David Gillan certainly is not happy that the Federal Deposit Insurance Corp. slapped a cease-and-desist order on the payday lending business he manages for County Bank of Rehoboth, Del., but he sees one positive coming out of the situation.

Standards that were "nebulous" before the order was published on March 11 and made public last week are now sharply defined, said Mr. Gillan, the bank's vice president. With the regulator's expectations down on paper, he said, County is clear on what it must do to keep making payday loans.

"That's exactly the way I see it," Mr. Gillan said. "We've got a game plan, and as long as we execute it we'll continue to be a leader" in payday lending.

County's determination to stay in the business is understand-able - last year it generated 40% of the $284 million-asset company's revenue, or $11.6 million.

County began making the short-term loans about 10 years ago. According to its president and chief executive, Harold L. Slatcher, it booked roughly 850,000 of them in 2004.

The number of banks involved in payday lending has dwindled to a handful in recent years, but those that are still doing it appear every bit as committed to it as County Bank. Republic Bancorp Inc. in Louisville, for example, said earlier this month that it was staying in the business even though it expects that the cost of complying with tough guidelines recently implemented by FDIC will halve its income from payday loans.

Like other banks involved in payday lending, County Bank relies on a network of third-party, storefront servicers - in its case 23 companies with more than 900 locations - to actually make the loans.

In the cease-and-desist, the FDIC said County Bank had tolerated sloppy and hazardous lending practices by its servicers, including letting individuals other than the borrower execute loan documents, and giving repeat borrowers new loans before an FDIC-imposed mandatory waiting period had expired. (The policy is designed to limit borrowers to six payday loans a year, FDIC spokesman David Barr said.)

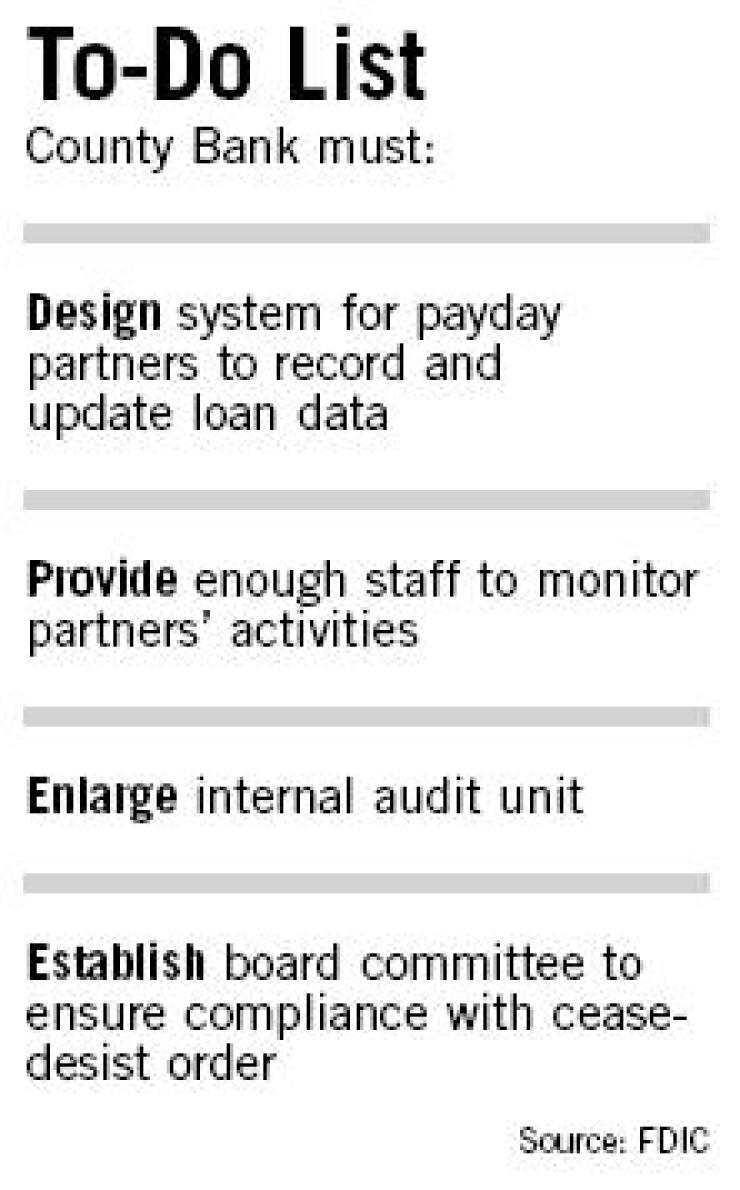

The regulator said that County Bank's board of directors and management team failed to provide effective oversight to the payday loan program. It ordered the bank to improve its information systems and internal auditing and to do a better job of monitoring its retail partners. It also ordered the board to create a committee to oversee the company's compliance with the cease-and-desist order.

Mr. Slatcher said that the FDIC began examining the bank in October 2004 but that he did not learn that an enforcement action was in the works until a week before it was issued.

The company has already complied with most of the stipulations in the eight-page cease-and-desist order, and the board never considered getting out of payday lending, Mr. Slatcher said.

"It's still worthwhile to do it," he said.

Despite intense criticism from community activists, who claim payday loans are too costly and gouge low- and moderate-income consumers, payday lenders say the industry continues to grow rapidly.

"There's incredible demand for this product," Mr. Gillan said. "Studies show that the number of stores offering it and the dollar volume of loans outstanding continue to increase. Obviously, consumers are comfortable with how it works."

Matt Schriner, the managing director of risk management for Sheshunoff Management Services in Austin, said it is possible for banks to run profitable payday lending businesses that can withstand regulators' scrutiny, but that it requires constant monitoring by management.

"It takes the right team that is focused on the controls," Mr. Schriner said. "You cannot take your eye off of" the retail providers "for a minute."