-

Boston Private Financial Holdings has appointed a Silicon Valley executive to its board.

October 7 -

Relationship and people skills certainly remain important, but today's wealth management leaders require far more than those largely sales-oriented abilities.

October 7

-

Robo-advisers have myriad conflicts of interest and fall short of the standard of care under fiduciary investment law. The Labor Department's endorsement of these algorithmic investment guides seems curious and misplaced.

October 7

-

Lebenthal Holdings, the family-owned wealth management firm run by Alexandra Lebenthal, has hired former Ally Bank chief Barbara Yastine to be co-chief executive.

October 5 -

Banks worldwide are in danger of losing significant profits in several lending areas to nonbank alternative lenders, according to a McKinsey study.

October 1 -

One woman on the all-male management board is not too much to ask, especially if it can take two years (or 20?) to get there, Deutsche Bank decides; Goldman, Morgan Stanley and Citi try mending their leaky pipeline, with some success (but sadly, 100 more years of this is what we're looking at, ladies); also get updates on Mary Jo White, Sallie Krawcheck and WomenCorporateDirectors.

October 1

-

UBS Financial Services of Puerto Rico has agreed to pay $34 million to settle charges by the Securities and Exchange Commission and Financial Industry Regulatory Authority that it failed to supervise a former broker who had customers invest in UBSPR affiliated mutual funds using money borrowed from an affiliated bank.

September 29 -

Sallie Krawcheck, the former Bank of America and Citigroup executive, is adding a female-oriented investing platform to her ventures meant to promote women in business.

September 28 -

The marketplace lender is paying $30 million in cash plus an undisclosed amount of stock. It plans to use BillGuards apps, which come with detailed information about their users financial habits, to attract new borrowers.

September 24 -

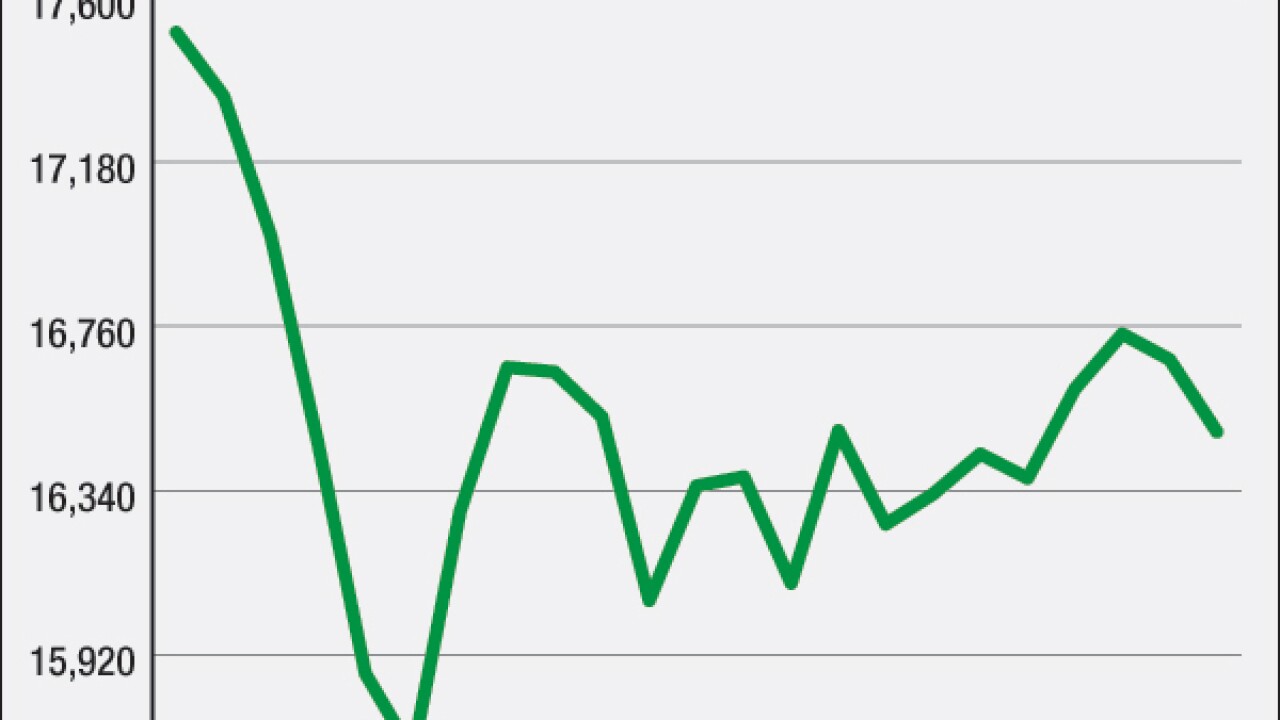

During the recent market volatility, apps that aim to lure non-typical investors into the market faced a problem with which all digital-only financial products contend: no office to visit for reassurance. Companies turned to emails, tweets and pop-up messages to try to replicate the soothing voice.

September 18