The deadline has arrived for mandatory submissions to the Federal Housing Administration's Electronic Appraisal Delivery portal, but as many as one-third of lenders that originate FHA-insured mortgages have yet to use the new system.

The good news is most of the laggards have at least registered to use the portal, and any company that hasn't taken that first step can receive credentials and begin submitting appraisals within two days of signing up.

Lenders and their appraisal management company vendors have been able to submit appraisals to the EAD on a voluntary basis for about a year. Still, the new requirement, which applies to all FHA loans with case numbers on or after June 27, may be a source of consternation in the short run for industry procrastinators.

"For us it was relatively easy, but I think they're going to feel some pain unless they have a vendor manage it," said Andy Chojnowski, chief operating officer at The Federal Savings Bank. "There's definitely some training involved."

The FHA phased in hundreds of early adopters and most of the stragglers are small players in the government lending space that may not need to originate an FHA loan right away and should be able to gear up fairly easily. Most lenders and vendors have been using EAD for at least the last few weeks, said Chuck Rumfola, senior vice president of strategic initiatives at Veros Real Estate Solutions, the vendor that built the FHA's portal, as well as a similar system for Fannie Mae and Freddie Mac.

"There are lenders that have not submitted through the portal yet so they will have to. FHA has a lot of lenders that do really small volumes, so it's not a big worry," Rumfola said. "The lenders that are actively using the portal make up the vast majority of FHA's endorsement volume."

There are 1,700 active lenders that have originated FHA-insured mortgages in the last 12 months. Days before the mandatory appraisal delivery deadline, 1,601 of these had gotten credentials to submit appraisals through the EAD portal, and 66.1% had submitted appraisals electronically.

While this means the majority of lenders had some experience delivering e-appraisals prior to the deadline, it also showed there are hundreds that need to act very quickly to get up to speed.

The William Fall Group, an appraisal management company that handles FHA e-appraisal delivery for some of its clients, is equipped to set up clients already in its system "in a very short time," according to CEO William Fall and Charles Warr, senior vice president of business services. For others it might take longer.

"Predictably, someone will have some technology frustration," due to the deadline, Fall said.

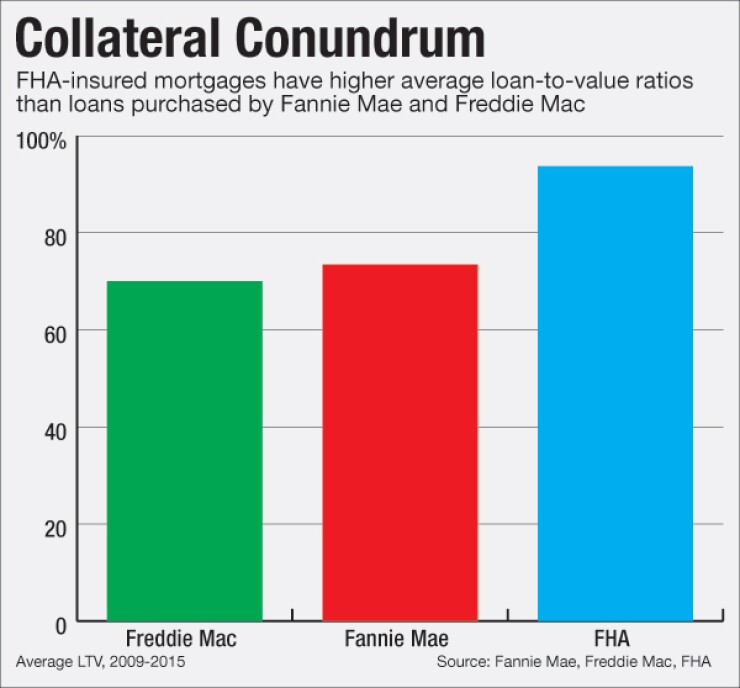

The electronic collection, analysis and feedback on appraisals could be a helpful risk management tool for the FHA because the Department of Housing and Urban Development's insurance arm is responsible for covering the credit risk of many loans with higher loan-to-value ratios.

When LTVs are higher, loans can be more affordable to borrowers because they require less of a down payment, but the collateral provides less of a buffer against possible depreciation that could lower property values relative to the loan.

"You don't want to have anything off [with the appraisal] when you're working on that thin of a margin," Rumfola said.

The FHA deadline comes five years to the day that Fannie Mae and Freddie Mac launched their Uniform Collateral Data Portal. Like the FHA, the government-sponsored enterprises let lenders and appraisal management companies practice uploading appraisals before it became a requirement in March 2012.

"For any lender that has been submitting to the GSEs this will be an extremely simple transition for them," Rumfola said.

When lenders first started using the Uniform Collateral Data Portal, some faced loan processing delays as they adjusted to the system's error messaging. Errors initially resulted in warnings, but later halted loan submissions until lenders corrected problems.

An FHA

But over time, the portal is expected to help the FHA collect more detailed information about the loans it insures and make the process of submitting loans more efficient.

"It will save some time in that information doesn't have to be entered more than once," said Cherylayne Walker, director of the home valuation policy division in HUD's office of single-family program development.

Before they began requiring electronic delivery of full appraisals, the FHA and Fannie and Freddie collected minimal appraisal data and only required lenders to submit full reports on loans that received additional review.

The FHA's desire to collect appraisal reports was first revealed in 2012 in the annual GSE Scorecard, where the Federal Housing Finance Agency required Fannie and Freddie to "cooperate with FHA implementation of portal to accept electronic appraisals," and tied the effort to GSE executives' compensation.

The FHA's EAD technology will provide feedback to lenders based on an automated analysis that will initially take into account only the submitted appraisal. It will identify concerns such as missing information and data in one part of the document that is not consistent with data in another part of the document, but it won't check the integrity of the appraisal relative to other area values.

"With EAD, you still have to make sure the comparables support the value," Chojnowski said.

The government agency plans to later use automation similar to Fannie Mae's Collateral Underwriter, which provides feedback on e-appraisals based on comparisons to external measures such as other appraisals in the area. Fannie used information it collected through electronic appraisal delivery to create this comparative database.

"It's a long-term goal" for the FHA, Walker said. "We don't have a specific time frame at this time."

While lenders with low FHA loan volumes can submit e-appraisals through a portal, those contending with higher-volume e-appraisal deliveries have had to set up systems integration.

System-to-system efforts have required more time to implement than portal use, but those requiring such integrations are primarily higher-volume players, and most of those are already delivering appraisals electronically to the FHA, Fall said.

Lenders that outsource appraisal delivery to third parties must invite the vendor to submit FHA files on their behalf through the Electronic Appraisal Delivery portal. Twenty vendors offer interfaces to EAD and 20 are authorized to handle delivery on lenders' behalf, according to HUD.