-

Hoping to wring more electronic transactions from the shrinking pool of paper checks, Nacha is rethinking its stance on converting business checks into automated clearing house payments.

April 23 -

Payments executives say businesses are trying to reduce their costs by shifting more payments to the ACH system, but these gains have been offset by a sharp decline in check conversion, long a major driver of transaction volume.

April 7

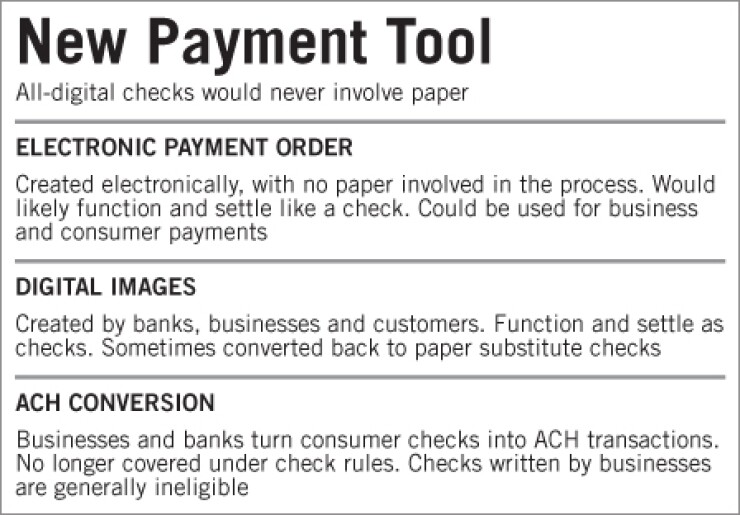

Now that converting paper checks into electronic transactions has gained widespread acceptance, bankers are considering a new payment format that would bypass paper altogether.

Though there is still no consensus on how an all-digital check would function, or whether it's even needed, the idea is gaining steam in payments circles and has been endorsed by the Federal Reserve banks.

"With the tremendous amount of success that the industry's had over the last five years in implementing image exchange," the question remains, "what's left for the industry to use to make the process more efficient," said David Walker, the president and chief executive of the Electronic Check Clearing House Organization in Dallas.

The digital check concept is not new, but it has attracted a good deal of attention since the Federal Reserve Bank of Chicago published a policy discussion paper in November promoting "electronic payment orders," or EPOs.

"Due to the Check 21 revolution, digital images have replaced paper items in the clearing and settlement process," the report said. "We argue that a new kind of check, one never having any paper form whatsoever, could complete this transformation and enhance consumer welfare."

The idea could also have implications for the viability of the mobile payments concept, which is generating plenty of buzz. "Imagine a world where consumers could write and send completely digital checks or EPOs from their mobile phones," the report said.

A digital check fits within the long-range goal of groups like ECCHO, Nacha, The Clearing House Payments Co. LLC and others that are driving the concept of "native electronic transactions" — payments that don't begin with a paper check but retain the same remittance information.

"We have very much focused in the last year or so to say how can we effectively eliminate that step," said Janet Estep, the president and CEO of Nacha, the Herndon, Va., trade group that oversees the ACH system.

The focus for the future is on "never having to write" a check to begin with, Estep said, while still having the "information that can flow along with the payment. That's where the true value is delivered."

The Fed paper suggested that banks could benefit from all-digital checks because they could devote fewer resources to their check systems and could clear check payments faster. They could eliminate costs associated with delivering paper checks to the bank of first deposit and printing and processing paper checks.

"At that point, the entire check edifice devoted to processing paper would have been eliminated, and the huge investment that has been made to modernize and electronify the back end of the check processing system could be leveraged," the report said.

Certainly, not every payment-systems observer is as gung-ho as the Chicago Fed. Some are hard-pressed to clearly define how a digital check would differ from the existing imaging networks or systems that convert checks into automated clearing house transactions.

"I do wonder exactly which problem this is trying to solve," said Steve Ledford, a senior expert and leader in the global payments practice of the New York consulting firm McKinsey & Co.

"When you look at why people use checks, it's generally not because they like using checks. It's generally driven by business processes that they have in place that just happen to have checks built into them," he said.

"If you're actually moving to a completely online or completely digital way of originating the payment, it seems there are other existing methods that could work just as well," such as ACH and wires, Ledford added.

For his part, banking-technology analyst Aaron McPherson is concerned that the potential costs to banks would outweigh the benefits.

EPOs or digital checks would present "yet another way for merchants and corporates to obtain the benefits of electronic payments without having to pay card-based interchange" fees, McPherson, an analyst with IDC Financial Insights in Framingham, Mass., wrote in a January research note. "All they would need to do is have their customers generate an EPO and send it to them over the Internet; they could then pass it along as a remotely captured item, just as if it had been scanned at the point of sale or lockbox."

But while the potential success of digital checks is uncertain, the concept is something banks should at least be following, McPherson wrote.

Some companies already are developing technology that could facilitate the creation of digital checks.

Global Standard Financial Inc., an Alpharetta, Ga., company founded four years ago by a former Microsoft Corp. executive, has obtained patents covering the creation of "Digitally Originated Checks," or DOCs.

One patent, No. 7,539,646, describes creating a digital check through an electronic payment system by using paperless Check 21 images.

"This allows the use of the Check payment system in place of debit cards, ACH transfers, credit cards, and the like," the patent states.

Clark Gilder, Global Standard's founder and CEO, said he has spoken with several large banks and payments processors about his technology over the past two years. Bankers at smaller institutions have expressed the most interest, he said.

Gilder sees potential for the technology to make it easier for charities, for example, to accept donations and for small businesses to pay their customers.

Charities currently face paying card transaction fees or processing paper checks, Gilder said. Organizations could use Global Standard's technology to let donors create a digital check from a central website.

In the small-business market, Global Standard could distribute its technology to a company such as Intuit Inc. to integrate with its QuickBooks software for small-business accounting.

"If you could integrate and provide an add-on within QuickBooks to extract those instructions securely and reliably instead of printing the paper check," and then "automate accounts payable and the accounts receivable process," Gilder said.

In a retail setting, Gilder said merchants could generate digital checks at the point of sale by swiping special debit cards that feature a second magnetic strip. The second strip would contain the data needed to create a check tied to a customer's checking account.

However, Gilder said such a process would require investment from card providers, issuers, merchants and other parties in the transaction chain and is not currently his focus.

The key to making a digital check a viable payment option is ensuring affordability for consumers, businesses and participants in the merchant processing chain, said Katy Jacob, a policy research specialist at the Chicago Fed and co-author of the bank's paper.

"Our interest is always in seeing the payment system being more efficient" and making sure the "cost structure of this makes sense to allow the overall goal of bringing checks into the digital world," Jacob said.

There are still scenarios in which paying electronically is nearly impossible, she said, noting she can't pay her day-care provider with a debit or credit card and many landlords require their renters to pay with a check. A digital check or electronic payment order could change that, but Jacob and McKinsey & Co.'s Ledford agreed that motivating landlords and other small merchants to accept a digital format can be difficult unless a large number of users are demanding it.

"Payment systems really depend on network effects — a group of willing originators and receivers of the payments," Ledford said. "Getting to that critical mass is not easy."