-

The Consumer Financial Protection Bureau is charging the law firm Frederick J. Hanna & Associates $3.1 million over allegations that it illegally filed debt collection lawsuits against consumers.

December 28 -

Tech startup Global Debt Registry hopes a central, online record of consumer debt will help end abuses in collection practices. But the byzantine world of debt collections is full of challenges.

December 29 -

BBVA Compass is using technology to create a "kinder, gentler" debt collection system that also happens to be far more efficient and cost-effective.

July 30

Recent high-profile settlements and a

In December, the Consumer Financial Protection Bureau

The Times article tells the story of a retired electrician with multiple sclerosis living on Social Security who suddenly realizes a debt collector has garnished his bank account after suing him for an old debt. The victim never knew the lawsuit had been brought against him until the money was gone.

Other, similar examples abound.

There are at least two ways technology could solve or reduce these problems. One is better communication and negotiation with borrowers, perhaps accompanied by a self-service portal through which debtors can adjust their payments,

The other is better recordkeeping and documentation, to help eliminate fraud, double-dealing and other forms of abuse.

The Federal Trade Commission, which examined 5,000 debt portfolios purchased by the nation's largest debt buyers in 2013, found that only 12% included documentation.

Many collectors work debts for which they've never seen the charge-off statement or prior statements. They don't know the collections efforts that have already taken place, and they don't even know the terms and conditions of the original paper.

If there were a central place where consumers and collectors could quickly check the records, the process could potentially be smoother and fairer to both parties.

Two centralized databases for consumer debt exist, run by Convoke Systems and Global Debt Registry. Once banks register credit cards and other consumer loans in one of these databases, the registries maintain an audit trail of the debt buyers and collections agencies that trade the paper.

Global Debt Registry also lets consumers look up their own records and receive "extinguishment reports" when they've paid their debt.

"This is a centralized utility for the purposes of clarifying rights that would help facilitate commerce and be better for consumers," said Ben Kahrl, general counsel at Global Debt Registry. "And hopefully avoid a lot of the litigation and confusion that surrounds what should be a basic practice of collecting on small-dollar debt. It would clarify who owns collection rights and make this information available to consumers."

A national registry is one way to make sure that when debt is transferred from owner to buyer, the documentation stays authentic and current, with change of title and appropriate documentation, saidJan Stieger, executive director of DBA International, an association of debt buyers.

"The industry is in full support of making sure there's no degradation of documentation integrity when debt is transferred from an originating creditor to a buyer," she said.

Waiting for the CFPB

The CFPB, several state attorneys general and trade groups have supported the concept of a national debt registry. But, although some debt collectors and banks have signed up for and use the debt registries, most haven't. They're in a holding pattern, frozen by the knowledge that regulators like the CFPB are planning to release guidance.

In November 2013, the CFPB came out with an advanced notice of proposed rulemaking that would update regulations under the 1977 Fair Debt Collection Practices Act.

"That was a double-edged sword," said Kahrl. "On one hand, it created a spotlight and an acknowledgement of what we do, and that this is a possible means of solving debt collection problems. But the flip side has been that because there's an expectation that this rulemaking is coming, a lot of the feedback we've gotten from the big banks is that while they're interested in this, they're not ready to adopt anything until they know what comes out of that rulemaking."

Banks especially don't want to adopt a new solution before being told it will be acceptable or sufficient to meet the regulatory requirements, Kahrl said. Yet, he said, "much of what the CFPB has been concerned about would be solved by adopting what we do."

One question the CFPB needs to answer in its new rules, one that would affect how a national registry would operate, is this: what is appropriate documentation of debt?

"The purpose of the documentation for an account is to make sure you're collecting the right amount and that you have the right person and that you have the authority to collect that debt," Stieger noted. "Is that 11 bank statements, or 16, or 18 as the Chase order says, or 12 as the OCC says? Those are the kinds of things we're waiting for the CFPB to come out and say."

Stieger doesn't expect the CFPB to issue its new debt collection rules until 2017, partly because the bureau is focused for now on arbitration and payday lenders.

"It's caused the industry to be in a holding pattern and a paralysis," she said. "Nobody wants to sell debt because they don't know what the rules are around documentation, phone messages, etc. I would do anything to have clear rules."

