-

A heightened regulatory focus may be a direct result of early positioning as a business distanced from the rest of the payments industry, which may be keeping more banks from offering prepaid products.

April 29 -

FinCEN's final rule to prevent prepaid accounts from being used to launder money attempts to balance the concerns of many parties.

July 26 -

The Bancorp Inc. of Wilmington, Del., hopes to boost its health-care and payroll operations with a $60.6 million deal to buy the prepaid card unit of BankFirst Corp. of Sioux Falls, S.D.

July 19

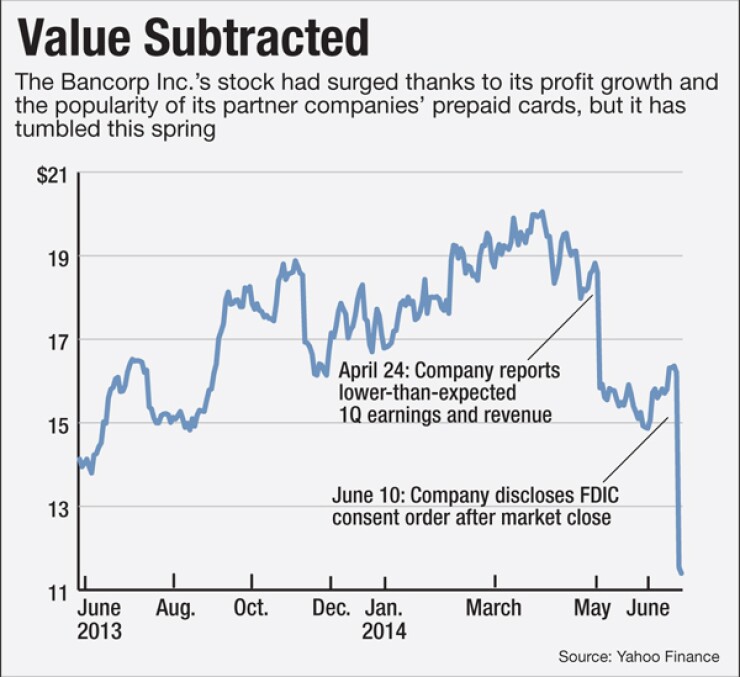

Over the last five years, the surging popularity of prepaid cards has helped carry The Bancorp Inc. (TBBK) to remarkable profits.

The Wilmington, Del., company, which issues cards for NetSpend, Western Union and many other companies, saw its net income grow six-fold between 2009 and 2013. During the same period, Bancorp's stock price rose at three times the rate of a broad index of bank stocks.

But on Wednesday, Bancorp shares plunged by 30% after the $4.7 billion-asset company disclosed that it will have to curtail the growth of its prepaid card business, at least temporarily, as part of an agreement with the Federal Deposit Insurance Corp.

The list includes hiring new personnel; adding new procedures in order to comply with anti-money-laundering and foreign-sanctions laws; and conducting a review of any suspicious activity over the last 18 months.

For the company's shareholders, some of the most worrisome provisions relate to Bancorp's prepaid card business. Its Bancorp Bank unit agreed not to issue any new general-purpose prepaid cards, or establish any new distribution channels for its existing general-purpose cards, until the FDIC has approved a report outlining its compliance plans.

Bancorp doesn't believe the restrictions "will have a material impact on revenue," according to a filing with the Securities and Exchange Commission.

But the surprise consent order called into question Bancorp's plans for continued growth in the prepaid business, analysts at Sandler O'Neill wrote in a research note Wednesday. "We were greatly surprised by the commentary in the filing that this order should not impact revenues," they wrote.

The ensuing sell-off of Bancorp shares illustrates the danger for banks in concentrating heavily on an emerging business line in this case, prepaid cards. It also shows that bank regulators are scrutinizing the prepaid industry closely.

"Issuers need to constantly monitor their programs and make sure that their partners and internal systems are all working together to meet regulatory requirements," Ben Jackson, director of Mercator Advisory Group's prepaid advisory service, said in an email.

This week's announcement is not the first time that Bancorp has run afoul of the FDIC. In 2012 the company

In the Bancorp's most recent annual report, issued in March, Chief Executive Officer Betsy Cohen and Chief Operating Officer Frank Mastrangelo wrote: "We have invested significantly in infrastructure to accommodate further growth, including significant compliance and legal-related expenditures."

"Yet the businesses we operate are unlike most other institutions; we provide value to clients in ways that are not traditional for banks," the letter to Bancorp shareholders continued. "This represents both our greatest opportunity and biggest risk. The regulatory environment continues to be challenging, and the learning curve can be steep when there is not a long historical basis from which the businesses can be viewed and measured."

Bancorp officials did not respond to requests for comment for this article. The FDIC consent order was prescriptive; it did not allege any violations based on past conduct, and it stated that Bancorp Bank neither admits nor denies that it violated any laws or regulations. In its SEC filing, Bancorp said that it has already made multiple changes to address the requirements of the consent order.

The FDIC agreement affects more than just Bancorp's prepaid card business.

It also places a moratorium on new contractual relationships with third-party companies that use the automated clearing house network to process payments for its customers. And it prohibits, for the time being, Bancorp Bank's existing third-party payment processing customers from adding any new merchants as clients.

Shortly after Bancorp disclosed the FDIC order, analysts at both Sandler O'Neill and Sterne, Agee & Leach downgraded their outlook for the company's stock.

"In our experience, a 12- to 18-month time frame to resolve this issue would not be out of the question," analysts at Sterne Agee wrote.

William Wallace, an analyst at Raymond James, reiterated his outperform' rating on Bancorp, but lowered his target price for the stock from $18 to $14. Shares were trading at $11.44 late Friday.

Wallace said in an interview that the consent order will add about $3 million in additional expenses that will remain over time. But he also said: "It really created a crisis of confidence more than a materially negative financial impact."

Other banks that have recently run into regulatory problems with their anti-money-laundering programs have struggled to resolve them quickly. M&T Bank's (MTB) proposed acquisition of Hudson City Bancorp (HCBK)

For nonbank companies that rely on banks to issue prepaid cards, the Bancorp consent order should have limited implications because other banks offer similar services, analysts said.

Bancorp touts itself as the nation's leading private-label banking resource, and it benefits from having fewer than $10 billion in assets, which means that its cards are not subject to the statutory restrictions on swipe fees. But the same is true of certain competitors, including Sunrise Banks in Minnesota and Central National Bank in Oklahoma.

Jackson, the consultant at Mercator, predicted that Bancorp's competitors will likely get more requests to serve as prepaid card issuers as a result of this week's events.