-

Banks face immense challenges trying to keep up with technology, but they also must cater to older customers with big deposit accounts who still use their branch.

December 21

-

Boston Private Financial Holdings has appointed its chief executive, Clayton Deutsch, as CEO of its bank subsidiary, Boston Private Bank & Trust.

December 18 -

JPMorgan Chase investment bank head Daniel Pinto said internal technology projects, including those focused on blockchain, big data and robotics, will be a "major priority" next year.

December 18 -

State Street said it incorrectly invoiced at least $200 million in asset servicing expenses to clients over a period of 18 years.

December 18 -

TriState Capital Holdings in Pittsburgh has agreed to buy asset management firm Killen Group in Berwyn, Pa., for between $30 million to $35 million in cash, based on conditions tied to the asset manager's cash flow.

December 17 -

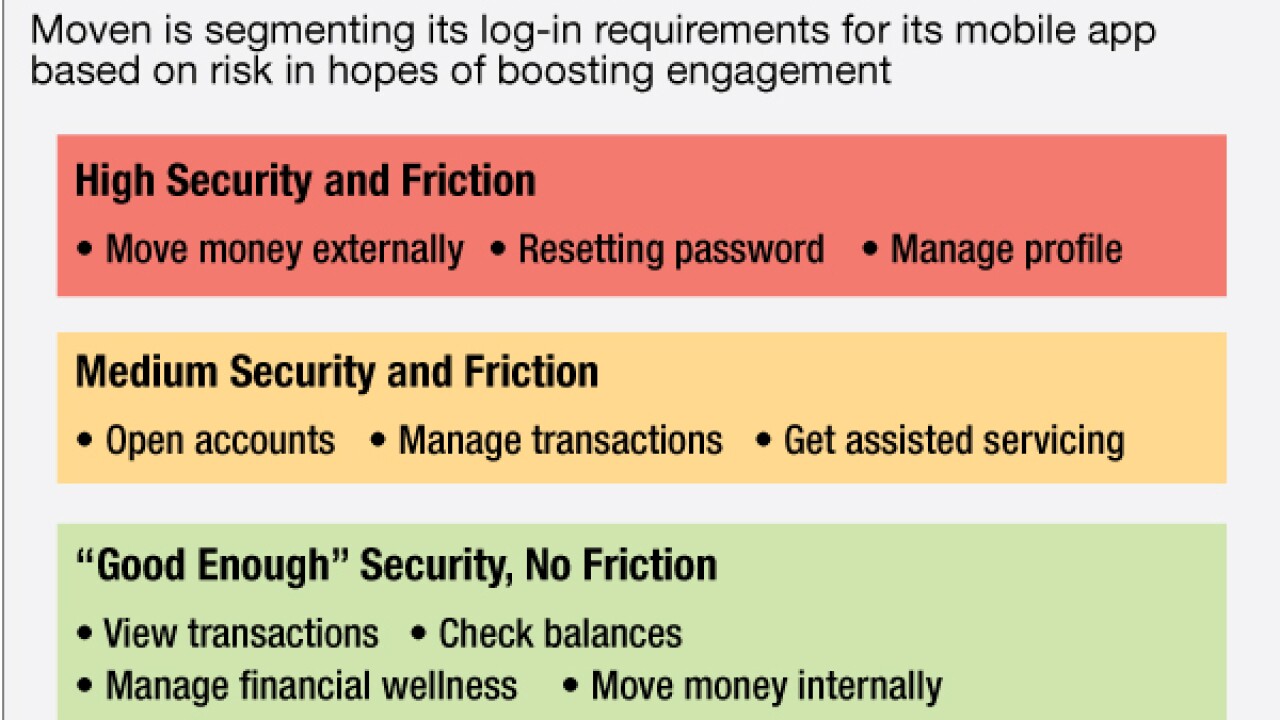

Moven will soon prompt its customers for usernames and passwords only for riskier transactions. By removing the login for most functions, the company aims to drive engagement in an app meant to be used on the go.

December 17 -

First Tennessee Bank has established a partnership with the nonprofit Operation Hope to offer free financial literacy workshops and counseling sessions in several branches.

December 9 -

Affluent customers deserve special attention, but banks have to think outside of the box to improve loyalty and customer satisfaction with this important customer segment.

December 9

-

Why a small bank like First Mid-Illinois ignored the conventional wisdom 'Commercial banks buy property/casualty firms.' 'Private-equity will outbid you.' 'Leave the innovation to the big guys.' and bought a retail health-insurance agency.

December 8 - California

First Republic Bank in San Francisco has promoted Mike Selfridge to the newly created role of chief banking officer.

December 7