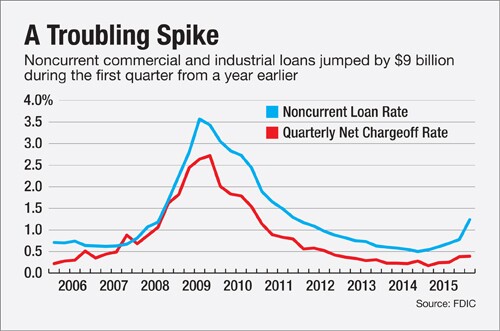

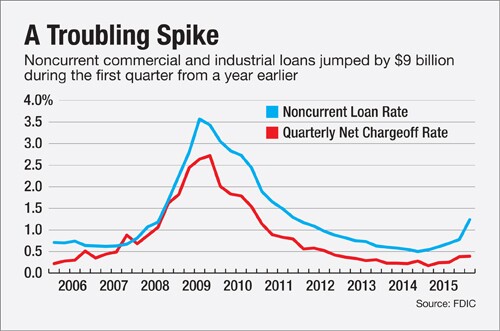

Noncurrent Loans

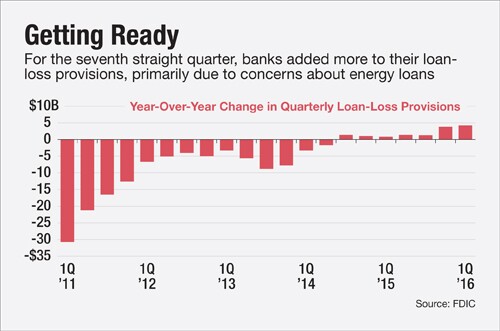

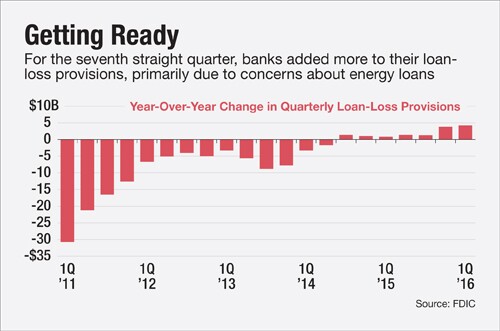

Loan Loss Reserves

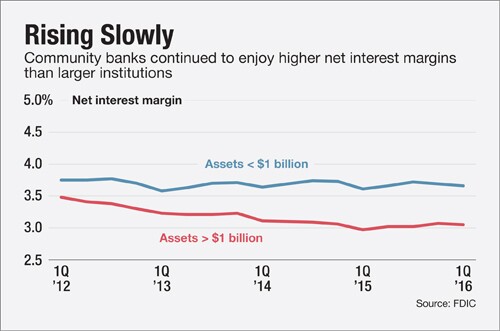

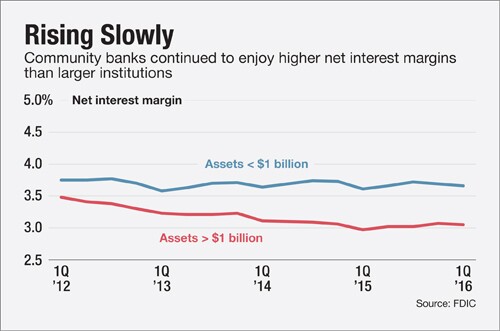

Net Interest Margins

Loan Growth

The giant custody bank plans to offer specialized instruction in cybersecurity, AI and other topics to 1,000 community bank executives.

The bank and Chinese technology giant are speeding transaction processing for business payments, Airwallex makes a deal to bolster its payments tech and more in the American Banker global payments and fintech roundup.

The superregional bank, which pulled the plug on bitcoin custody services in 2022, is reintroducing those services following the demise of an unfavorable SEC rule.

The American Fintech Council urged a federal court to deny requests by banking groups to stay the Consumer Financial Protection Bureau's open banking rule compliance dates while litigation is ongoing.

Attackers used stolen vendor credentials to move $130M, underscoring vulnerabilities in real-time payment systems.

The payment company claims the bank is trying to "take advantage" of uncertainty around open banking regulations.