-

Housing advocates say there is a gap between the relief borrowers are seeing on the ground and what the five largest servicers agreed to do as part of the $25 billion settlement signed in February.

December 7 -

A consumer group questions why the top five mortgage servicers are getting credit under the $25 billion national mortgage settlement for forgiving principal in short sales when the goal of the program is to keep borrowers in their homes.

August 31

With an enormous population, a vast landscape dotted with vacant homes, and the charred remains of the U.S. subprime lending industry, California sustained more damage from the foreclosure crisis than any other state.

So it only seemed right that Californians should receive the largest portion of the roughly $20 billion that the five biggest mortgage servicers agreed in February to provide to homeowners in 49 states, in order to settle claims related to alleged abuses of consumers.

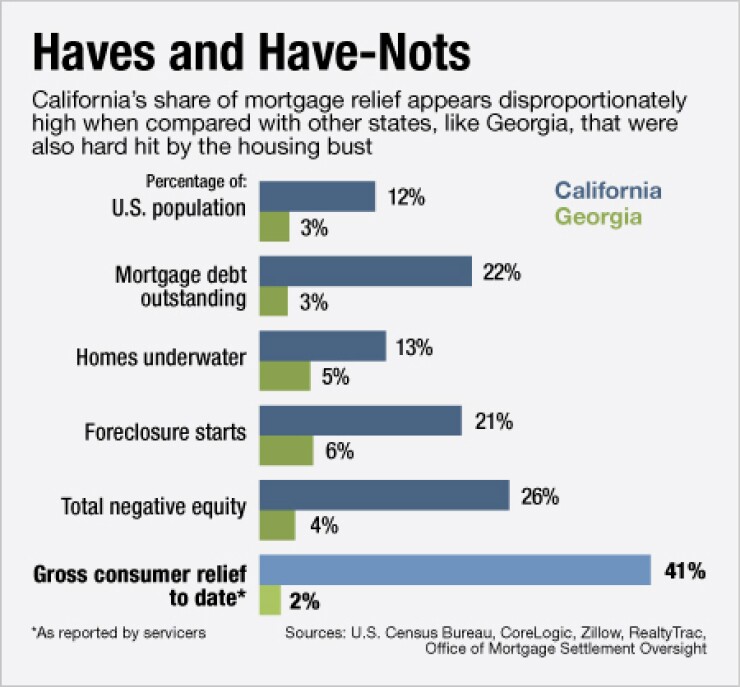

Ten months later, though, it is becoming apparent just what an oversized piece of the pie the Golden State got. Through Sept. 30, California homeowners received nearly 41% of the nationwide pot, which is billions of dollars more than an analysis of nationwide mortgage data suggests is fair. In addition, California's hefty share of the proceeds may have come at the expense of other deserving states.

One of the have-not states is Ohio, where Rust Belt housing woes have been overshadowed by the larger real-estate problems of the Sun Belt. Ohioans, who make up 3.7% of the U.S. population and have suffered 3.2% of the nation's foreclosure starts, have received less than 1% of the consumer relief dollars under the multistate settlement.

"I certainly think it's problematic," said David Rothstein, who studies the foreclosure crisis for Policy Matters Ohio, a left-leaning policy research organization. "I don't think that people really anticipated that certain states would have that much larger a percentage of homeowners being helped."

California's windfall is a by-product of a side deal that the state's attorney general, Kamala Harris, cut with Bank of America (BAC), JPMorgan Chase (JPM) and Wells Fargo (WFC), using her leverage as the top prosecutor in the nation's largest state to extract as much money as possible. The state also won tough provisions to enforce and monitor the deal, giving its homeowners another leg up over other Americans who are also seeking funds.

Michael Troncoso, senior counsel to Attorney General Harris, argued that California deserves a large share of the pie because it was "one of the hardest hit states in the country by any metric."

Like others who helped negotiate the nationwide settlement, Troncoso also believes that the total settlement amount would have been smaller for all states if California had not signed on to the agreement.

"I don't think it's fair to say that this came at the expense of other states," he said. "It's difficult to have a multi-billion dollar national settlement without the largest state."

Florida and Nevada, also among the most severely affected states, followed California's lead in striking side deals that guaranteed them sizable cuts of the funds, though not their shares are as not generous as California's is.

Other states that had less leverage, or failed to use the bargaining power they had, got significantly smaller shares, even in proportion to the damage they suffered from the foreclosure crisis. As a result, struggling homeowners in Arizona, Georgia and other states are less likely to receive the settlement dollars that might keep them in their homes than Californians are.

Iowa Attorney General Tom Miller, the lead negotiator for the states, defended the division of funds, noting that California is the biggest state and that its residents have lost a huge amount of equity in their homes.

"We knew that [the funds] would go disproportionately throughout the country because the bubble was much worse in certain parts of the country," he said. "But we were all willing to go along with that because it made real sense for homeowners across the country."

