-

A recent study found that customers want products like identity theft alerts and mobile bill pay from their banks. But many community banks are unable or unwilling to offer those products.

June 27 -

Credit card delinquencies ticked down in March, and releases of reserves for loan losses boosted first quarter profits.

April 15 -

KeyBank is the latest regional that will start issuing its own cards again in hopes of growing revenue and wallet share.

August 2

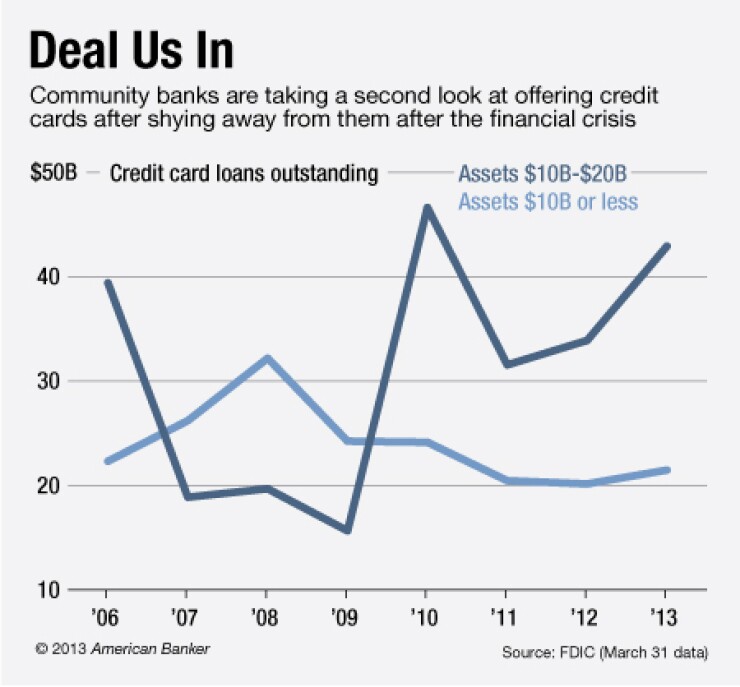

Community banks, which retreated from credit cards after the financial crisis, are finally willing to give the product another look.

Credit cards are becoming more attractive to small banks because they open up a new revenue stream at a time when loan demand is soft and interest rates are low, industry experts say. Still, there are unique risks and costs involved that banks must carefully consider before jumping in, experts say.

Small banks "are getting squeezed to death because they can't get a spread right now," says Frank Farrar, president of Farrar Banking Group, which owns four banks including the $470 million-asset First Savings Bank in Beresford, S.D.

"Credit card returns are bigger than what you can get on a normal loan," adds Farrar, who also owns Capital Services, a Sioux Falls, S.D., company that manages and services card portfolios.

The number of small banks that offer credit cards has fallen roughly 25% in the last five years, though the decline has leveled out recently, says Scott Reaser, a principal of strategic sourcing at First Annapolis Consulting.

A

For smaller banks, offering credit cards could help keep bigger banks from making deeper inroads into their markets, says Brian Riley, senior research director at CEB TowerGroup. "Not having a card strategy is a liability," he says.

In the past, many community banks have offered credit cards by working as an agent for a larger financial institution. Cards are branded as the local bank, which earns fees by signing up customers, along with some money from the interest and interchange fees. The larger financial institution manages most of the program.

This is becoming a less desirable option for smaller banks that want to "control the customer experience," says Andrew Mathieson, managing director at Total System Services.

"Many are finding these programs are less successful in addressing the needs of their customers," Mathieson says. "Community banks feel disenfranchised by the process."

The ability for community banks to issue cards, which can bring in more revenue than an agent relationship, has become easier, industry observers say. Self-issuing banks "realize all of the program revenue," according to "A Path Chosen Prudently," a working paper by the Kessler Group that compares self-issuance and agent programs.

"A fair number of folks are looking at assets in this yield-starved world," says Jeff Bullian, vice president of marketing and consulting services division at Kessler who co-wrote the paper. "Credit cards look great right now given where we are in the economic cycle."

Profit from credit card assets last year was significantly higher than other bank assets, says Jerry Craft, president and chief executive at Corserv. He says adding credit cards could boost a community bank's earnings by 10%.

Besides the potential for a higher return, self-issuance has risks. A bank incurs the operational costs and must hold capital against the assets. Often banks underestimate the costs associated with starting up the card program and how long before it becomes profitable, says Andrea Perry, a vice president in the marketing and consulting services division at Kessler who also co-wrote the firm's paper. "The market is viable right now but banks need to take into consideration the finances," she says.

The credit card business is very cyclical. That is something that bankers may not fully realize right now, given that delinquencies are very low, Bullian says.

Banks often underestimate the costs for marketing, obtaining cardholders and maintaining a portfolio, Perry says. Smaller banks also can have problems offering rewards programs that are competitive with larger banks.

Credit cards also have their own unique set of risks, experts say. Banks must successfully plan for possible fraud by having employees with the right type of expertise.

Being able to analyze account data is critical for card portfolios, regardless of whether the cards are self-issued or offered through an agent bank program, experts say. Data are "only as good as it can be interpreted," Bullian says.

Capital Services is looking to capitalize on bankers' interest in offering cards and a need for solid credit card analytics, says Charles Hendrickson, the company's president and CEO. Capital Services has mainly provided card services to Farrar Banking's banks, though it is now eager to work with other banks with $500 million to $5 billion in assets, Hendrickson says.

"The whole world is going to prepaid cards, credit cards or mobile transactions," Farrar adds. "In the long haul, people won't need to go to a bank."

Capital Services will provide a range of services to small banks, such as creating a card program, servicing portfolios and analyzing data. Normally, smaller banks just consider asset yields and return on assets rather than reviewing a product's profitability at an individual account level, Hendrickson says. Taking a deeper look can help drive returns, he adds.

"Many banks aren't getting the penetration that they could get in their current footprint," Hendrickson says. "They don't know how to test into it and they can't capture what is happening."