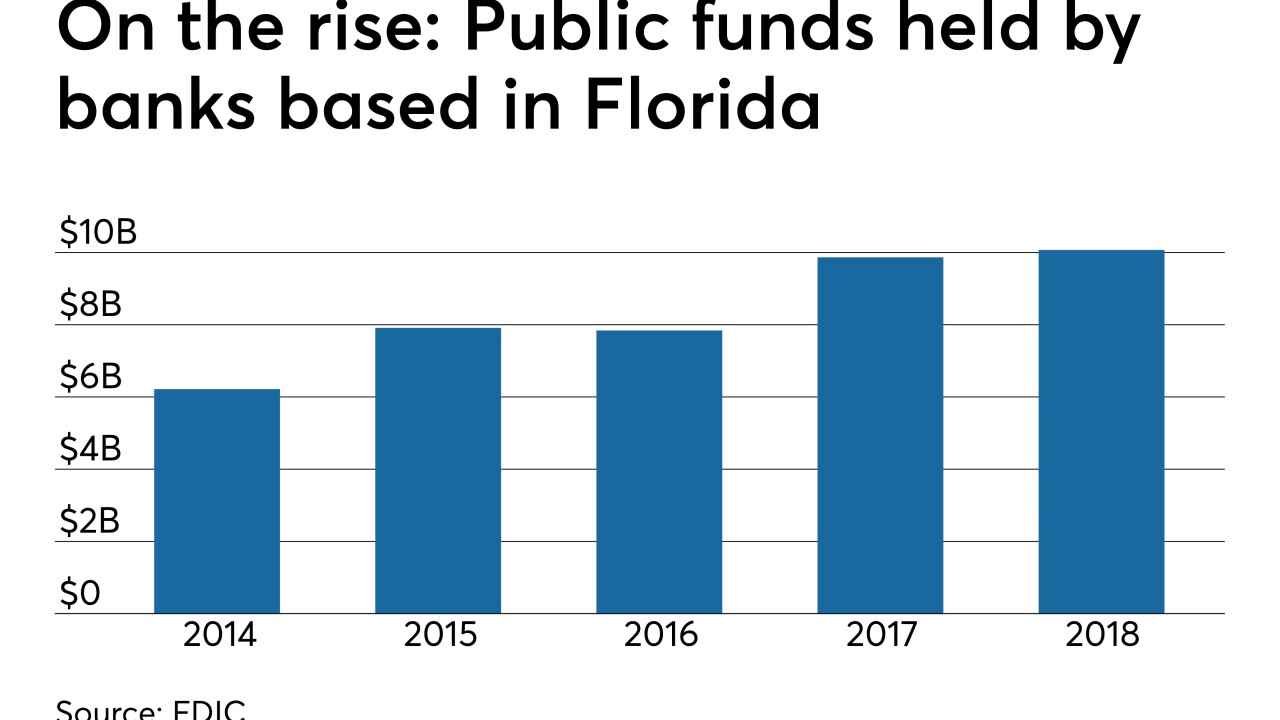

State law bars credit unions from accepting deposits from cities, counties and other government entities. Florida banks say it should stay that way unless tax advantages for credit unions are removed, but credit unions counter that banks are trying to stifle competition.

March 22