A Direct-To-Consumer Deal

The $25 billion mortgage agreement, which grew out of the robo-signing scandal, is the largest multistate deal since the national tobacco settlement of 1998. But the mortgage settlement was structured quite differently than the tobacco deal, where corporations cut checks directly to the states based on an agreed-upon formula.

A comparatively small part of the mortgage settlement works that way, but most of it does not.

The 49 participating states and the District of Columbia — Oklahoma didn't sign on — receive a total of $2.5 billion in direct cash payments. Each state's allocation was determined based on a straightforward formula that takes into account the state's share of foreclosure starts nationwide, in addition to its portions of seriously delinquent loans, residential loans serviced, and mortgages where the homeowner owes more than the home is worth.

California's allocation of that money is $411 million, or 16% of the nationwide total. That's in the general range that one might expect, given the state's size and its concentration of soured mortgages.

But a much larger part of the national settlement — $20 billion — is earmarked for consumer relief. That category includes short sales, refinances, and mortgage modifications, some of which involve principal reductions. The states themselves never receive these funds. The banks make arrangements with homeowners and credit the funds directly to customer accounts.

Iowa AG Miller, a Democrat, and some of his fellow attorneys general were determined to strike a deal that would require the banks to begin granting principal reductions, which were not yet happening on any large scale.

But to get there, Miller faced a Herculean task — trying to satisfy the interests of 50 different states, including both Democratic and Republican elected officials. While California and some other states were fighting for the largest possible share of the money, Democratic attorneys general from New York, Delaware and Massachusetts were pushing to preserve certain legal claims under the settlement.

(Later on, K&L Gates, a law firm, would title a report on the agreement "

The deal that Miller and federal representatives reached with the five banks — in addition to Bank of America, Chase and Wells Fargo, Citigroup (NYSE: C) and Ally Financial signed onto the agreement — did not include any requirement regarding how much of the consumer relief funds were to be distributed in each state.

That lack of specificity provided bargaining space for Harris, the California AG who broke off to hold separate talks with the banks.

California Flexes Its Muscles

Harris, now a rising star in the Democratic Party nationally, declined through a spokesman to be interviewed for this article. But people who know the attorney general describe her as a tough-as-nails negotiator. At one point she walked away from the negotiating table, according to a source familiar with the talks.

Harris' office had laid groundwork for these negotiations by creating a Mortgage Fraud Strike Force in 2011. That team of prosecutors made more credible the threat that she might ditch the negotiations and file suit against the banks.

During the final week of talks, it remained unclear whether California would sign on to the settlement.

Reuters reported on Feb. 6, three days before the settlement was announced, that California's participation would

Meanwhile, the side deal that California eventually struck requires Bank of America, Chase and Wells Fargo to provide a total of $12 billion in loan modifications, short sales and other consumer relief to California residents.

The $12 billion for California does not come directly out of the $20 billion in consumer relief nationally, due to differences in how credits for the various forms of relief are calculated.

Still, B of A, Chase and Wells guaranteed billions of dollars more to Californians than were going to be trimmed from the national total if California dropped out of the talks. That suggests that some of California's gain might have come out of the pockets of residents of other states.

But that scenario assumes the five banks would have agreed to a multistate settlement that did not include California. And it's not clear the banks would have signed a deal that left them liable to lawsuits filed by the nation's largest state.

What's harder to dispute is that California's share of the consumer relief funds is disproportionately larger than what other states are receiving.

Through Sept. 30, the five participating banks stated that they have sent $8.9 billion in gross consumer relief to Californians, according to a

For comparison, California is home to 12% of the U.S. population. Since early 2005, California has had 17.7% of the nation's foreclosure completions and 21.1% of the nation's foreclosure starts, according to RealtyTrac data.

Those data suggest that Californians deserved perhaps 15% to 20% of the consumer relief dollars under the settlement.

That estimate increases if one also considers home prices, which are higher in California than in almost every other state.

Because California homes cost more, a 20% fall in home prices wipes out more home equity in California than it does elsewhere. California has 18.2% of the nation's underwater homes but 26.1% of the nation's total negative equity, according to data from CoreLogic.

Still, even if California deserved 26% of the settlement's consumer relief dollars, that's roughly $3.3 billion less than what its residents have received to date.

Bank of America did not respond to a request for comment for this article, while both Citigroup and Chase declined an opportunity to comment.

Ally Financial said in a statement that it "is committed to honoring the terms" of the settlement agreement "and will continue to solicit all eligible borrowers."

Wells Fargo said in a written statement that the geographic distribution of its consumer relief activities "remains consistent with the distribution of its portfolio and also reflects the fact that the financial commitments under the settlement are focused on borrowers who are in a negative equity position."

For its part, the California Attorney General's Office said that the $20 billion pool of relief available to consumers nationwide would have been smaller if California had dropped out of the talks.

"I think there are billions of dollars more that are available nationwide because of what California and the federal government did," Troncoso said.

