-

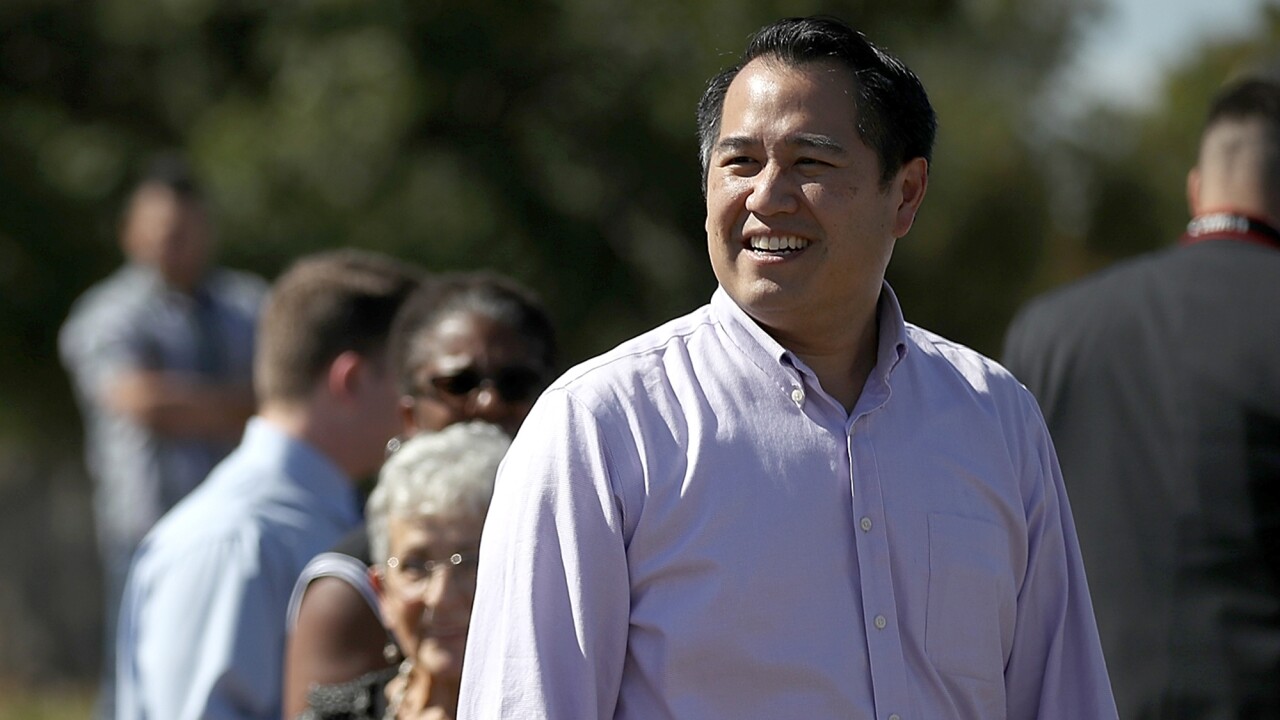

Mark Calabria said he wants Fannie Mae and Freddie Mac to take preliminary steps by Jan. 1 toward exiting conservatorship.

May 20 -

Banks are starting to lower their rates to savers, due to easier Fed policy and lower expected profits; Commercial lenders see big rise in non-performing loans.

May 20 -

His administration is looking at different alternatives to reform the housing finance system.

May 17 -

The White House is considering Derek Kan, an undersecretary at the Department of Transportation, for one of two open seats on the Federal Reserve Board, according to two people familiar with the matter.

May 17 -

Readers consider a Senate Banking Committee investigation into Facebook's use of consumer data, weigh the value of the CFPB's complaints database, debate legislation that would require big bank executives to testify before Congress annually and more.

May 16 -

Eric Blankenstein, the CFPB's policy director for supervision, enforcement and fair lending, has been criticized for using a racial slur in blog posts 15 years ago and claiming the majority of hate crimes were hoaxes.

May 15 -

In his first public policy speech as director of the Federal Housing Finance Agency, Mark Calabria stressed that Fannie Mae and Freddie Mac will have to raise significant capital via a public offering and take other steps in order to escape government control.

May 14 -

The Federal Housing Finance Agency has named three senior advisers for policy, economics and communications.

May 13 -

The White House is considering conservative economist Judy Shelton to fill one of the two vacancies on the Federal Reserve Board of Governors.

May 13 -

Readers weigh in on Wells Fargo's latest efforts to mollify regulators, debate the value of a "mini CFPB" in California, consider proposed changes to the Community Reinvestment Act and more.

May 9