-

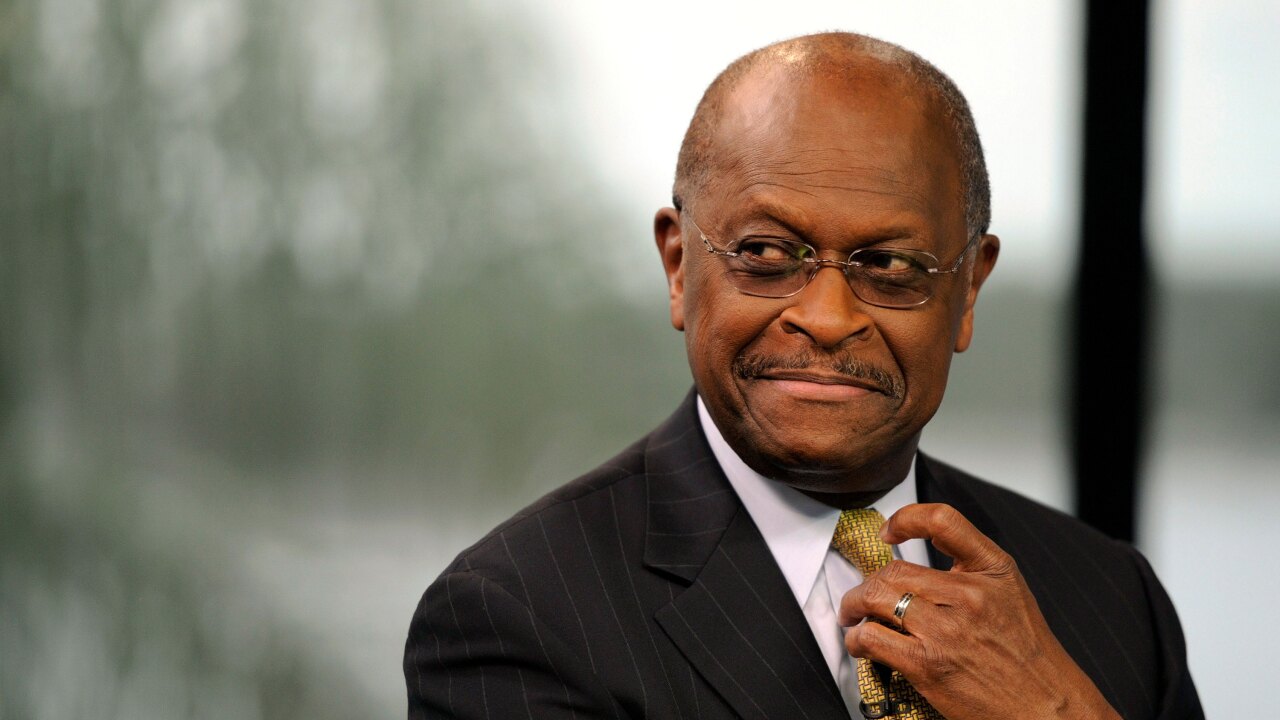

If Cain is chosen for the Federal Reserve Board, it would be starkly out of step with the administration’s other nominations and may reveal a drastic change in the president’s attitude toward the central bank.

February 1 American Banker

American Banker -

The lawmakers said the lack of someone with a state supervisory background among the agency's three inside board seats violates federal law.

January 31 -

Herman Cain, the former pizza company executive who ran for the Republican presidential nomination in 2012, is being considered by President Trump for a seat on the Federal Reserve Board.

January 31 -

The Federal Housing Finance Agency has appointed a special assistant to President Trump and former Trump campaign official as chief of staff of the agency.

January 31 -

A White House spokeswoman said the administration wants to work with Congress on a housing finance reform plan, providing evidence that changes might not be imminent.

January 29 -

The hiring of a former GOP congressional aide suggests the bureau will continue to rely on political appointees in senior positions.

January 28 -

The acting head of the Federal Housing Finance Agency has promised substantial changes for Fannie Mae and Freddie Mac, but the exact mechanics and timeline of an administration plan are still a mystery.

January 28 -

Chris D’Angelo, the CFPB's associate director of supervision, enforcement and fair lending, is leaving the bureau after eight years to become a chief deputy attorney general in New York state.

January 24 -

Fannie Mae and Freddie Mac shares soared Friday amid fresh reports that the Trump administration is working on proposal that would recommend freeing the mortgage-finance giants from government control.

January 18 -

In letters to the Treasury secretary and CEOs of the largest banks, the Massachusetts Democrat questioned why Mnuchin was trying to quell liquidity fears that had not previously been mentioned by regulators.

January 18 -

The Trump administration is considering whether to renominate Marvin Goodfriend to join the Federal Reserve Board, a person familiar with the matter said.

January 17 -

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17 -

Sen. Elizabeth Warren questioned the five largest U.S. retail banks in a letter on what they are doing to reduce the impact of the government shutdown on customers.

January 16 -

Sen. Elizabeth Warren is asking whether acting White House Chief of Staff Mick Mulvaney's reported talks to be president of the University of South Carolina violated the Stop Trading on Congressional Knowledge Act.

January 15 -

Many federal agencies have been closed for more than three weeks, making it the longest shutdown in U.S. history. With no end in sight, here's how it's affecting banks, credit unions and mortgage lenders.

January 13 -

Acting Ginnie Mae President Michael Bright will leave his post on Jan. 16 and will no longer seek confirmation to be the permanent head of the mortgage secondary market agency.

January 9 -

From anti-money-laundering reform to pot banking, there are deals to be had on financial services legislation. The question is whether anyone wants to make them.

January 8

-

The White House has officially nominated Mark Calabria as the next director of the Federal Housing Finance Agency.

January 8 -

Santander taps JPMorgan Chase exec Colleen Canny to lead retail network; can Trump actually fire Fed's Powell?; will 2019 bring long-awaited reform of Fannie Mae, Freddie Mac?; and more from the past two week's most-read stories.

January 4 -

The central bank chairman said Friday that he would not step down if asked to do so by the president, adding that he has not received any direct communications from the White House about the agency’s interest rate policy.

January 4