One State Gets Its Own Watchdog

In March, Attorney General Harris tapped Katherine Porter, a University of California, Irvine, law professor who is one of the nation's leading academic experts on mortgage servicing, to monitor the settlement's implementation in California.

Inside the law school on UC-Irvine's campus, Porter oversees a team of 11 employees, including seven lawyers. One of their key responsibilities is pursuing complaints lodged by California homeowners.

Porter and her staff represent another advantage that California holds as the five big banks are distributing benefits across the country. Although the settlement has a national monitor — former North Carolina Banking Commissioner Joseph Smith holds that job — no other state has established an office dedicated to ensuring that its residents get relief.

The California office's employees are assigned to different banks, and when they receive a consumer complaint, they often reach out directly to the bank in an effort to resolve the problem.

Their letters can't be easily ignored: under the California side deal, if the three banks fail to meet their obligations, they are on the hook for hundreds of millions of dollars in payments to California's state government.

As of early December, the office's database had 2,167 complaints, which the monitor receives directly, as well as from the Attorney General's Office, consumer attorneys and housing counselors.

Some borrowers are seeking a principal reduction, some want monthly payment relief, while others

"I do a lot of loan-level investigation," Porter explained in an interview. "It is the key that unlocks robust enforcement."

Porter is an energetic Elizabeth Warren protégé who gets excited talking about finding ways to improve the mortgage servicing process, long notoriously unfriendly to consumers.

"We never say to a servicer, 'This is bad. Fix it.' We say, 'This is bad. Here is a way that you could fix it. Does that way work for you?'"

In an interview, Smith, the national monitor, said Porter's group has helped him keep tabs on the servicers to make sure they are honoring their end of their settlement.

The national monitor's office does not investigate individual complaints in the way that California does. When asked if Porter is bringing specific homeowners' cases to his attention, Smith responded drily. "Only every day," he said.

The Impact Elsewhere

California is not the only state that left the settlement negotiations with a sweetened deal, but it did blaze the trail. In Florida, Attorney General Pam Bondi secured a side deal that was modeled so dutifully on California's agreement that no one even bothered to change the document's font.

Under that agreement, B of A, Wells and Chase guaranteed they would provide $4 billion in consumer relief to Floridians. That's not as favorable as California's $12 billion commitment, but an analysis of mortgage market data suggests that Floridians are faring better than they would have done under a more equitable deal.

Through September, Florida homeowners received 16.5% of the consumer relief awarded nationwide under the settlement, according to the national monitor's report.

For comparison, Florida is home to 6.1% of the nation's population, has 8.7% of the nation's foreclosure completions, 15.6% of the nation's foreclosure starts, and 16.7% of the nation's underwater homes, based on the same data sources as were used for California.

Nevada reached its own side deal with Bank of America, settling a lawsuit previously filed by the state, and requiring B of A to set aside $750 million in consumer relief for its residents. "The settlements are in proportion to that of California," the Nevada Attorney General's office

According to the most recent data, Nevada has received 4.2% of the consumer relief delivered nationwide. That's larger than Nevada's share of the U.S. population, its share of underwater mortgages, of foreclosure starts and completions, and of total negative equity.

The nationwide mortgage data do carry a couple of caveats. Those numbers are based on a broad view of the market, whereas the consumer relief portion of the national settlement excludes loans owned by Fannie Mae and Freddie Mac, as well as those serviced by firms outside the industry's top five.

So if one of the top five banks has a larger-than-average servicing footprint in a particular state such as California, it would make sense for that bank to be providing more consumer relief to Californians. Data on the geographic breakdown of each servicer's portfolio is not publicly available.

Still, it's hard to escape the fact that the three states that cut deals to guarantee a share of the $20 billion are getting more than the various nationwide mortgage metrics suggest they should.

Iowa AG Miller defended the settlement by saying, "States like Ohio didn't have the huge bubble that California, Arizona, Nevada and Florida had, so that does have an impact."

But Arizona, one of the states hurt most by the foreclosure crisis, has not fared as well as the three so-called sand states that negotiated side deals.

Arizona has 2.1% of the U.S. population, 4.2% of the negative equity nationwide, 4.8% of the underwater mortgages, 5.7% of the foreclosure completions and 5.8% of the foreclosure starts.

Through September, Arizona had gotten 4.5% of the settlement's consumer relief — within the range of what the data suggest it should receive, but not more.

Many other states are faring worse.

For example, Georgia has received only 2.2% of the nationwide consumer relief — despite having 3.1% of the U.S. population, 3.7% of the nation's negative equity, 4.8% of the underwater mortgages, 5.6% of the foreclosure starts, and 5.7% of the foreclosure completions.

"We don't have our side agreements. We don't have our own monitor," said John O'Callaghan, president and chief executive officer of the Atlanta Neighborhood Development Partnership. "The squeaky wheel gets the oil."