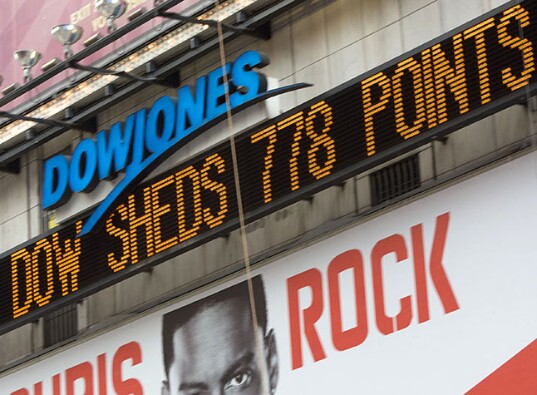

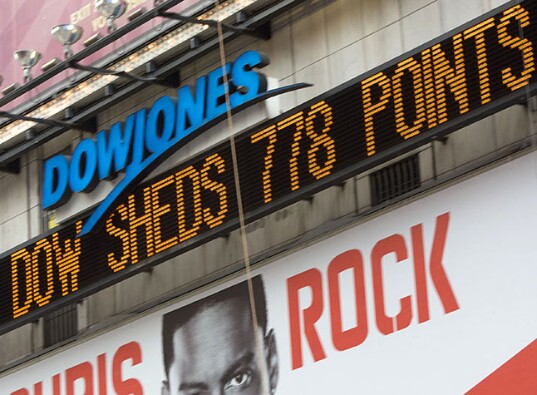

The End of the Big Investment Bank

Regulations Crimp Profits

Retail Ambitions Take Shape

A New Source of Deposits

Building Out Wealth Management

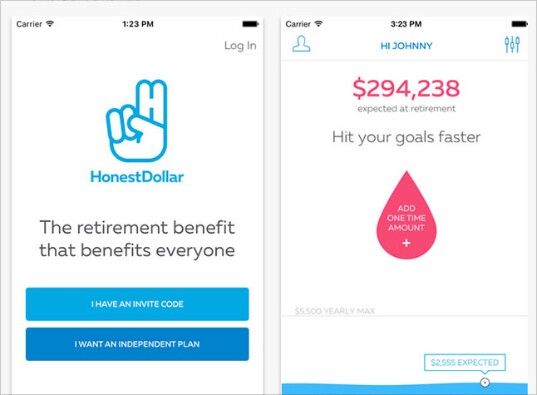

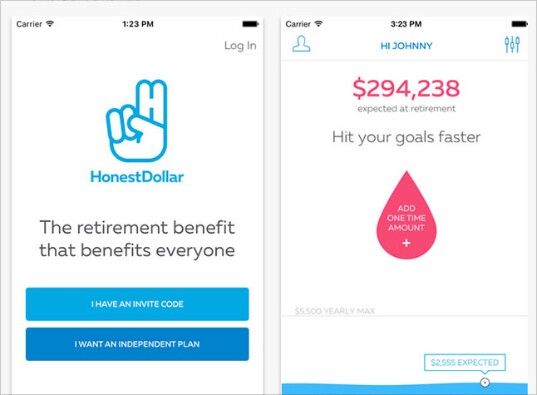

Next Prong in Digital Strategy: Retirement Plans

BayFirst Financial, which has reported problems with SBA loans, expects to reach an agreement with its regulators in connection with credit administration and other issues.

A report from J.D. Power indicates that the neobank Chime gained the highest percentage of newly opened checking accounts in the third quarter of 2025.

The court upheld the Federal Reserve Board's right to block Custodia from direct access to its payment systems. The bank is considering asking for a rehearing.

The Tacoma, Washington-based bank, which has completed two mergers since 2023, said Thursday that it will buy back up to $700 million of its own shares over the next year.

New York State's former top regulator Adrienne A. Harris has rejoined Sullivan & Cromwell as of counsel and senior policy advisor; Founders Bank appointed Karen Grau to its board of directors; Deutsche Bank's DWS Group is opening an office in Abu Dhabi; and more in this week's banking news roundup.

Earned wage access provider EarnIn, which historically has been known for direct-to-consumer EWA, is now integrating its services with payroll providers. The move comes as consumer advocate groups step up efforts for stricter regulation of the industry.