Related content:

Treasury Department

But Treasury also declared its willingness to work with Congress on legislation to develop new protections for small businesses borrowing less than $100,000.

"For small businesses, transparency requires standardized all-in pricing metrics, so that a business understands a loan's true cost and can make like-to-like comparisons across different loan products," Antonio Weiss, counselor to the Treasury secretary, said in a speech late last year.

If Hillary Clinton wins the presidency, Treasury seems likely to stay on its current course. All bets are off, though, if Donald Trump prevails.

Related content:

Sen. Sherrod Brown

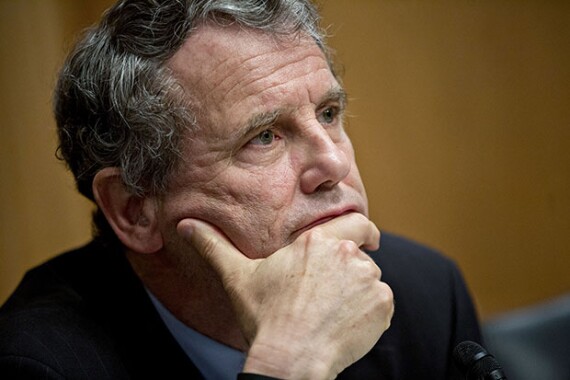

In July, Brown argued that fintech firms should be subject to rules similar to those that apply to the industry's incumbents. Three months earlier, he expressed concern that online small-business lending may be falling through cracks in the regulatory system.

If Democrats can regain control of the U.S. Senate, Brown seems likely to ascend to the top seat on the Senate Banking Committee. That perch would give him a great deal of power in the emerging policy debate over online lending.

Related content:

Federal Trade Commission

"To be meaningful, these types of efforts need robust procedures to monitor compliance and tangible consequences when the rules aren't followed," said Jessica Rich, director of the FTC's consumer-protection bureau.

Related content:

Federal Reserve Researchers

But the work of Fed researchers, led by Ann Marie Wiersch at the Cleveland Fed and others based outside of Washington, is helping to shape the policy agenda.

A widely cited Fed study from August 2015 found that small-business owners have a hard time comparing the products offered by online lenders a result that suggests standardized disclosures are needed.

Meanwhile, a Fed survey from earlier this year found that just 15% of small businesses that successfully applied for credit from an online lender reported being satisfied.

In a new sector where highly regarded research is scarce, the Fed has emerged as an influential player.

Related content:

Consumer Financial Protection Bureau

In March the CFPB announced that it had begun accepting complaints about online lenders. The announcement represented only a cosmetic change consumers had previously been able to file complaints about installment loans, which make up a large percentage of the online lending business but it sent a signal to the industry that the CFPB was now watching.

The following month, the CFPB tapped Grady Hedgespeth, a former Small Business Administration official, to head its new Office of Small Business Lending Markets. Around the same time, the agency cited equal access to small-business loans as one of nine top priorities for the next two years.

Related content:

Office of the Comptroller of the Currency

Back in March, the agency released an 11-page white paper about the idea of "supporting responsible innovation." Then in May the OCC said that it is contemplating a limited-purpose charter for fintech companies.

That approach would yield some important benefits to online lenders they would not have to contend with state lending laws. But it could also bring new costs, such as regular examinations or the responsibility of complying with the Community Reinvestment Act.

Related content:

Rep. Patrick McHenry

Last month he introduced two pieces of legislation that would benefit the sector, including a bill that would preempt state interest rate caps for lenders that partner with banks to issue loans.

That measure would undo the effects the online lending sector felt from an unfavorable 2015 decision by a federal appeals court.

"We have a national marketplace when it comes to lending," McHenry told reporters in March, "and when you have a national marketplace you have to have a national law and regulatory structure that keeps with that."

Related content:

California Department of Business Oversight

California officials are conducting an inquiry into 14 firms' compliance with laws and regulations dealing with referral fees, bank partnerships and fair lending.

The Bay Area is to home to numerous large U.S. online lenders, including Lending Club, Prosper Marketplace, Social Finance and more. California's probe could result in enforcement actions against particular firms; it could also lead to new regulations.

"These online lenders are filling a need in today's economy, and we have no desire to squelch the industry or innovation," Jan Lynn Owen, commissioner of the department, said in a press release when the probe was launched. "We have a duty, however, to protect consumers and businesses, and they have more and more at stake as this industry grows."

Related content: