-

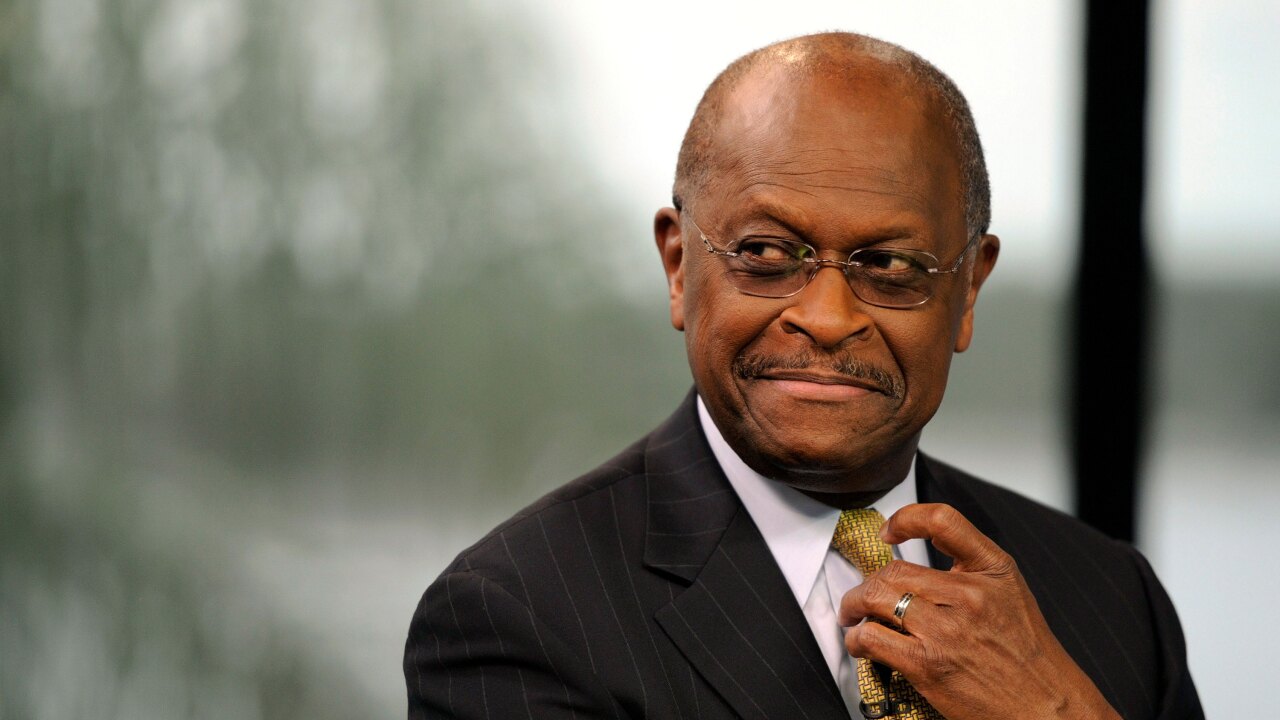

Herman Cain, the former pizza company executive who ran for the Republican presidential nomination in 2012, is being considered by President Trump for a seat on the Federal Reserve Board.

January 31 -

The Federal Housing Finance Agency has appointed a special assistant to President Trump and former Trump campaign official as chief of staff of the agency.

January 31 -

A White House spokeswoman said the administration wants to work with Congress on a housing finance reform plan, providing evidence that changes might not be imminent.

January 29 -

The hiring of a former GOP congressional aide suggests the bureau will continue to rely on political appointees in senior positions.

January 28 -

The acting head of the Federal Housing Finance Agency has promised substantial changes for Fannie Mae and Freddie Mac, but the exact mechanics and timeline of an administration plan are still a mystery.

January 28 -

Chris D’Angelo, the CFPB's associate director of supervision, enforcement and fair lending, is leaving the bureau after eight years to become a chief deputy attorney general in New York state.

January 24 -

Fannie Mae and Freddie Mac shares soared Friday amid fresh reports that the Trump administration is working on proposal that would recommend freeing the mortgage-finance giants from government control.

January 18 -

In letters to the Treasury secretary and CEOs of the largest banks, the Massachusetts Democrat questioned why Mnuchin was trying to quell liquidity fears that had not previously been mentioned by regulators.

January 18 -

The Trump administration is considering whether to renominate Marvin Goodfriend to join the Federal Reserve Board, a person familiar with the matter said.

January 17 -

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17