-

Sometime on Saturday, the bitcoin network will pass a milestone in its development. Here's why some bankers are paying attention.

July 8 -

Gov. Pat McCrory on Wednesday signed the North Carolina Money Transmitters Act, as requested by the state banking commissioner's office.

July 7 -

David Saul, State Street's chief scientist, has completed a proof of concept for the Financial Industry Business Ontology, a standard way of expressing contract terms electronically. To him, it's a prerequisite for blockchain technology and smart contracts.

July 14 -

The director of innovation at ATB Financial explains why his bank became one of the first to send cross-border payments on the Ripple network, and whether this could be a plausible alternative to Swift.

July 12

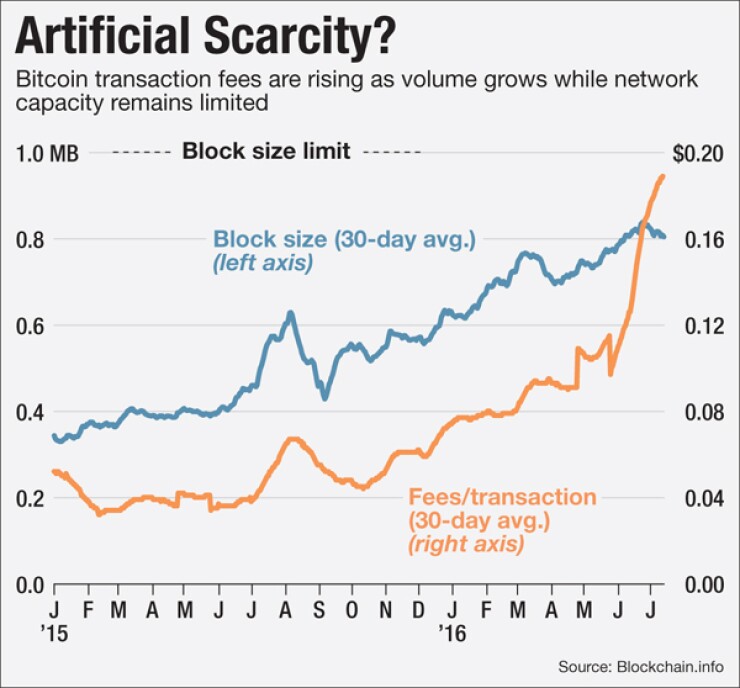

Two recent essays have made the argument for retaining the one-megabyte limit on the size of bitcoin blocks, which limits the number of transactions the network can process. These contributions help reveal something that the technically oriented bitcoin community doesn't focus on very much: the block size debate is about human values. The debate will be less acrimonious if bitcoin community leaders surface and compare these values.

In a

But to Deschapell, the daily spending use case is "largely a dream." Today's use case, he wrote, is investment. Everyday spending of bitcoins will wait at least until investment growth brings bitcoin's still-significant volatility under control, he argued.

In a similar

[Get up to speed on distributed ledgers, cryptocurrencies and the bleeding edge of fintech at American Banker's third annual Blockchains + Digital Currencies conference July 28 in New York. Click

"[T]here's little evidence," Rajasekhar wrote, "that bitcoin's users are concerned about the cost of using the network." And later: "cheap is not what bitcoin's real users are looking for."

While their observations are accurate, Deschapell's and Rajasekhar's embrace of the status quo in bitcoin use struck me. My own belief has been that a substantial goal of the bitcoin community is to increase global financial inclusion. Indeed, when an ascendant Bitcoin Foundation commissioned me to

In that view, the investment use case is a means to an end. Yes, it is gratifying to see bitcoin adoption increasing among mainstream investors, but that doesn't alleviate the daily human toll of poverty and oppression. Getting bitcoin into daily use around the globe remains a badly unmet urgency.

The "fee market" produced by small blocks — the writer and researcher Konrad Graf calls it a

The benefits of the proposed Lightning Network seem clear, but this second-layer bitcoin protocol, meant to allow essentially limitless instantaneous transactions, must overcome certain hurdles. It remains unclear how payment routing will work or whether it will become a centralized payment system of the type bitcoin was meant to surpass. Lightning's benefits to global financial inclusion await both the development of the technology itself, and then the economic and human capital of both worldwide Lightning nodes and the knowledge to use them.

Pushing simple bitcoin adoption in the global south has been a challenge, and it has by no means been met. The block size constraint produces additional barriers.

The reason for maintenance of the current limit on blocks is, of course, to avoid the centralizing influence of bigger blocks on bitcoin mining and nodes. Centralization could allow bitcoin's immutability to be undercut by miners themselves or by governments commandeering miners. Given these threats, Deschapell wrote with emphasis, "if bitcoin can … be scaled without sacrificing any degree of decentralization, then this is clearly the path that should be taken." It's a value-laden recommendation, strongly phrased, and it gives primacy to the investment use case for bitcoin, diminishing (by delay) the financial inclusion use-case.

Giving preference to investors over a larger global user base also implies a different strategy for protecting bitcoin from government attacks (which appear more salient than miner attacks). Limiting the block size may inure bitcoin structurally by keeping mining and nodes more dispersed. Growing the bitcoin user base may inure bitcoin politically by making it as integral to society as the internet itself.

In trade-offs among values, there are no right or wrong answers (and there is often no one question). But at the risk of oversimplification, the question comes down to this: Should bitcoin most serve investors while one form of attack resistance — decentralization — is burnished? Or should the bitcoin community refocus on the global financial inclusion goal while burnishing another form of attack resistance through widespread adoption?

Deschapell and Rajasekhar have contributed by opening avenues for discussion of our values, and strategies for advancing them. It's a tall order for a community of computer nerds, but participants in the blocksize debate who know where their values lie should express them. They will do a better job of negotiating the progress of bitcoin toward widely agreed upon ends.

Jim Harper is a senior fellow at the Cato Institute.