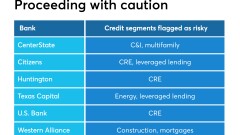

Anticipating recession, banks start scrubbing loan books

(Full story

Lenders dread prospect of Fannie, Freddie losing CFPB exemption

(Full story

Fed plans to launch real-time payment service by 2024

(Full story

KeyBank rolls out no-fee overdraft, debit-linked savings accounts

(Full story

How Trump’s political appointees thwarted tougher settlements with two big banks

(Full story

Revenue-strapped lenders take another look at unbanked customers

(Full story

Walmart crypto coin patent could be a back door to banking

(Full story

Fifth Third is latest bank to raise its minimum wage

(Full story

2020 race pulls Elizabeth Warren away from Senate Banking Committee

(Full story

LendingClub eyes 3Q profit, looks to reopen credit spigot

(Full story