Richard Davis, chairman and CEO of U.S. Bancorp, about ongoing settlement talks between state attorneys general and top mortgage servicers

Christopher Carey, chief financial officer of the $23 billion-asset City National Corp. of Los Angeles

Irene Dorner, president and CEO of HSBC USA, said of selling off profitable businesses and bank branches

Daniel Tarullo, governor, Federal Reserve Board, on concerns a merger could create another "too big to fail" institution

Robert J. Shiller, a Yale University economist and the namesake of the closely watched Standard & Poor's/Case-Shiller home price indexes

John Poelker, who was assigned by the Treasury Department to the board of First Banks Inc. in Clayton, Mo., after that company missed at least six consecutive dividend payments on its Tarp money

Susan O'Donnell, a managing director at Pearl Meyer & Partners LLC, an executive search firm, on serving on a bank board

Julie Conroy McNelley, a senior risk and fraud analyst at Aite Group LLC, reacting to Visa's incentive plan to fast-track merchant acceptance of chip cards in the U.S.

Lynn E. Szymoniak, a plaintiff's lawyer in West Palm Beach, Fla.

Raj Date, acting director, CFPB

Wayne Abernathy, the director of regulatory affairs and financial institutions policy at the American Bankers Association, on the release of the Volcker Rule

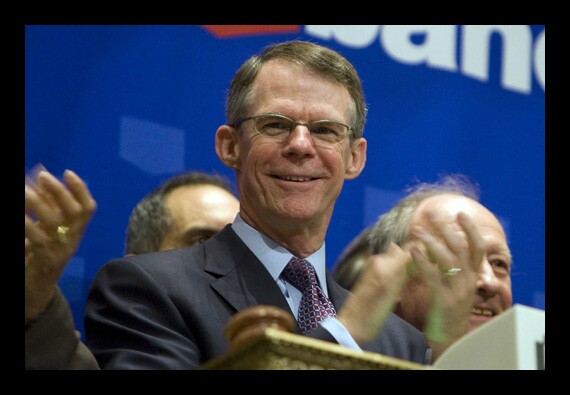

Rick Waddell, chairman and CEO of Northern Trust Corp., questioning rival Bank of New York Mellon's decision to charge clients for holding large deposits

Lewis S. Ranieri, mortgage industry veteran and pioneer of the mortgage-backed security

Craig Meader, chairman and CEO, First National Bank of Kansas

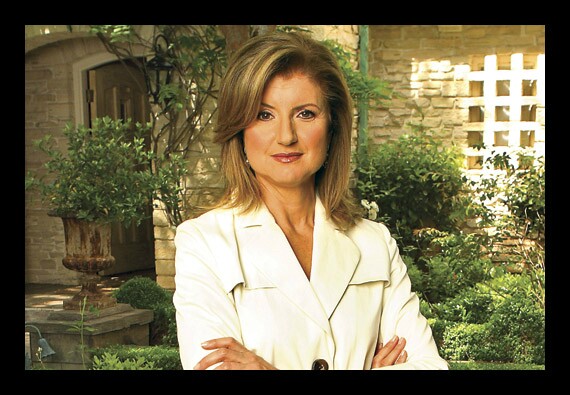

Arianna Huffington, founder of The Huffington Post