In addition to the CFPB, the Uniform Law Commission, which created the uniform commercial code, is looking at state debt collection laws, which vary greatly. It's formed a study committee on the transfer and recording of consumer debt, and one of the ideas the committee is studying is of a national debt registry.

Logistical Questions

One drawback to the idea of a national registry is the industry already has two, run by Global Debt Registry and Convoke, and more may be in development.

"Do you run into the problem where this debt is registered with Convoke, but that debt is registered with GDR?" Stieger noted. "Is it one system or multiple systems? Is it a government-run system?"

Either way, she noted, a lot of sensitive, personally identifiable information would be stored in multiple places where hackers could try to steal it.

Another issue is cost. When banks register debt with Global Debt Registry or Convoke, they pay a fee, a cost that inevitably gets passed down the chain.

Some skeptics of the idea of a national registry point to MERS, the mortgage registry that came under fire during the financial crisis for muddying the ownership of distressed loans.

Global Debt Registry is talking to regulators, consumer advocates, banking lawyers and others, "so the result would be something everybody could live with," Kahrl said.

Will It Hold Up in Court?

Debts are sometimes pursued by unscrupulous or misinformed collectors long after they have been charged off, sold, or released. Consumers can be intimidated into paying.

Therefore the biggest benefit to debtors of a national registry would be proof that would convince a court they paid off their loan or credit card outstandings, or that the amount is less than they're being dunned for.

Global Debt Registry's extinguishment report, which is offered free to consumers, is a statement by the last owner of record that a debt has been resolved, by settlement, payoff, by being discharged to bankruptcy, or being deemed uncollectable because it's so old.

It would be hard for anybody to repudiate that document once it's in the consumer's hands, Kahrl said.

"Debt collection is a volume business, there's not a lot of money made on any particular case," he noted. So it wouldn't be worth the time and resources to fight a case where the debtor has such documentation.

An extinguishment report would overcome the problem of the consumer who paid a debt, but doesn't remember the name of the company it paid.

Kahrl described a typical consumer's predicament: "All I remember is that I had that old Home Depot or Amex card and I paid off somebody, but I never chose the debt collection agency, and it's probably the only time in my life I've been called by that company. Some of us don't have the greatest recordkeeping and it's hard to keep track of what we did two years ago."

The extinguishment report does not have the same legal significance as a recorded lien release and it has not been tested in court.

"But as a practical matter, it is physical evidence, it is a sworn statement, it is a record the registry could come forward and testify to," Kahrl said. "That record is admissible as a matter of law." For a legal stamp of approval, all transactions in Global Debt Registry are electronically signed by the buyer and seller. Some courts have accepted the firm's records as evidence, he said.

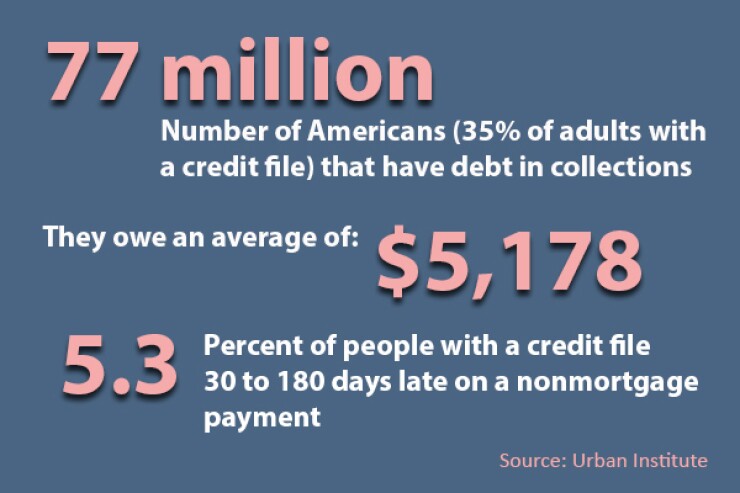

Debt collection affects more than just deadbeats. A layoff, a serious medical condition, an accident, a family crisis, fraud or theft can quickly turn a conscientious bill payer into someone who can't make ends meet.

The idea of a national registry isn't flawless and a lot will depend on execution. But it seems a lot better than what we have today, which is no way for consumers to verify whether a debt collector is telling the truth.

Editor at Large Penny Crosman welcomes feedback at