-

A broader index of consumer delinquencies also fell during the third quarter, but past-due payments on home equity loans rose.

January 3 -

Consumer delinquencies, which were already at relatively low levels, fell even further in the second quarter of the year, according to a new report from the American Bankers Association.

October 4

With green shoots emerging in the U.S. housing market, another encouraging sign arrived Tuesday in a new report from the American Bankers Association: delinquencies on second mortgages, which remain stubbornly high six years after the housing bubble burst, dropped in the fourth quarter.

The percentage of consumers who were late on paying their home equity loans fell to 4.03%, their lowest level in three quarters. For home equity lines of credit, delinquencies dropped to 1.93%, also lower than at any point since the first quarter of 2012.

Whether the declines will mark the start of a sustained improvement remains to be seen. In the second half of 2011, delinquencies on second mortgages fell before they began climbing again last year.

James Chessen, chief economist at the American Bankers Association, cautions against reading too much into data from a single quarter. Still, with household wealth and personal incomes continuing to climb - both are at or near pre-crisis highs — there's reason for optimism.

"I think it's the improved financial position of households that may explain the decline in home-related delinquencies," Chessen says.

The quarterly report tracks delinquencies in various consumer debt categories, but it does not include data on first mortgages. It counts a payment as delinquent if it is 30 days or more overdue.

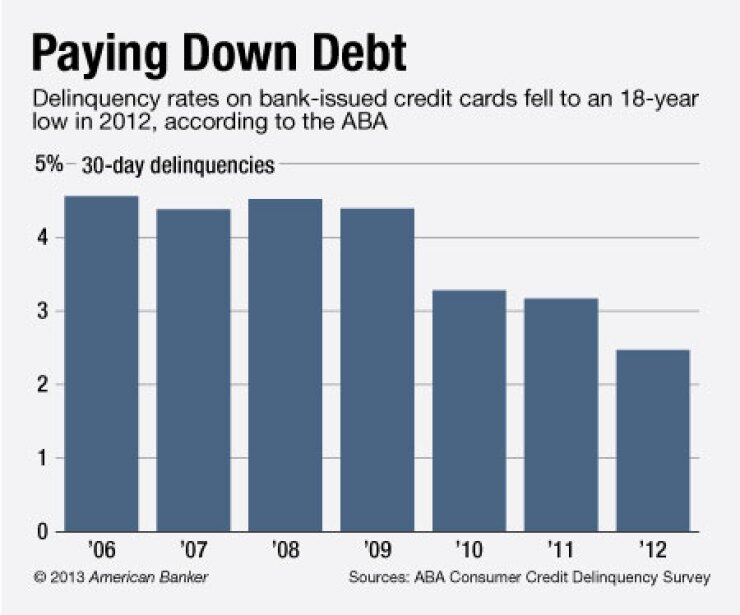

In recent quarters, while delinquency rates on second mortgages have stayed elevated, the percentage of consumers who are late on their credit-card payments has dropped to record-low levels.

That trend continued in the fourth quarter of last year, with the delinquency rate on bank-issued credit cards hitting an 18-year low, according to the report. Only 2.47% of credit card payments were late in the fourth quarter, compared with a 3.87% average over the last 15 years.

Chessen attributes the falling delinquency rate to more conservative behavior by borrowers and banks, as well as to banks being more aggressive in charging off loans that were never going to be repaid.

Also in the fourth quarter: delinquencies on loans that banks make through automobile dealers fell from 2.08% to 1.85%; delinquencies on loans that banks make directly to car buyers rose slightly 0.95% to 0.96%; and delinquencies on personal loans fell from 2.14% to 2.08%.

In addition, an index that the banking trade association uses to track delinquencies on a variety of closed-end bank consumer loans fell to its lowest level since the second quarter of 2006.

That index tracks not only home equity loans, auto loans and personal loans, but also mobile home loans, loans on recreational vehicles and boats, and property improvement loans. It dropped to 1.99% in the fourth quarter, down from 2.16% during the previous three months.

"It shows that consumers continue to make a very concerted effort to get their debt levels under control," Chessen says. This cautious approach may slow short-term economic growth, but it will help the U.S. economy over the long run, he adds.

The drop in delinquencies on second mortgages is another piece of good news for the U.S. housing market, which is showing signs of a rebound.

Nationally, home prices rose 9.7% during the 12 months that ended in January, according to a recent report from CoreLogic. While pending home sales