-

The bank that for many defines ultrawealthy is now in the market to serve investors whose employers don't even offer 401(k)s.

March 14 -

Chase is investing in digital and technology resources in a way that's reminiscent of the Silicon Valley model, as it looks to create more direct interaction with its customers on its website.

March 14 -

Banks need to rethink their purpose to serve its younger customers, many of whom are inundated with choices. Banks have a tremendous opportunity to win these overbanked customers if they can figure out a way to become the financial hub.

March 7 -

Northern Trust has agreed to buy Aurora Investment Management, a hedge fund portfolio manager that's owned by Natixis Global Asset Management.

March 7 -

Tech giants like Intel and Apple are doing more business with women- and minority- owned underwriters; Christine Lagarde has five more years at the IMF; and why Lehman Sisters might not have failed. Plus, are girls getting a bad rap from dictionaries and bad counsel from parents?

February 25

-

Two big Canadian banks reported quarterly results on Thursday.

February 25 -

The private-banking prowess of newly acquired City National was the steadying influence Royal Bank of Canada needed amid global and domestic economic shocks in its latest quarter.

February 24 -

Several money managers increased their holdings in banking companies during the fourth quarter and added new investments in other banks.

February 17 -

The Madrid-based bank announced Thursday that it will invest $250 million in Propel Venture Partners.

February 11 -

The Canadian bank's U.S. wealth management arm is moving toward a hybrid digital-human advice platform, partnering with BlackRock's FutureAdvisor to add robo tools for its 1,900 advisers.

February 3 -

HSBC is testing a new money management app that uses push notifications to nudge customers into saving more and spending less.

January 29 -

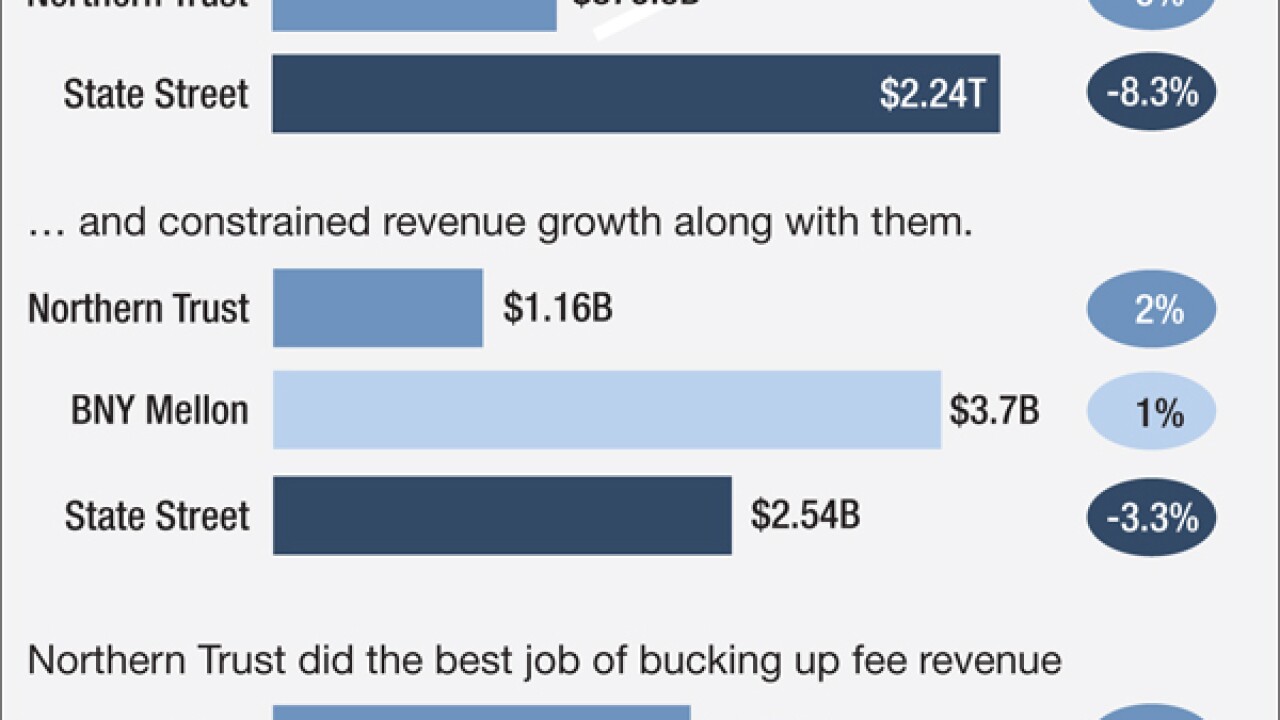

Bank of New York Mellon, Northern Trust and State Street have all pledged to cut costs as challenging global equity markets, low interest rates, a strengthening U.S dollar and heightened regulatory expectations continue to crimp revenue and profit margins.

January 28 -

American International Group announced $3.6 billion in new costs to fill a reserve shortfall and said it will hold an initial public offering for its mortgage insurer and sell an adviser network as Chief Executive Peter Hancock seeks to boost returns and protect his job after criticism from activist investor Carl Icahn.

January 26 -

Bank of New York Mellon has become a big believer in reverse mortgages, particularly home equity conversion mortgages insured by the Federal Housing Administration.

January 25 -

Anthony Weagley is combining a new emphasis on wealth management with Malvern's reputation as a small-town community bank to bolster the Pennsylvania company's financial performance.

January 20 -

CEO James Gorman says the firm can achieve higher profit margins for the wealth management unit through greater expense discipline, additional growth of its lending business and unspecified digital opportunities.

January 20 -

Unfavorable equity markets and lower transaction volumes led Northern Trust Corp. to report a 2% drop in fourth-quarter profit.

January 20 -

In 34 years at American Express Co., Ken Chenault has helped reinvent the credit-card company more than once. But his latest push into new frontiers is faltering behind the scenes.

January 20 -

The Government Accountability Office will examine the role of the Centers for Medicare and Medicaid Services in helping state health insurance exchanges transition from state-based information systems to the federal program.

January 20 -

The Minneapolis bank has promoted longtime executive Andrew Cecere to president, a title held by Chairman and CEO Richard Davis for more than a decade.

January 19